PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801904

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801904

Cyclone Separator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

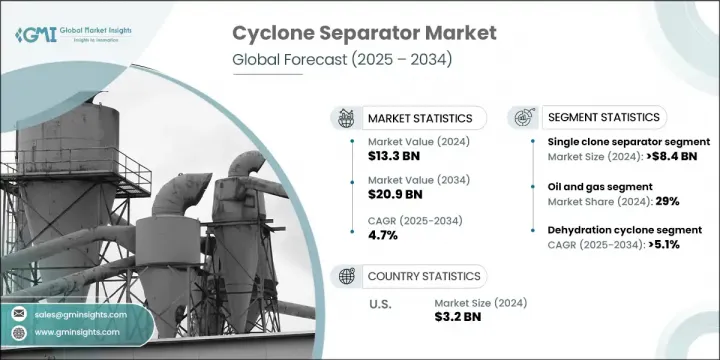

The Global Cyclone Separator Market was valued at USD 13.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 20.9 billion by 2034. The market is gaining traction due to the increasing push toward clean energy solutions and stringent global environmental regulations. As the demand for biomass, solar, and other alternative energy sources increases, so does the requirement for high-performance air filtration systems to reduce emissions and protect equipment. Cyclone separators have emerged as vital solutions due to their efficiency in handling particulates, supporting sustainability goals across multiple industries.

Technological advancements such as multi-stage filtration, CFD-optimized designs, and hybrid systems have significantly improved performance and energy efficiency. Their role is rapidly evolving, especially in precision-intensive sectors like chemicals, electronics, and pharmaceuticals. In the Asia-Pacific region, countries experiencing fast industrialization are driving demand due to tighter emission regulations. Cyclone separators are being widely adopted in response to growing infrastructure and manufacturing activity. In today's competitive landscape, features such as product customization and material durability are becoming critical for buyer decision-making, especially as industries prioritize long-term reliability and low maintenance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.3 Billion |

| Forecast Value | $20.9 Billion |

| CAGR | 4.7% |

Single cyclone separators reached USD 8.4 billion in 2024 and is anticipated to grow at a CAGR of 4.6% through 2034. Their widespread adoption is attributed to low upfront costs, simple mechanical structure, and minimal maintenance requirements. With no moving parts, these systems offer a cost-efficient solution in environments where continuous uptime and budget control are essential, making them especially appealing in heavy industries seeking operational reliability.

The oil & gas sector held a 29% share in 2024 and is set to grow at a CAGR of 5.2% between 2025 and 2034. Cyclone separators are critical throughout the entire value chain-from upstream operations requiring devices for desanding and liquid-gas separation to downstream applications involving gas processing, refining, and pipeline maintenance. These separators play a crucial role in reducing particulate load, safeguarding high-value machinery, and ensuring uninterrupted operations in high-pressure, high-volume environments.

United States Cyclone Separator Market held a 79% share generating USD 3.2 billion in 2024. This growth is fueled by strict environmental policies requiring advanced air quality management solutions. Regulations compel industries to deploy efficient particulate removal technologies. Cyclone separators are commonly used as pre-filtration tools, effectively decreasing the burden on final filtration systems, ensuring regulatory compliance, and optimizing overall operational efficiency.

Key players actively shaping the Cyclone Separator Market include Mikropor, Sulzer, FLSmidth, Gulf Coast Air & Hydraulics, Cyclone Engineering Projects, Multotec, The Weir Group, KREBS, Exterran Corporation, Air Dynamics, Cyclotech, Haiwang Hydrocyclone, Mahle Industrial Filtration, Elgin Separation Solutions, and Cyclone Separator Australia. Leading manufacturers in the cyclone separator market are focusing on strategic product innovation and regional expansion to strengthen their competitive positions. Companies are increasingly integrating advanced simulation tools like CFD to optimize separator designs for greater efficiency and lower energy consumption. Product diversification to serve high-precision industries such as pharmaceuticals, electronics, and clean energy is also on the rise. Players are forming partnerships with industrial clients to deliver tailored solutions that meet strict emission and operational standards. Many firms are expanding their global manufacturing and distribution networks to serve emerging markets, especially in Asia-Pacific.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By clone type

- 2.2.4 By capacity

- 2.2.5 By application

- 2.2.6 By end use industry

- 2.2.7 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Axial flow

- 5.3 Reverse flow

Chapter 6 Market Estimates & Forecast, By Clone type, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Single clone separator

- 6.3 Multi-clone separator

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Up to 2000 kg/hr

- 7.3 2000 kg/hr. - 3000 kg/hr

- 7.4 Above 3000 kg/hr

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Dehydration cyclone

- 8.3 Desliming cyclone

- 8.4 Slag removal cyclones

- 8.5 Others (concentration cyclone, cyclone group etc.)

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Oil and gas

- 9.3 Chemical

- 9.4 Mining and mineral processing

- 9.5 Power generation

- 9.6 Food and beverages

- 9.7 Others (pulp & paper, textiles, pharmaceutical etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Air Dynamics

- 12.2 Cyclone Engineering Projects

- 12.3 Cyclone Separator Australia

- 12.4 Cyclotech

- 12.5 Elgin Separation Solutions

- 12.6 Exterran Corporation

- 12.7 FLSmidth

- 12.8 Gulf Coast Air & Hydraulics

- 12.9 Haiwang Hydrocyclone

- 12.10 KREBS

- 12.11 Mahle Industrial Filtration

- 12.12 Mikropor

- 12.13 Multotec

- 12.14 Sulzer

- 12.15 The Weir Group