PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801910

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801910

Water Soluble Fertilizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

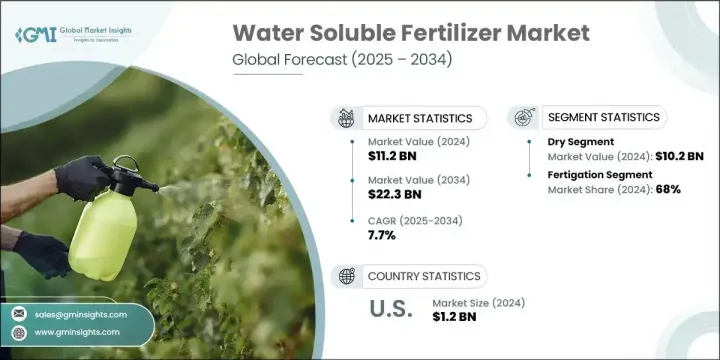

The Global Water Soluble Fertilizer Market was valued at USD 11.2 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 22.3 billion by 2034. This anticipated growth stems from rising demand for efficient, fast-acting fertilizers that support precision farming and meet growing food requirements. As awareness around the advantages of water-soluble formulations increases-especially their compatibility with modern irrigation systems-growers are steadily shifting away from conventional fertilizers. These fertilizers are favored for their rapid absorption, targeted nutrient delivery, and compatibility with sustainable practices. Their widespread use in greenhouse farming and specialty crops also contributes to demand. High-value crops and the need for increased productivity from limited farmland are accelerating market adoption.

Despite these opportunities, the market faces some hurdles. High product prices, limited access to advanced irrigation in developing nations, and low awareness in some areas may restrict market expansion. Water-soluble fertilizers appeal to growers due to their simplicity in application and plant availability. These fertilizers can be integrated into irrigation systems or applied directly to the soil, offering greater control over dosage and timing. As interest grows among traditional and high-value crop growers, the preference for sustainable, eco-conscious options continues to reshape the market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $22.3 Billion |

| CAGR | 7.7% |

The fertigation segment accounted for a 68% share in 2024. With ongoing improvements in nutrient application and water conservation methods, fertigation-delivering nutrients through irrigation-has emerged as the most efficient approach. It minimizes labor and maximizes nutrient use. Foliar feeding is another growing technique, offering a fast nutrient delivery method to treat plant deficiencies. Additionally, controlled-release fertilizers are becoming more common, ensuring a steady nutrient supply and reducing the need for repeated applications, thus supporting resource conservation.

Among product types, the powdered formulations are popular due to their long shelf life, ease of storage, and simple measurement. However, they can be dusty and difficult to handle. Liquid fertilizers offer superior nutrient uptake and mix well with other liquids but face challenges in transport and storage due to shorter shelf life. Granules offer a balance of ease of use and long shelf life, though they tend to be pricier. Growers select among these forms based on cost, application convenience, and specific crop needs.

U.S. Water Soluble Fertilizer Market generated USD 1.2 billion in 2024. The nation's increasing shift toward precision agriculture and enhanced nutrient use efficiency has pushed demand for water-soluble fertilizers. Farmers are rapidly adopting drip and pivot irrigation systems, which are well-suited for fertigation. This technique ensures nutrient delivery to plant root zones, improves uptake, and minimizes losses through runoff, leading to cost savings and more efficient fertilizer use.

Key players active in the Global Water Soluble Fertilizer Market include Sinochem Hong Kong (Group) Co., Ltd., Yara International ASA, Nutrien Ltd., Haifa Group, and Israel Chemicals Ltd. (ICL). To strengthen their global position, leading companies in the water-soluble fertilizer market are pursuing a combination of product innovation, geographic expansion, and strategic partnerships. R&D remains a top priority, with firms developing customized, crop-specific solutions and formulations compatible with modern irrigation systems. Companies are also investing in digital platforms that support precision application and enable growers to make data-driven decisions. Expanding into emerging markets where agricultural modernization is gaining momentum helps capture new demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Form

- 2.2.2 Product

- 2.2.3 Crop

- 2.2.4 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dry

- 5.2.1 Powder

- 5.2.2 Granules

- 5.3 Liquid

Chapter 6 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Nitrogenous

- 6.2.1 Urea

- 6.2.2 Ammonium nitrate

- 6.2.3 Calcium nitrate

- 6.2.4 Others

- 6.3 Micronutrient

- 6.3.1 Iron

- 6.3.2 Manganese

- 6.3.3 Others

- 6.4 Phosphatic

- 6.4.1 Mono-ammonium phosphate

- 6.4.2 Phosphoric acid

- 6.4.3 Others

- 6.5 Potassium

- 6.5.1 Potassium chloride

- 6.5.2 Potassium sulfate

- 6.5.3 Potassium nitrate

Chapter 7 Market Size and Forecast, By Mode of Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Foliar

- 7.3 Fertigation

Chapter 8 Market Size and Forecast, By Crop, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Cereals

- 8.3 Vegetables

- 8.4 Fruits

- 8.5 Plantation

- 8.6 Turf & ornamentals

- 8.7 Greenhouse crops

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Yara International

- 10.2 Israel Chemicals

- 10.3 Nutrien

- 10.4 Everris

- 10.5 Sinochem Hong Kong

- 10.6 Haifa Group

- 10.7 AGAFERT

- 10.8 K+S Aktiengesellschaft

- 10.9 COMPO EXPERT

- 10.10 The Mosaic Company

- 10.11 Coromandel International

- 10.12 VAKI-CHIM