PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801941

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801941

Metal Cutting Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

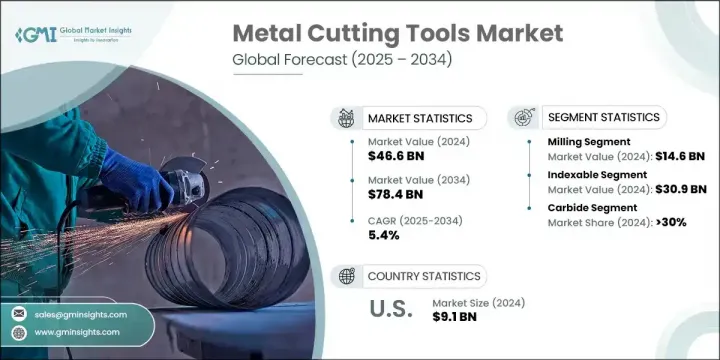

The Global Metal Cutting Tools Market was valued at USD 46.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 78.4 billion by 2034. The market is witnessing strong momentum as cutting-edge CNC and multi-axis machining continue to evolve metal cutting tools from simple standalone devices into smart, interconnected manufacturing systems. As IoT integration and adaptive tooling become more prevalent, modern-day machinists are now required to merge automation proficiency with data analytics and high-precision skills. This shift toward intelligent manufacturing environments is pushing demand for advanced technical training and continuous upskilling. Asia-Pacific leads the global market, propelled by a robust manufacturing base and government-led industrial expansion. The region's quick uptake of CNC and intelligent machining platforms is enhancing productivity and streamlining output across industries.

Heavy investments in automotive and electronics production, especially in countries like Japan, India, and China, are significantly boosting demand for precision tooling. Policy-driven incentives aimed at industrial modernization are further accelerating equipment upgrades across manufacturing plants. Milling tools dominate the metal cutting segment, owing to their adaptability, high material removal rates, and compatibility with CNC systems and multi-axis machines. These tools are widely deployed in applications that require both rough cutting and fine finishing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.6 Billion |

| Forecast Value | $78.4 Billion |

| CAGR | 5.4% |

Milling tools generated USD 14.6 billion in 2024 and are projected to grow at a CAGR of 6.6% through 2034. Their widespread use in automotive and industrial sectors drives this dominance, thanks to their accuracy and ability to handle intricate shapes and surface finishes. The combination of flexibility and functionality makes milling essential for both primary and secondary machining processes.

The Indexable tools generated USD 30.9 billion in 2024 and are expected to register a CAGR of 5.8% during 2025-2034. These tools stand out due to their ability to reduce downtime and costs by using replaceable inserts that can be rotated to expose fresh cutting surfaces. This design eliminates the need for frequent regrinding and setup, making indexable tools ideal for continuous, high-speed machining in mass production scenarios. Sectors like heavy equipment manufacturing and general engineering benefit from their durability and consistent performance.

United States Metal Cutting Tools Market held an 87.5% share, generating USD 9.1 billion in 2024. The country's solid manufacturing infrastructure and widespread adoption of CNC machinery continue to fuel market expansion. Backed by industrial automation trends and strong demand from sectors such as defense and automotive, the US remains both a leading producer and a major consumer of precision tooling. Regulatory support and export competitiveness also contribute to the country's solid market foothold.

Key companies shaping the Global Metal Cutting Tools Market include Nachi-Fujikoshi, Emerson, Walter, Stanley Black & Decker, Ceratizit, Seco Tools, TaeguTec, Kyocera, Iscar, Sumitomo Electric Hardmetal, Bosch, Guhring, Sandvik, OSG, Atlas Copco, and Mapal. To strengthen their presence, companies operating in the metal cutting tools market are investing heavily in R&D to develop next-generation tools that improve precision, durability, and machining speed. Focused efforts are being made to integrate AI and digital monitoring to enhance tool lifecycle management and performance analytics. Leading manufacturers are expanding production capabilities and forming joint ventures with local players to gain access to emerging markets. Diversifying product portfolios to include smart, indexable, and energy-efficient cutting tools is another core strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tool

- 2.2.3 Process

- 2.2.4 Material

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Tool, 2021-2034 ($Bn, Million Units)

- 5.1 Key trends

- 5.2 Indexable

- 5.3 Solid

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 ($Bn, Million Units)

- 6.1 Key trends

- 6.2 Milling

- 6.3 Drilling

- 6.4 Boring

- 6.5 Turning

- 6.6 Grinding

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Million Units)

- 7.1 Key trends

- 7.2 Carbide

- 7.3 High speed steel

- 7.4 Stainless steel

- 7.5 Ceramics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Million Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace & defense

- 8.4 Oil & gas

- 8.5 General machining

- 8.6 Medical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Million Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Atlas Copco

- 11.2 Bosch

- 11.3 Ceratizit

- 11.4 Emerson

- 11.5 Guhring

- 11.6 Iscar

- 11.7 Kyocera

- 11.8 Mapal

- 11.9 Nachi-Fujikoshi

- 11.10 OSG

- 11.11 Sandvik

- 11.12 Seco Tools

- 11.13 Stanley Black & Decker

- 11.14 Sumitomo Electric Hardmetal

- 11.15 TaeguTec

- 11.16 Walter