PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801918

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801918

Hyperscale Data Center Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

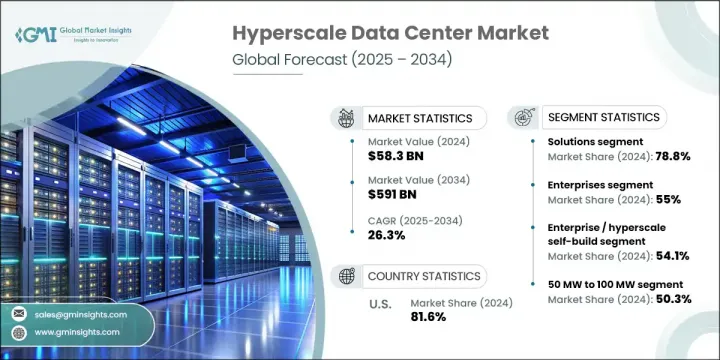

The Global Hyperscale Data Center Market was valued at USD 58.3 billion in 2024 and is estimated to grow at a CAGR of 26.3% to reach USD 591 billion by 2034. This expansion is driven by the surge in demand for digital services, cloud computing, artificial intelligence (AI), and big data analytics. Hyperscale data centers, designed for massive scalability, energy efficiency, and high-performance computing, are becoming critical for technology providers, corporations, and government agencies alike. As data consumption grows from various sources like social media, IoT devices, and enterprise applications, the need for these advanced data centers intensifies across global regions.

The COVID-19 pandemic played a pivotal role in accelerating market growth. While there were initial disruptions in construction and equipment supply in 2020, demand soared in 2021 due to the global shift towards remote work, e-learning, and online services. This led hyperscale providers to ramp up investments in expanding their networks, edge computing, and hybrid cloud infrastructures. Additionally, automation and remote management tools were adopted to maintain operations amid workforce challenges. As a result, services like AI-powered data management platforms, edge colocation, and workload orchestration have become increasingly crucial for market differentiation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.3 Billion |

| Forecast Value | $591 Billion |

| CAGR | 26.3% |

In 2024, the solutions segment accounted for 78.8% share, with a growth rate of 27.1% expected through 2034. This segment leads the market due to the increasing demand for scalable, high-performance IT infrastructure, such as servers, storage, networking hardware, and power and cooling solutions, which are essential for hyperscale environments. The booming sectors of cloud computing, AI, big data analytics, and streaming are driving the need for more robust, energy-efficient systems that enterprises are investing in.

The enterprise segment held the largest share, with 55% in 2024, and is forecasted to grow at a CAGR of 24.8% from 2025 to 2034. This dominance reflects the growing adoption of private and hybrid cloud infrastructure, essential for supporting mission-critical workloads, regulatory compliance, and data control. Enterprises in sectors such as banking, healthcare, telecom, and manufacturing are deploying hyperscale systems to modernize their IT frameworks, boost agility, and fortify cybersecurity.

U.S. Hyperscale Data Center Market held 81.6% share in 2024, generating USD 17.5 billion. The country's dominance is driven by a strong cloud computing ecosystem, extensive digital infrastructure, and substantial investments from major technology companies. The U.S. remains both a primary hub for hyperscale data operations and a key market for cloud adoption and enterprise digital transformation.

Leading companies in the Global Hyperscale Data Center Market include Microsoft, IBM, Amazon Web Services, Huawei Technologies, Alphabet, Broadcom, and Equinix. To strengthen their market presence, companies in the hyperscale data center sector are focusing on expanding their global footprints, investing in innovative technologies, and diversifying their service offerings. Cloud service providers are prioritizing automation and AI-driven data management solutions to enhance operational efficiency and reduce overhead costs. They are also investing heavily in edge computing to improve data processing speeds and reduce latency for customers. Additionally, collaboration with industry players and the implementation of hybrid cloud architectures are becoming standard strategies to meet customer demands for flexibility and scalability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 End use

- 2.2.4 Application

- 2.2.5 Power Capacity

- 2.2.6 Data Center

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing focus on R&D investments and product innovation

- 3.2.1.2 Introduction of electric power sport vehicles

- 3.2.1.3 Growing inclination towards recreational activities

- 3.2.1.4 Rising number of off-roading events

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of power sports vehicles

- 3.2.2.2 Increasing safety and environmental impact concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric power sports vehicle segment

- 3.2.3.2 Growing adventure tourism and eco-tourism

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Skills gap analysis and workforce development

- 3.8.1 Current data center skills shortage assessment

- 3.8.2 Future workforce requirements

- 3.8.3 Reskilling and upskilling initiatives

- 3.8.4 Corporate training vs individual certification

- 3.8.5 Academic institution partnerships

- 3.8.6 Government training programs

- 3.8.7 Career path development in data center management

- 3.9 Pricing analysis and cost models

- 3.9.1 Infrastructure cost structure analysis

- 3.9.2 Vendor pricing strategies

- 3.9.3 Subscription vs consumption-based models

- 3.9.4 Colocation pricing packages

- 3.9.5 Power usage cost breakdown

- 3.9.6 ROI assessment for hyperscale investment

- 3.9.7 Cost comparison across regions

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.13 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Cooling

- 5.2.2 Power

- 5.2.3 IT racks & enclosures

- 5.2.4 LV/MV distribution

- 5.2.5 Networking equipment

- 5.2.6 DCIM

- 5.3 Service

- 5.3.1 Installation & deployment

- 5.3.2 Maintenance & support

- 5.3.3 Monitoring services

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud providers

- 6.3 Colocation providers

- 6.4 Enterprises

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Retail & e-commerce

- 7.4 Government

- 7.5 IT & telecom

- 7.6 Entertainment & media

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Power Capacity, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 20 MW To 50 MW

- 8.3 50 MW To 100 MW

Chapter 9 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Enterprise / Hyperscale Self-Build

- 9.3 Hyperscale Colocation

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ABB

- 11.1.2 Alibaba Cloud

- 11.1.3 Alphabet

- 11.1.4 Amazon Web Services

- 11.1.5 Broadcom

- 11.1.6 Cisco Systems

- 11.1.7 Dell

- 11.1.8 Digital Realty Trust

- 11.1.9 Equinix

- 11.1.10 HPE

- 11.1.11 Huawei

- 11.1.12 IBM

- 11.1.13 Inspur

- 11.1.14 Intel

- 11.1.15 Lenovo

- 11.1.16 Marvell Technology

- 11.1.17 Microsoft

- 11.1.18 NVIDIA

- 11.1.19 Oracle

- 11.1.20 Schneider Electric

- 11.1.21 Vertiv

- 11.1.22 Western Digital

- 11.2 Regional Players

- 11.2.1 Colt

- 11.2.2 Corning

- 11.2.3 Fujitsu

- 11.2.4 Nlyte Software

- 11.2.5 Quanta Computer

- 11.2.6 Sify Technologies

- 11.2.7 Telefonaktiebolaget LM Ericsson

- 11.2.8 Tencent