PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801921

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801921

Hempcrete Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

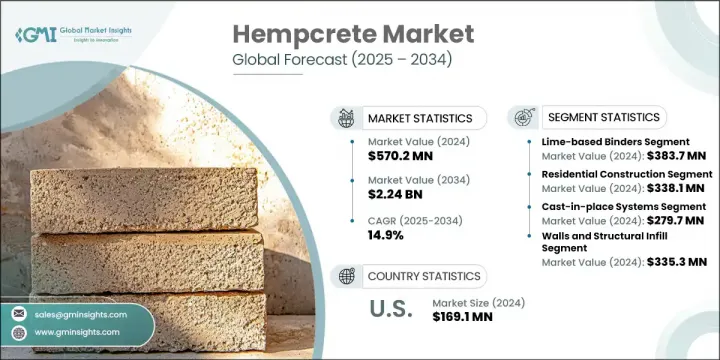

The Global Hempcrete Market was valued at USD 570.2 million in 2024 and is estimated to grow at a CAGR of 14.9% to reach USD 2.24 billion by 2034. As awareness of environmental impact grows, developers and builders are increasingly turning toward low-emission, sustainable construction alternatives. Hempcrete, being biodegradable and capable of sequestering carbon, aligns closely with global goals to reduce the carbon footprint in the built environment. Its natural properties make it an ideal material in energy-efficient buildings and eco-conscious residential design, helping meet both regulatory demands and consumer expectations for greener solutions.

Government mandates pushing for lower emissions and enhanced energy efficiency are further driving interest in natural materials like hempcrete. Several countries are enforcing stricter codes to reduce greenhouse gas emissions, which has prompted a shift toward using thermally efficient and natural insulation options. In addition, sustainability frameworks such as LEED and BREEAM are influencing construction companies to prioritize eco-friendly materials, ensuring steady demand for hempcrete across residential, commercial, and even industrial sectors in the long term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $570.2 Million |

| Forecast Value | $2.24 Billion |

| CAGR | 14.9% |

Lime-based binders segment generated USD 383.7 million in 2024 and is expected to grow at a CAGR of 14.5% from 2025 to 2034. These binders are well-aligned with hemp hurd, offering high breathability and strong carbon absorption. Lime binders uphold the environmentally friendly image of hempcrete and are commonly used in certified green housing. Though they take longer to cure and offer lower structural strength, continuous R&D has given rise to more performance-driven alternatives while keeping sustainability intact.

The residential construction segment generated USD 338.1 million in 2024 and capturing 59.2% share. With a CAGR of 14.4% anticipated through 2034, the sector benefits from rising interest in energy-efficient self-build homes, low-emission structures, and climate-conscious architectural trends. Hempcrete's thermal insulation, low toxicity, and CO2 absorbing qualities make it a favorable material for sustainable housing, particularly in environmentally progressive markets such as North America and parts of Europe.

U.S. Hempcrete Market was valued at USD 169.1 million in 2024 and is forecasted to grow at a CAGR of 14.1% through 2034. Domestic growth is supported by evolving regulations around hemp cultivation, demand for green building products, and increasing adoption of sustainable construction practices. Hempcrete has gained traction particularly in retrofitting and new housing across environmentally progressive states. Canada's support for the industrial hemp industry also contributes to robust cross-border collaborations and supply chains for modular and residential applications.

Key players shaping the Global Hempcrete Market include Hempitecture Inc., Cavac Biomateriaux, Hemp and Block, American Hemp LLC, and HempStone. To expand their market share, companies operating in the hempcrete industry are investing in research and development to enhance binder performance, speed up curing time, and improve structural strength. Strategic collaborations with sustainable construction firms and architects are helping to increase project visibility. Many are scaling their production capabilities and establishing localized supply chains to reduce logistics costs and improve product accessibility. Educational campaigns and certifications around green building standards are also used to position hempcrete as a viable mainstream alternative to traditional materials. These efforts collectively enhance brand credibility, regulatory compliance, and consumer trust across global markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Binder Type

- 2.2.3 Construction Method

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2021-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, Binder Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Lime-based binders

- 5.2.1 Hydraulic lime

- 5.2.2 Aerial lime

- 5.2.3 Modified lime formulations

- 5.3 Cement-based binders

- 5.3.1 Portland cement

- 5.3.2 Blended cement systems

- 5.3.3 Low-carbon cement alternatives

- 5.4 Alternative binders

- 5.4.1 Alkali-activated binders

- 5.4.2 Cenosphere binders

- 5.4.3 Geopolymer binders

- 5.4.4 Mycelium-based binders

- 5.5 Hybrid formulations

- 5.5.1 Lime-cement blends

- 5.5.2 Polymer-modified systems

- 5.5.3 Fiber-reinforced formulations

Chapter 6 Market Estimates & Forecast, By Construction Method, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cast-in-place systems

- 6.2.1 Hand-casting methods

- 6.2.2 Pneumatic placement

- 6.2.3 Formwork systems

- 6.3 Precast systems

- 6.3.1 Block manufacturing

- 6.3.2 Panel production

- 6.3.3 Modular components

- 6.4 Spray applications

- 6.4.1 Wet spray systems

- 6.4.2 Dry mix applications

- 6.4.3 Robotic spray systems

- 6.5 Advanced manufacturing

- 6.5.1 3d printing technology

- 6.5.2 Automated production systems

- 6.6 Digital fabrication methods

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Walls and structural infill

- 7.2.1 Residential applications

- 7.2.2 Commercial applications

- 7.2.3 Industrial applications

- 7.3 Insulation systems

- 7.3.1 Thermal insulation market

- 7.3.2 Acoustic insulation applications

- 7.3.3 Retrofit insulation solutions

- 7.4 Roofing and flooring

- 7.4.1 Roofing applications

- 7.4.2 Flooring systems

- 7.4.3 Specialty applications

- 7.5 Precast blocks and panels

- 7.5.1 Precast block market

- 7.5.2 Panel systems

- 7.5.3 Modular construction applications

- 7.6 Cast-in-place applications

- 7.6.1 On-site casting

- 7.6.2 Spray applications

- 7.6.3 Custom formulations

- 7.7 Emerging applications

- 7.7.1 3d printing applications

- 7.7.2 Composite materials

- 7.7.3 Specialty construction uses

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential construction

- 8.2.1 Single-family homes

- 8.2.2 Multi-family housing

- 8.2.3 Affordable housing projects

- 8.2.4 Retrofit and renovation

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Educational facilities

- 8.3.4 Healthcare facilities

- 8.4 Industrial construction

- 8.4.1 Manufacturing facilities

- 8.4.2 Warehouses and distribution centers

- 8.4.3 Agricultural buildings

- 8.4.4 Specialty industrial applications

- 8.5 Infrastructure projects

- 8.5.1 Public buildings

- 8.5.2 Community centers

- 8.5.3 Transportation infrastructure

- 8.5.4 Utility buildings

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 American Hemp LLC

- 10.2 Cavac Biomateriaux

- 10.3 Hemp and Block

- 10.4 Hemp Building Institute

- 10.5 Hemp Technology Ltd.

- 10.6 Hempitecture Inc.

- 10.7 HempStone

- 10.8 IsoHemp

- 10.9 Lower Sioux Indian Community

- 10.10 Rare Earth Global

- 10.11 rePlant Hemp Advisors

- 10.12 Sativa Building Systems