PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801949

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801949

Automated Breast Ultrasound Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

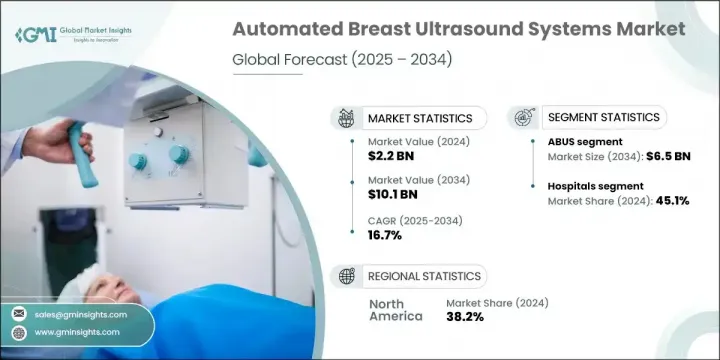

The Global Automated Breast Ultrasound Systems Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 16.7% to reach USD 10.1 billion by 2034. Rising breast cancer rates across the globe, growing emphasis on early detection, strong public health awareness, and government-backed screening initiatives are among the core factors driving this market forward. With rapid advances in medical imaging and diagnostic technology, automated breast ultrasound systems are gaining ground as essential tools in breast cancer screening, especially among women with dense breast tissue.

Automated breast ultrasound systems, or ABUS, offer advanced 3D visualization of the entire breast, providing consistent and standardized imaging without relying heavily on the skill of the operator. Their implementation is rapidly increasing in hospitals, imaging centers, and specialized breast care facilities due to their ability to enhance detection accuracy. By capturing high-resolution images across tissue layers, these systems support early diagnosis and improve patient outcomes. As health organizations continue prioritizing early-stage cancer identification, the integration of ABUS alongside other imaging methods becomes even more important. The focus on dense breast screening and AI-enhanced diagnostics is expected to drive demand and adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 16.7% |

In 2024, the ABUS category held the largest market value at USD 1.4 billion and will reach USD 6.5 billion by 2034, growing at a CAGR of 16.9%. Its leadership in the market stems from increasing demand for AI-powered diagnostics, wider awareness of breast cancer risks, and the growing use of these systems across healthcare environments for thorough screening and detailed analysis. ABUS delivers full 3D breast imaging, enabling radiologists to identify abnormalities that may go unnoticed with conventional mammography. Its high clarity reduced human error, and standardization has made it a key asset in breast cancer detection for patients with dense breast composition.

The hospitals segment held a 45.1% share in 2024. These facilities are equipped with advanced diagnostic technology and have access to skilled professionals, making them leading adopters of ABUS. As central hubs for cancer screening, diagnosis, and treatment, hospitals handle high patient volumes and benefit from public health screening programs, further promoting the use of automated ultrasound systems. The integration of ABUS into broader diagnostic workflows allows healthcare providers to offer more complete and efficient breast care services.

United States Automated Breast Ultrasound Systems Market reached USD 758.3 million in 2024. This growth is closely tied to the increasing incidence of breast cancer across the country, which has led to a surge in demand for precise, early-stage diagnostic tools. The U.S. healthcare ecosystem also benefits from a favorable regulatory environment, widespread public education on cancer screening, and strong investments in medical technology innovation. These factors create a solid foundation for ABUS adoption and continued market expansion.

Key companies active in the Global Automated Breast Ultrasound Systems Market include Siemens Healthineers, SonoCine, Inc., Canon, GE Healthcare, Real Imaging, Seno Medical Instruments Inc., Hologic, Supersonic Imagine, Shantou Institute of Ultrasonic Instruments, Theraclion, Metritrack, QView Medical, Delphinus Medical Technologies, Koninklijke Philips, CapeRay Medical, and Hitachi. Companies operating in the automated breast ultrasound systems market are strengthening their presence through a combination of innovation, global expansion, and collaborative partnerships. Leading players are heavily investing in R&D to enhance image quality, reduce scan time, and integrate AI-based interpretation tools. To meet increasing demand in both developed and emerging markets, manufacturers are expanding their distribution networks and entering strategic alliances with hospitals and diagnostic chains. Many firms are working on gaining faster regulatory approvals to accelerate product rollouts, especially in high-burden regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of breast cancer worldwide

- 3.2.1.2 Rising technological advancements in automated breast ultrasound systems

- 3.2.1.3 Limited capability of mammography in dense breast tissue patients

- 3.2.1.4 Rising awareness and favorable government initiatives regarding breast cancer

- 3.2.1.5 Increasing national breast screening programs across the globe

- 3.2.1.6 Increased reimbursement for breast ultrasound and digital breast tomosynthesis in the U.S.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the automated breast ultrasound system

- 3.2.2.2 Limited awareness of ABUS in developing countries

- 3.2.2.3 Lack of skilled or trained personnel in emerging nations

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of AI-integrated ABUS for predictive breast cancer screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automated breast ultrasound system (ABUS)

- 5.3 Automated breast volume scanner (ABVS)

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic imaging centers

- 6.4 Specialty clinics

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Canon

- 8.2 CapeRay Medical

- 8.3 Delphinus Medical Technologies

- 8.4 GE Healthcare

- 8.5 Hitachi

- 8.6 Hologic

- 8.7 Koninklijke Philips

- 8.8 Metritrack

- 8.9 QView Medical

- 8.10 Real Imaging

- 8.11 SonoCine, Inc.

- 8.12 Supersonic Imagine

- 8.13 Siemens Healthineers

- 8.14 Seno Medical Instruments Inc.

- 8.15 Shantou Institute of Ultrasonic Instruments

- 8.16 Theraclion