PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801943

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801943

Rigid Endoscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

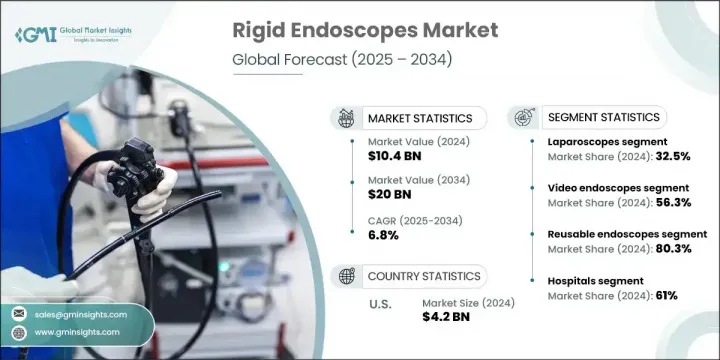

The Global Rigid Endoscopes Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 20 billion by 2034. Market expansion is largely driven by the rising incidence of chronic health issues and an aging global population. Rigid endoscopes are essential for performing minimally invasive procedures that aid in diagnosing and treating a wide range of conditions, including respiratory complications, digestive system ailments, and ENT disorders. These devices deliver crystal-clear imaging and are widely applied in surgeries involving the abdominal cavity, joints, reproductive system, and urinary bladder. Increasing patient preference for minimally invasive techniques-because of faster recovery, fewer complications, and lower hospitalization times-is playing a vital role in boosting demand. Additionally, ongoing advancements in high-definition imaging and surgical navigation tools further reinforce their adoption in both outpatient and inpatient care.

The laparoscopes category held 32.5% share in 2024, fueled by the expanding popularity of procedures like gallbladder removal, hernia repair, and gynecological surgeries that minimize post-operative pain and shorten hospital stays.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $20 Billion |

| CAGR | 6.8% |

The video endoscopes segment held 56.3% share in 2024, driven by their ability to deliver real-time, high-definition visualization, which enhances surgical precision and clinical documentation. These tools also facilitate team collaboration during operations, making them highly preferred across surgical departments.

U.S. Rigid Endoscopes Market generated USD 4.2 billion in 2024, supported by robust healthcare infrastructure and wide-scale adoption of minimally invasive surgical techniques. Strong reimbursement frameworks, a growing elderly population, and an uptick in early diagnostic screenings continue to bolster regional demand. Rising surgical volumes, advanced imaging innovations, and a focus on outpatient procedures across the country are sustaining this momentum. Leading manufacturers and medtech innovators in the U.S. are also channeling substantial investments into endoscopic R&D and automation.

Top players shaping the Rigid Endoscopes Market landscape include Stryker, Olympus Corporation, Richard Wolf, Karl Storz, Smith & Nephew, Fujifilm, Scholly Fiberoptic, Arthrex, PENTAX Medical, ConMed, B. Braun, Henke-Sass, Wolf, Cook Medical, XION GmbH, Boston Scientific, and Ambu A/S. Key strategies adopted by companies in the rigid endoscopes market include advancing product innovation through AI-assisted imaging, ergonomic instrument design, and integrated video systems to improve surgical precision. Mergers, strategic partnerships, and acquisitions are common to expand product portfolios and enter untapped geographic areas. Players are heavily investing in R&D to enhance minimally invasive platforms and explore robotic endoscopic technologies. Many are also strengthening after-sales service networks and engaging in physician training programs to drive adoption. Collaborations with surgical centers and institutions support early clinical adoption and increase market penetration globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Technology trends

- 2.2.3 Usability trends

- 2.2.4 End use trends

- 2.2.5 Region trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic conditions

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising adoption of minimally invasive surgeries

- 3.2.1.4 Increasing health awareness and demand for early-stage diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High device cost

- 3.2.2.2 Risk of patient discomfort and procedural limitations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and ambulatory surgical centers (ASCs)

- 3.2.3.2 Emerging markets with improving healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, 2024

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Future market trends

- 3.9 Go-to-market strategy

- 3.10 Pipeline analysis

- 3.11 Gap analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Laparoscopes

- 5.3 Arthroscopes

- 5.4 Cystoscopes

- 5.5 ENT endoscopes

- 5.6 Bronchoscopes

- 5.7 Ureteroscopes

- 5.8 Hysteroscopes

- 5.9 Other product types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Conventional endoscopes

- 6.3 Video endoscopes

- 6.4 Fiber-optic endoscopes

Chapter 7 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Reusable endoscopes

- 7.3 Disposable endoscopes

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 Arthrex

- 10.3 B. Braun

- 10.4 Boston Scientific

- 10.5 ConMed

- 10.6 Cook

- 10.7 Fujifilm

- 10.8 Henke-Sass Wolf

- 10.9 Olympus

- 10.10 PENTAX Medical

- 10.11 Richard Wolf

- 10.12 Scholly Fiberoptic

- 10.13 Smith & Nephew

- 10.14 Storz

- 10.15 Stryker

- 10.16 XION medical