PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801925

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801925

Powersports Aftermarket Size - By Vehicle, By Propulsion, By Application, By Sales Channel, By Component, Growth Forecast, 2025 - 2034

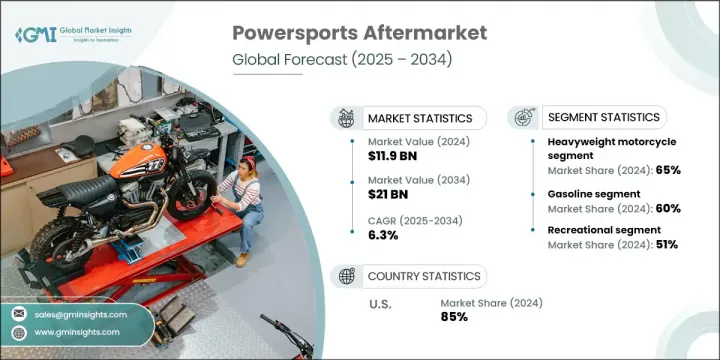

The Global Powersports Aftermarket was valued at USD 11.9 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 21 billion by 2034. This upward trend is shaped by rising interest in outdoor and recreational activities, alongside the evolution of vehicle performance technologies and the increasing presence of electric and hybrid-powered models. As more consumers embrace adventure lifestyles, the demand for aftermarket parts, accessories, and performance upgrades continues to rise. In recent years, digital platforms have helped reshape the industry landscape, with more riders purchasing upgrades, modifications, and repair kits online. Shifts in consumer behavior are also driving e-commerce growth, especially among users looking for customized solutions from the comfort of home. The post-pandemic momentum around outdoor experiences contributed significantly to the adoption of powersport vehicles, fueling demand across the board. Market players are adapting with expanded product offerings and seamless digital services that elevate customer convenience and satisfaction.

In 2024, the heavyweight motorcycle category held a 65% share and is projected to grow at a CAGR of 7% through 2034. These motorcycles-typically over 750cc-are favored by riders who prioritize customization, endurance touring, and long-term ownership value. Their robust design and touring capabilities often drive higher investment in aftermarket parts such as upgraded suspensions, luggage systems, performance exhausts, and lighting enhancements. Because riders of this segment are typically more enthusiastic about performance and personalization, the aftermarket ecosystem surrounding heavyweight bikes remains particularly strong.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.9 Billion |

| Forecast Value | $21 Billion |

| CAGR | 6.3% |

Gasoline-powered vehicles held 60% share in 2024, with growth anticipated at 7% CAGR through 2034. Gasoline continues to be the fuel of choice due to its widespread availability, high torque output, and extended range-factors that make these vehicles ideal for off-road and remote usage. This segment includes ATVs, motorcycles, utility terrain vehicles, and other performance machines, which often experience significant wear and tear, resulting in sustained demand for replacement components and upgrade kits. The resilience and reliability of gasoline engines ensure that users continue to invest in enhancements and long-term maintenance.

United States Powersports Aftermarket held 85% share and generated USD 4.72 billion in 2024. The US powersports aftermarket thrives on strong consumer adoption, established ownership patterns, and a deeply rooted off-road culture. Its robust network of retail channels, dealerships, and service centers makes aftermarket products easily accessible, while widespread adoption of e-commerce supports direct-to-consumer sales. The presence of notable brands like BRP, Polaris, Yamaha, and Honda, combined with digital-forward platforms such as RevZilla and Rocky Mountain ATV/MC, continues to strengthen the US market's position and responsiveness to shifting consumer preferences.

Leading companies in the Global Powersports Aftermarket include VANCE & HINES, BRP, K&N Engineering, Polaris, Arctic Cat, Dayco Incorporated, and S&S Cycle. Companies operating in the powersports aftermarket are focusing heavily on digital transformation, expanding their e-commerce reach, and offering personalized buying experiences. Product diversification is another core strategy, with brands introducing innovative parts and accessories tailored to specific vehicle types and rider preferences. Strategic collaborations with OEMs help boost brand visibility and expand distribution networks. Investments in R&D are targeted at improving product durability, performance, and compliance with evolving emission standards. Many players are leveraging data analytics and CRM platforms to understand customer behavior and deliver targeted marketing.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 Sales channel

- 2.2.6 Component

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in global outdoor recreation and adventure tourism

- 3.2.1.2 Surge in ATV, UTV, snowmobile, and motorcycle ownership among youth

- 3.2.1.3 Increase in demand for vehicle customization

- 3.2.1.4 Rising disposable income of individuals in North America and Europe

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fragmented market with intense price competition

- 3.2.2.2 Diverse and complex regulatory compliance across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric powersports vehicles aftermarket

- 3.2.3.2 Growth in online and mobile customization services

- 3.2.3.3 Rising powersports adoption in emerging markets

- 3.2.3.4 Integration of smart connected accessories

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Distribution channel evolution and omnichannel strategies

- 3.8.1 Traditional dealer network transformation

- 3.8.2 Independent retailer and specialty shop dynamics

- 3.8.3 Online marketplace integration and direct-to-consumer models

- 3.8.4 Warehouse and distribution center optimization

- 3.9 Consumer behavior and purchase pattern analysis

- 3.9.1 DIY vs. Professional installation preferences

- 3.9.2 Brand loyalty and OEM vs. Aftermarket preferences

- 3.9.3 Seasonal purchase patterns and inventory cycles

- 3.9.4 Price sensitivity and value perception analysis

- 3.10 Pricing strategy evolution and value proposition analysis

- 3.11 Digital transformation and e-commerce integration

- 3.11.1 Online sales platform development and market penetration

- 3.11.2 Digital catalog and product configuration systems

- 3.11.3 Mobile commerce and app-based ordering solutions

- 3.11.4 Augmented reality and virtual fitting technologies

- 3.12 Product innovation and performance enhancement trends

- 3.12.1 Performance upgrade technologies and market adoption

- 3.12.2 Smart technology integration and connected accessories

- 3.12.3 Lightweight materials and advanced manufacturing

- 3.12.4 Customization and personalization technology trends

- 3.13 Price trends

- 3.13.1 By region

- 3.13.2 By Vehicle

- 3.14 Production statistics

- 3.14.1 Production hubs

- 3.14.2 Consumption hubs

- 3.14.3 Export and import

- 3.15 Cost breakdown analysis

- 3.16 Sustainability and environmental aspects

- 3.16.1 Sustainable practices

- 3.16.2 Waste reduction strategies

- 3.16.3 Energy efficiency in production

- 3.16.4 Eco-friendly Initiatives

- 3.16.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.1.1 Side by side vehicle

- 5.1.2 All-terrain vehicle

- 5.1.3 Heavyweight motorcycle

- 5.1.4 Personal watercrafts

- 5.1.5 Snowmobile

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Recreational

- 7.3 Utility

- 7.4 Commercial

- 7.5 Sports

- 7.6 Construction

- 7.7 Defense

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Suspension & Brake Parts

- 9.3 Exhaust Systems

- 9.4 Tires & Wheels

- 9.5 Body Parts & Frames

- 9.6 Batteries & Electricals

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Akrapovic d.o.o.

- 11.1.2 BRP

- 11.1.3 Continental

- 11.1.4 Fox Factory

- 11.1.5 Honda Powersports

- 11.1.6 Kawasaki Motors

- 11.1.7 Magura GmbH

- 11.1.8 Polaris

- 11.1.9 Suzuki Motor

- 11.1.10 Yamaha Motor

- 11.2 Regional Players

- 11.2.1 Acerbis S.p.A

- 11.2.2 All Balls Racing

- 11.2.3 Kimpex

- 11.2.4 Mitas Tires

- 11.2.5 Motovan

- 11.2.6 Polisport Group

- 11.2.7 ProX Racing Parts

- 11.2.8 SBS Friction A/S

- 11.2.9 TM Designworks

- 11.2.10 Twin Air

- 11.3 Emerging Players

- 11.3.1 Baja Designs

- 11.3.2 Cycra Performance Plastics

- 11.3.3 FMF Racing

- 11.3.4 IMS Products

- 11.3.5 Racetech Products

- 11.3.6 Renegade Powersports

- 11.3.7 Scorpion Exhausts

- 11.3.8 Tusk Racing

- 11.3.9 Vortex Racing

- 11.3.10 ZETA USA