PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801940

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801940

Voltage Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

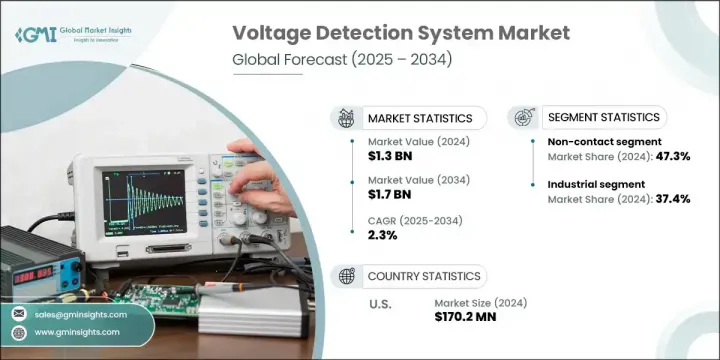

The Global Voltage Detection System Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 2.3% to reach USD 1.7 billion by 2034. The market's upward trajectory is being driven by increasing emphasis on efficient energy usage, propelled by environmental regulations and sustainability initiatives. Innovations in smart grid technologies, automated distribution networks, and intelligent metering are improving energy reliability and system performance. The adoption of smart grid frameworks is enabling real-time voltage monitoring, allowing for predictive diagnostics and remote maintenance. Voltage detection systems are becoming essential in industrial automation, where safety and accuracy are paramount.

Compact, high-performance sensors are now integrated into complex environments, enhancing monitoring in confined or sensitive settings. Integration with IoT platforms and the ability to deliver wireless, real-time data is improving operational continuity while keeping maintenance costs in check. Infrastructural upgrades and modernization of legacy power networks are reinforcing the demand for advanced detection systems, particularly those offering seamless communication and system compatibility. As global electrification continues, precision and safety in voltage detection are becoming critical across sectors ranging from utilities to manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $1.7 Billion |

| CAGR | 2.3% |

The non-contact voltage detection systems held 47.3% share in 2024 and is expected to register a CAGR of 3.1% through 2034. These systems offer the benefit of enhanced safety by allowing technicians to identify live wires without making physical contact, reducing exposure to electric shock. Widely favored for routine inspections and rapid diagnostics, these tools are user-friendly and suitable for both novice and experienced operators. The combination of convenience and reliability is expanding their use across maintenance and safety applications.

The industrial sector held 37.4% share in 2024 and is forecasted to grow at a CAGR of 1.7% from 2025 to 2034. High-voltage environments such as factories and manufacturing facilities require precise verification before initiating procedures like lockout/tagout (LOTO). Voltage detection systems are critical in safeguarding personnel and preventing arc flash incidents. Their integration into safety protocols is ensuring equipment remains compliant with safety standards, while minimizing operational risk.

United States Voltage Detection System Market was valued at USD 170.2 million in 2024. Growth in the U.S. is fueled by strict occupational safety regulations under bodies such as OSHA and NFPA 70E, which necessitate verified distancing protocols and safety checks. The country's aging electrical infrastructure also demands regular testing and maintenance, encouraging industrial and utility sectors to invest in reliable detection tools. The increasing share of renewable energy sources, including solar and wind, is expanding the scope of voltage monitoring across diverse power generation systems.

Prominent companies in the Global Voltage Detection System Market include Epoxy House, Chauvin Arnoux, Megger, PENTA, Electrisium International, Fluke Corporation, K.K. Sales Corporation, DEHN SE, Horstmann, Xiamen Andaxing Electric Group, Georg Jordan, C&S Electric Limited, Thorne & Derrick, KPB INTRA s.r.o, Orion EE, Cyclotech, Kries-Energietechnik GmbH & Co. KG, ELECTRONSYSTEM MD srl, ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH, Dipl.-Ing. H. Horstmann GmbH, Arshon Technology, Kyoritsu, and Cole-Parmer Instrument Company. To strengthen their presence in the voltage detection system market, companies are focusing on product innovation and expanding global distribution networks. Many manufacturers are integrating IoT compatibility and wireless features to improve system intelligence and adaptability in both industrial and utility applications. Emphasis is placed on miniaturizing sensors to support use in compact or remote environments. Partnerships with energy utilities and infrastructure firms are helping companies scale quickly in smart grid modernization projects. Firms are also investing in R&D to enhance accuracy and reliability, aligning with evolving safety standards. In response to increasing demand across emerging economies, some players are establishing regional manufacturing hubs to streamline supply chains and reduce costs, thereby improving access to cost-effective, high-performance detection solutions worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1.1 Raw material and component suppliers

- 3.1.1.2 Design and engineering

- 3.1.1.3 Manufacturing and assembly

- 3.1.1.4 Distribution and logistics

- 3.1.1.5 Marketing and sales

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Price trend analysis, 2021-2034

- 3.8 Import/export trade analysis

- 3.8.1 Key importing countries

- 3.8.2 Key exporting countries

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Contact

- 5.3 Non-contact

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

- 6.5 Utilities

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 Australia

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 China

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ARCUS ELEKTROTECHNIK ALOIS SCHIFFMANN GMBH

- 8.2 Arshon Technology

- 8.3 C&S Electric Limited

- 8.4 CATU SAS

- 8.5 Chauvin Arnoux

- 8.6 Cole-Parmer Instrument Company

- 8.7 DEHN SE

- 8.8 Dipl.-Ing. H. Horstmann GmbH

- 8.9 Electrisium International

- 8.10 ELECTRONSYSTEM MD srl

- 8.11 Epoxy House

- 8.12 Fluke Corporation

- 8.13 Georg Jordan

- 8.15 K.K. Sales Corporation

- 8.16 Klein Tools

- 8.17 KPB INTRA s.r.o

- 8.18 Kries-Energietechnik GmbH & Co. KG

- 8.19 Kyoritsu

- 8.20 Megger

- 8.21 Orion EE

- 8.22 PENTA

- 8.23 Thorne & Derrick

- 8.24 Xiamen Andaxing Electric Group