PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801944

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801944

Biomedical Refrigerators and Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

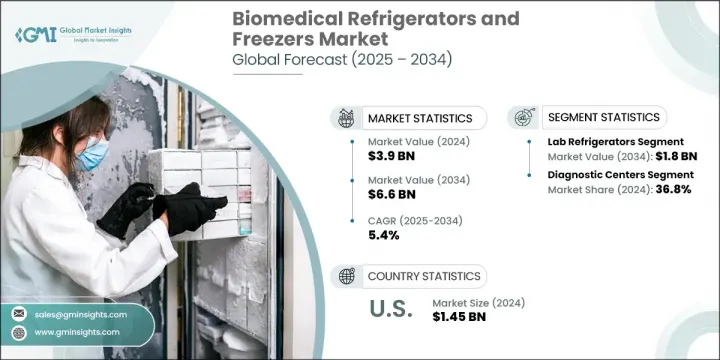

The Global Biomedical Refrigerators and Freezers Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6.6 billion by 2034. Market growth is primarily fueled by technological innovations, rising biopharmaceutical development, increasing organ transplant activity, and expanded government funding for research and clinical trials. These drivers are collectively creating robust demand across both advanced and developing regions. Biomedical refrigerators and freezers are critical storage solutions in healthcare, pharmaceutical, and research environments. These systems are engineered to maintain precise temperature control to preserve the integrity and stability of medications, vaccines, biological samples, and lab reagents.

The rise in global demand for organ transplants further amplifies the importance of these systems, as they help preserve donated organs and tissues prior to transplantation. Ensuring the quality of these sensitive materials directly affects patient outcomes and scientific research success. With more focus on medical advancements, especially in biotechnological sectors, the need for reliable cold storage systems is becoming more pronounced. Biomedical cold storage equipment continues to serve as a vital link in maintaining regulatory compliance, operational efficiency, and product safety in labs, diagnostic centers, and medical facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 5.4% |

The lab refrigerators segment generated USD 1.1 billion in 2024 and is forecasted to hit USD 1.8 billion by 2034, growing at a CAGR of 5.7%. This segment benefits from the increasing demand for precise temperature-controlled solutions across laboratory environments. Expansion in research activity and increased pharmaceutical product development are driving laboratories to adopt advanced refrigeration units. These systems, which typically operate between 2°C and 8°C, offer a dependable option for safely storing temperature-sensitive materials such as reagents, samples, and chemical compounds critical to testing and development processes.

In 2024 the diagnostic centers held the highest market share at 36.8%. These facilities heavily rely on biomedical cold storage equipment to handle the growing volume of diagnostic tests and biological samples. With preventive healthcare gaining more attention and awareness rising around early disease detection, the need for reliable sample storage has grown. Biomedical refrigeration systems ensure that sample quality is maintained throughout the testing cycle, supporting efficiency and diagnostic accuracy within these centers.

United States Biomedical Refrigerators and Freezers Market generated 1.45 billion in 2024. Several factors are accelerating this growth, including greater investments in life sciences, expansion of pharmaceutical and biotech production facilities, and stricter quality control requirements from regulatory bodies. Increasing activity in areas like personalized medicine, vaccine research, and genomics is fueling the demand for state-of-the-art lab equipment. This is significantly contributing to the need for high-performance refrigeration systems in R&D institutions and commercial healthcare settings across the country.

Key players driving the Global Biomedical Refrigerators and Freezers Market include NuAire, PHC Corporation, BINDER, Aegis Scientific, Eppendorf, Lab Research Products, Thermo Fisher Scientific, Azbil Corporation, Stirling Ultracold, Helmer Scientific, So-Low Environmental Equipment, Follett Products, B Medical Systems, Powers Scientific, and Migali Scientific. Leading manufacturers in the biomedical refrigerators and freezers market are prioritizing product innovation, global expansion, and advanced temperature control technology to strengthen their market positions. Companies are heavily investing in R&D to develop energy-efficient, eco-friendly, and IoT-enabled refrigeration units that provide remote monitoring and temperature tracking. To enhance global footprint, key players are expanding distribution networks and forming strategic partnerships with healthcare providers and research institutions. Some companies are also leveraging automation and AI to improve device performance, minimize downtime, and meet regulatory compliance requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising government support for research activities and clinical trials

- 3.2.1.2 Technological advancements in biomedical refrigerators and freezers

- 3.2.1.3 Increasing geriatric population base

- 3.2.1.4 Increasing demand for biopharmaceuticals and organ transplantation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Presence of large number of local players providing affordable refurbished equipment

- 3.2.2.2 Release of hydrofluorocarbons from refrigerators and freezers have deleterious impact on environment

- 3.2.2.3 High purchase costs, maintenance costs and energy costs of biomedical refrigerators and freezers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Plasma freezers

- 5.3 Blood bank refrigerators

- 5.4 Lab refrigerators

- 5.5 Lab freezers

- 5.6 Ultra-low temperature freezers

- 5.7 Shock freezers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood banks

- 6.3 Pharmacies

- 6.4 Hospitals

- 6.5 Research labs

- 6.6 Diagnostic centers

- 6.7 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Aegis Scientific

- 8.2 Azbil Corporation

- 8.3 B Medical Systems

- 8.4 BINDER

- 8.5 Eppendorf

- 8.6 Follett Products

- 8.7 Helmer Scientific

- 8.8 Lab Research Products

- 8.9 Migali Scientific

- 8.10 NuAire

- 8.11 PHC Corporation

- 8.12 Powers Scientific

- 8.13 So-Low Environmental Equipment

- 8.14 Stirling Ultracold

- 8.15 Thermo Fisher Scientific