PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801911

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801911

Flexible Endoscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

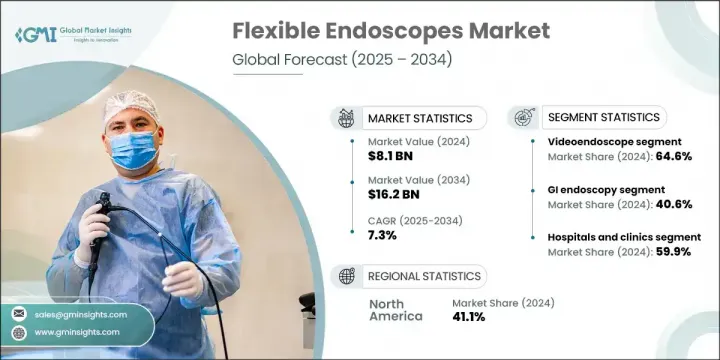

The Global Flexible Endoscopes Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 16.2 billion by 2034. This growth trajectory is fueled by the rising number of chronic disease cases, the increasing shift toward minimally invasive procedures, and heightened awareness of early-stage diagnostic care. As more patients seek procedures with lower risks, faster recovery, and lower costs, flexible endoscopy continues to gain ground across healthcare systems. Continuous innovation in visualization technologies, enhanced precision tools, and improved patient comfort is also elevating the appeal of these devices. Additionally, the rising popularity of outpatient and ambulatory care settings is creating new demand, with flexible endoscopes offering scalable, cost-effective diagnostic and therapeutic solutions across clinical disciplines.

The flexible endoscopes feature a pliable insertion tube that allows physicians to navigate complex anatomical structures during diagnostic and surgical procedures without large incisions. Their role in supporting less-invasive healthcare is expanding rapidly. The preference for these devices is rising among both patients and physicians due to advantages such as faster recovery, reduced trauma, and lower overall costs. These devices have become fundamental in modern treatment workflows by enabling precise and efficient care delivery, particularly in complex cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 7.3% |

In 2024, the videoendoscope segment accounted for 64.6% of the global market. This dominance is attributed to their superior image clarity, real-time visualization, and adaptability across a wide range of clinical specialties. Videoendoscopes use miniaturized cameras and advanced optics that deliver high-definition visuals to external displays, greatly enhancing diagnostic accuracy and supporting complex interventions. Their use spans across gastroenterology, pulmonology, gynecology, and urology. These features have cemented their place as essential tools for precision medicine in minimally invasive care settings.

The gastrointestinal (GI) endoscopy segment held a 40.6% share in 2024. Increasing rates of digestive tract disorders and growing public interest in routine screening are key factors boosting this segment. GI endoscopy continues to grow as a preferred diagnostic method due to its ability to reduce hospital stays and improve patient comfort. This segment's growth also reflects ongoing advancements in endoscopic technology that make procedures more efficient and safer, driving increased adoption across healthcare providers globally.

U.S. Flexible Endoscopes Market was valued at USD 3.2 billion in 2024. The region benefits from a robust healthcare infrastructure, widespread use of advanced medical equipment, and a growing senior population with increasing healthcare needs. The U.S. remains a primary contributor to growth within the region, supported by high demand for early diagnostics and frequent screenings. Strong penetration of modern endoscopy systems across hospitals and outpatient centers continues to fuel expansion in this mature yet growing market.

Key players in the Global Flexible Endoscopes Market include CooperSurgical, XION, PENTAX Medical, STORZ, RICHARD WOLF, Machida, Boston Scientific, FUJIFILM, BD, ENDOMED SYSTEMS, Laborie, and OLYMPUS. Companies operating in the flexible endoscopes market are focusing on expanding their product offerings with technologically advanced and user-friendly systems. The strategic investments in R&D aim to develop ultra-thin, high-definition scopes with enhanced maneuverability and AI-assisted visualization. Manufacturers are also leveraging partnerships with hospitals and specialty clinics to boost product access and deployment across varied care settings. Additionally, efforts are underway to expand their geographic reach through regulatory approvals and local manufacturing hubs in emerging economies. Market leaders are investing in after-sales support, maintenance services, and physician training programs to strengthen brand loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic conditions

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing popularity of minimally invasive therapies

- 3.2.1.4 Rising health awareness and demand for early-stage diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory process

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and robotic systems

- 3.2.3.2 Rising healthcare investments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Reimbursement scenario

- 3.8 Transition toward single-use/disposable flexible endoscopes

- 3.9 Pipeline analysis

- 3.10 Start-up scenario

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Future market trends

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Videoendoscope

- 5.3 Fiberscope

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 GI endoscopy

- 6.3 Pulmonary endoscopy

- 6.4 ENT endoscopy

- 6.5 Urology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BD

- 9.2 Boston Scientific

- 9.3 CooperSurgical

- 9.4 ENDOMED SYSTEMS

- 9.5 FUJIFILM

- 9.6 Laborie

- 9.7 Machida

- 9.8 OLYMPUS

- 9.9 PENTAX Medical

- 9.10 RICHARD WOLF

- 9.11 STORZ

- 9.12 XION