PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801928

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801928

Data Center Outsourcing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

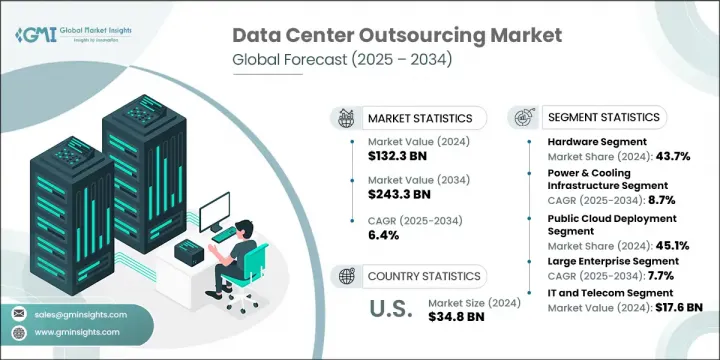

The Global Data Center Outsourcing Market was valued at USD 132.3 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 243.3 billion by 2034. The demand for data center outsourcing continues to rise as businesses increasingly pursue flexible and secure infrastructure solutions. Organizations are embracing hybrid cloud strategies that combine the control of private clouds with the agility of public cloud services. This approach enables companies to scale operations while maintaining tighter oversight of critical data. Outsourcing providers are now offering integrated solutions that span both private and public environments, optimizing performance and cost management simultaneously.

As emerging technologies such as 5G, IoT, and real-time applications gain momentum, enterprises are turning to edge computing for faster processing at the source of data generation. This has led to a shift toward more distributed outsourcing models, where smaller, decentralized facilities are placed closer to end users. In the US, hyperscale operators, including Microsoft Azure, Google Cloud, AWS, and IBM, are leading the outsourcing movement with their massive infrastructure and capacity to support enterprises at scale without hefty upfront investments. Meanwhile, data privacy frameworks such as HIPAA, FINRA, and CCPA are shaping outsourcing demand, driving businesses to work with providers who offer certified facilities, robust compliance support, and regional regulatory alignment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $132.3 Billion |

| Forecast Value | $243.3 Billion |

| CAGR | 6.4% |

The hardware segment captured 43.7% share in 2024 and is projected to grow at a CAGR of 6.4% through 2034. With rising data volumes and evolving technologies, organizations are opting to outsource hardware management to cut capital expenses and adopt an operating cost model. Managing in-house infrastructure upgrades proves cost-intensive and time-consuming, which is why outsourcing hardware services has become a preferred path for scalability and agility.

The power and cooling infrastructure segment is expected to register a CAGR of 8.7% from 2025 to 2034. Outsourcing providers are introducing advanced energy management solutions to support high-performance computing environments. Technologies such as AI-based temperature control, liquid cooling, and free cooling are being adopted to handle heat generated by dense workloads while also reducing energy consumption and enhancing system reliability.

United States Data Center Outsourcing Market held a 76.1% share in 2024, generating USD 34.8 billion. The US remains a global hub for data centers, driven by the presence of major providers such as Equinix, Amazon Web Services (AWS), Verizon Communications, and Google Cloud. As regulatory frameworks become more complex, companies increasingly seek third-party partners with the compliance credentials and infrastructure to navigate evolving data privacy laws. Canada's enterprise market is also transitioning toward cloud-driven outsourcing models, prioritizing speed, innovation, and cross-platform orchestration. Providers with strong hybrid and multi-cloud capabilities are seeing increased traction across the region.

Key companies operating in the Global Data Center Outsourcing Market include Cognizant, Tata Consultancy Services (TCS), Fujitsu, Accenture, Amazon Web Services (AWS), Google Cloud, Microsoft Azure, Equinix, Verizon Communications, and Digital Realty. To strengthen their position in the competitive data center outsourcing space, companies are focusing on expanding global infrastructure, integrating edge computing solutions, and offering hybrid and multi-cloud management platforms. Strategic investments are being made in AI-based automation for data management, energy optimization, and real-time monitoring. Providers are also forming alliances with hyperscale cloud vendors to co-deliver scalable services while ensuring compliance with evolving regional regulations. Emphasis is being placed on offering flexible service models, cost-effective infrastructure-as-a-service (IaaS), and dedicated support for industry-specific compliance, like healthcare or finance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Physical infrastructure

- 2.2.4 Deployment model

- 2.2.5 Organization Size

- 2.2.6 Industry vertical

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Profit margin analysis

- 3.1.2 Cost structure

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Value chain analysis

- 3.2.1 Data center infrastructure providers

- 3.2.2 Managed service providers

- 3.2.3 Cloud service providers

- 3.2.4 System integrators and consultants

- 3.2.5 End use organizations

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing cloud adoption

- 3.3.1.2 Cost efficiency

- 3.3.1.3 Focus on core business

- 3.3.1.4 Advanced security requirements

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Data privacy concerns

- 3.3.2.2 Dependence on service providers

- 3.3.2.3 High initial transition costs

- 3.3.2.4 Complexity of integration

- 3.3.3 Market opportunities

- 3.3.3.1 Expansion of edge computing

- 3.3.3.2 Green data center initiatives

- 3.3.3.3 Growth in IoT and 5G technologies

- 3.3.3.4 Increasing regulatory compliance needs

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Pricing models and cost structure analysis

- 3.5.1 Colocation pricing framework

- 3.5.2 Managed services pricing models

- 3.5.3 Cloud services cost structures

- 3.5.4 Total cost of ownership (TCO) analysis

- 3.5.5 CapEx vs OpEx decision framework

- 3.6 Service level agreements (SLA) and performance metrics

- 3.6.1 Uptime and availability standards

- 3.6.2 Performance benchmarking

- 3.6.3 Security and compliance requirements

- 3.6.4 Disaster recovery and business continuity

- 3.6.5 Support and maintenance standards

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 LATAM

- 3.7.5 MEA

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Data center capacity analysis and supply-demand dynamics

- 3.10.1 Global capacity overview

- 3.10.2 Supply-side analysis

- 3.10.3 Demand-side analysis

- 3.10.4 Capacity planning and forecasting

- 3.10.5 Capacity investment and financing

- 3.11 Power usage effectiveness (PUE) analysis and benchmarking

- 3.11.1 PUE fundamentals and industry standards

- 3.11.2 Global PUE performance analysis

- 3.11.3 PUE optimization strategies and technologies

- 3.11.4 Power distribution efficiency

- 3.11.5 IT equipment efficiency

- 3.11.6 AI-Driven PUE optimization

- 3.11.7 PUE impact on business decisions

- 3.12 Energy efficiency technologies and optimization strategies

- 3.12.1 Advanced cooling technologies

- 3.12.2 Power management and distribution efficiency

- 3.12.3 IT infrastructure efficiency

- 3.12.4 Monitoring and management systems

- 3.12.5 ROI and business case for energy efficiency

- 3.13 Strategic scenarios and best case analysis

- 3.14 Comprehensive case studies and success stories

- 3.15 Technology and innovation landscape

- 3.15.1 Current technology analysis

- 3.15.2 Emerging technology trends

- 3.16 Patent analysis

- 3.17 Sustainability and environmental strategies

- 3.17.1 Environmental impact assessment

- 3.17.2 Green data center technologies and solutions

- 3.17.3 Sustainable infrastructure design

- 3.17.4 Environmental regulations and compliance

- 3.17.5 Corporate sustainability strategies

- 3.17.6 Economic benefits of sustainability

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Service

Chapter 6 Market Estimates & Forecast, By Physical Infrastructure, 2021 - 2034 (USD Mn)

- 6.1 Key trends

- 6.2 Data center facilities

- 6.3 Power & cooling infrastructure

- 6.4 Racks & cabinets

- 6.5 Cabling & wiring

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 (USD Mn)

- 7.1 Key trends

- 7.2 Public cloud deployment

- 7.3 Private cloud deployment

- 7.4 Hybrid cloud deployment

- 7.5 Community cloud deployment

- 7.6 Multi-cloud deployment

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD Mn)

- 8.1 Key trends

- 8.2 Small/medium enterprises

- 8.3 Large enterprises

- 8.4 Government and public sector

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 (USD Mn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT and telecom

- 9.4 Healthcare and life sciences

- 9.5 Government and public sector

- 9.6 Manufacturing and industrial

- 9.7 Retail and e-commerce

- 9.8 Other industries

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Poland

- 10.3.7 Nordics

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Singapore

- 10.4.5 Indonesia

- 10.4.6 Australia

- 10.4.7 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Mexico

- 10.5.4 Chile

- 10.5.5 Colombia

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Leaders

- 11.1.1 Accenture

- 11.1.2 AWS

- 11.1.3 Cognizant

- 11.1.4 Digital Realty

- 11.1.5 Equinix

- 11.1.6 Google Cloud

- 11.1.7 Hewlett Packard Enterprise (HPE)

- 11.1.8 IBM

- 11.1.9 Microsoft Azure

- 11.1.10 NTT

- 11.1.11 Tata Consultancy Services (TCS)

- 11.2 Regional Players

- 11.2.1 CyrusOne

- 11.2.2 Fujitsu

- 11.2.3 Interxion

- 11.2.4 Iron Mountain

- 11.2.5 Kyndryl

- 11.2.6 Lumen Technologies

- 11.2.7 Rackspace Technology

- 11.2.8 Schneider Electric

- 11.3 Emerging Players

- 11.3.1 AT&T

- 11.3.2 Verizon Communications