PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801954

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801954

US Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

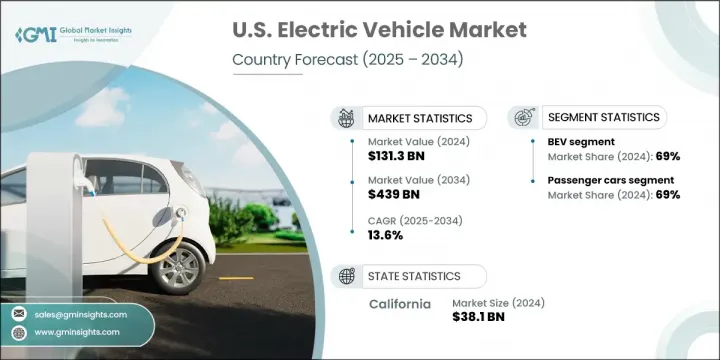

U.S. Electric Vehicle Market was valued at USD 131.3 billion in 2024 and is estimated to grow at a CAGR of 13.6% to reach USD 439 billion by 2034. This growth is propelled by strong government incentives, rapid expansion of the EV charging network, and growing consumer awareness about environmental impact. Both federal and state-level policies are laying a foundation for widespread EV adoption, while automakers are innovating to deliver vehicles with longer battery ranges, faster charging capabilities, and advanced driver assistance systems.

Demand is also driven by significant investments in battery production, vehicle electrification, and digital platforms. Collaborations between automakers, tech firms, and clean energy providers are transforming the transportation landscape and pushing toward a zero-emission future. Companies like Chevrolet, Tesla, and Zero Motorcycles are all playing key roles in shaping the US EV ecosystem, supported by advancements in battery systems, software integrations, and connected driving experiences. American firms are increasingly integrating digital technologies and offering smart mobility solutions suited for next-gen consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $131.3 Billion |

| Forecast Value | $439 Billion |

| CAGR | 13.6% |

The battery electric vehicles (BEVs) held a 69% share in 2024 and are projected to grow at a CAGR of 14% through 2034. Consumers are increasingly choosing BEVs for their all-electric powertrains, zero tailpipe emissions, and ongoing improvements in public charging options. With stricter emissions regulations in place, automakers are shifting focus toward BEV production to meet sustainability targets and appeal to eco-conscious buyers.

The passenger car segment held a 69% share in 2024, growing at a CAGR of 13% through 2034. Enhanced interest in advanced infotainment systems, smarter connectivity, and improved safety features is accelerating EV sales in this category. Manufacturers are incorporating high-tech, software-driven features to meet consumer expectations for efficient and intelligent mobility experiences.

California Electric Vehicle Market held a 71% share and generated USD 38.1 billion in 2024. The state remains at the forefront due to its strong zero-emission vehicle policies, generous incentives, and widespread charging infrastructure. California's leadership in clean energy programs, along with its cluster of technology-driven firms, has fostered a thriving environment for EV innovation. These initiatives have laid the groundwork for future growth in autonomous and connected electric vehicles.

Key automakers in the US Electric Vehicle Market include Ford, Mercedes-Benz, BMW, Nissan, Hyundai, Audi, Volkswagen, Tesla, Harley-Davidson, Chevrolet, and Zero Motorcycles. To strengthen their market presence, US electric vehicle companies are leveraging several strategic approaches. Key players are investing in vertically integrated manufacturing, particularly around battery technologies and electric drivetrains, to improve cost control and supply chain stability. Partnerships with software firms and clean energy providers are enabling innovation in autonomous driving features, cloud-based services, and smart charging solutions. Manufacturers are also expanding their retail networks and offering flexible financing and subscription models to attract a wider customer base.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Propulsion

- 2.2.3 Vehicle

- 2.2.4 Drivetrain

- 2.2.5 Battery

- 2.2.6 Range

- 2.2.7 Price Range

- 2.2.8 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Market value chain analysis

- 3.2.1 Raw materials and mining

- 3.2.2 Component manufacturing

- 3.2.3 Vehicle assembly and integration

- 3.2.4 Distribution and retail

- 3.2.5 Aftermarket and services

Chapter 4 Competitive Landscape, 2024

- 4.1 Industry impact forces

- 4.1.1 Growth drivers

- 4.1.1.1 Federal and state-level incentives

- 4.1.1.2 Expansion of EV charging infrastructure

- 4.1.1.3 Advancements in battery technology

- 4.1.1.4 Rising fuel prices and environmental awareness

- 4.1.1.5 OEM investments and diverse EV model launches

- 4.1.1.6 Electrification of corporate and government fleets

- 4.1.2 Industry pitfalls and challenges

- 4.1.2.1 Limited charging infrastructure in rural areas

- 4.1.2.2 High upfront vehicle cost

- 4.1.3 Market opportunities

- 4.1.3.1 Development of fast-charging networks

- 4.1.3.2 Integration with renewable energy sources

- 4.1.3.3 Growth of EV-as-a-Service and subscription models

- 4.1.3.4 Vehicle-to-Grid (V2G) technology adoption

- 4.1.1 Growth drivers

- 4.2 Growth potential analysis

- 4.3 Regulatory landscape

- 4.4 Porter’s analysis

- 4.5 PESTEL analysis

- 4.6 Technology and Innovation landscape

- 4.6.1 Current technological trends

- 4.6.2 Emerging technologies

- 4.7 Electric vehicle technology evolution

- 4.7.1 Battery technology development

- 4.7.1.1 Lithium-ion battery chemistry evolution

- 4.7.1.2 Energy density and performance improvements

- 4.7.1.3 Fast charging capability development

- 4.7.1.4 Battery management system advances

- 4.7.1.5 Thermal management and safety systems

- 4.7.1.6 Cost reduction and manufacturing scale

- 4.7.1.7 Lifecycle and durability enhancements

- 4.7.2 Electric Drivetrain Technology

- 4.7.1 Battery technology development

- 4.8 Electric motor design and efficiency

- 4.8.1.1 Power electronics and inverters

- 4.8.1.2 Transmission and drivetrain integration

- 4.8.1.3 Regenerative braking systems

- 4.8.1.4 Vehicle control and management systems

- 4.8.1.5 Noise, vibration, and harshness (NVH)

- 4.8.1.6 Performance optimization and Tuning

- 4.8.2 Charging technology and standards

- 4.8.2.1 AC and DC charging protocols

- 4.8.2.2 Fast charging and ultra-fast charging

- 4.8.2.3 Wireless and inductive charging

- 4.8.2.4 Vehicle-to-Grid (V2G) technology

- 4.8.2.5 Smart charging and grid integration

- 4.8.2.6 Charging standards and interoperability

- 4.8.2.7 Mobile and portable charging solutions

- 4.9 Sustainability and environmental aspects

- 4.9.1 Sustainable practices

- 4.9.2 Waste reduction strategies

- 4.9.3 Energy efficiency in production

- 4.9.4 Eco-friendly Initiatives

- 4.9.5 Carbon footprint considerations

Chapter 5 Competitive Landscape, 2024

- 5.1 Introduction

- 5.2 Company market share analysis

- 5.2.1 Northeast

- 5.2.2 Midwest

- 5.2.3 Southern

- 5.2.4 Western

- 5.3 Competitive analysis of major market players

- 5.4 Competitive positioning matrix

- 5.5 Strategic outlook matrix

- 5.6 Key developments

- 5.6.1 Mergers & acquisitions

- 5.6.2 Partnerships & collaborations

- 5.6.3 New Product Launches

- 5.6.4 Expansion Plans and funding

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 HEV

- 6.4 PHEV

- 6.5 FCEV

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Two-wheelers

- 7.2.1 Electric scooters

- 7.2.2 E-bikes

- 7.2.3 Electric mopeds

- 7.3 Passenger cars

- 7.3.1 Sedan

- 7.3.2 SUV

- 7.3.3 Hatchback

- 7.4 Commercial vehicles

- 7.4.1 Light

- 7.4.2 Medium

- 7.4.3 Heavy

- 7.5 Specialty EVs

- 7.5.1 Off-road EVs (ATVs, UTVs)

- 7.5.2 Golf carts

- 7.5.3 Utility EVs

Chapter 8 Market Estimates & Forecast, By Drivetrain, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Front-wheel drive

- 8.3 Rear-wheel drive

- 8.4 All-wheel drive

Chapter 9 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Sealed lead acid

- 9.3 Nickel metal hydride (NiMH)

- 9.4 Lithium Ion

Chapter 10 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Less than 100 km

- 10.3 100 km to 200 km

- 10.4 200 km to 300 km

- 10.5 Above 300 km

Chapter 11 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 Below USD 10,000

- 11.3 USD 10,000 to USD 30,000

- 11.4 USD 30,000 to USD 50,000

- 11.5 Above USD 50,000

Chapter 12 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 Personal

- 12.3 Commercial

- 12.3.1 Ride-sharing & ride-hailing

- 12.3.2 Logistics & delivery

- 12.3.3 Corporate fleets

- 12.4 Government

- 12.4.1 Public transportation

- 12.4.2 Utility fleets

- 12.4.3 Law enforcement

- 12.5 Private

- 12.5.1 Universities

- 12.5.2 Industrial campuses

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 13.1 Key trends

- 13.2 Northeast

- 13.2.1 Maine

- 13.2.2 Massachusetts

- 13.2.3 New Jersey

- 13.2.4 New York

- 13.2.5 Pennsylvania

- 13.3 Midwest

- 13.3.1 Illinois

- 13.3.2 Indiana

- 13.3.3 Michigan

- 13.3.4 Ohio

- 13.3.5 Wisconsin

- 13.3.6 Iowa

- 13.3.7 Kansas

- 13.3.8 Minnesota

- 13.3.9 Missouri

- 13.3.10 Nebraska

- 13.3.11 North Dakota

- 13.3.12 South Dakota

- 13.4 South

- 13.4.1 Florida

- 13.4.2 Georgia

- 13.4.3 North Carolina

- 13.4.4 South Carolina

- 13.4.5 Virginia

- 13.4.6 West Virginia

- 13.4.7 Alabama

- 13.4.8 Kentucky

- 13.4.9 Mississippi

- 13.4.10 Tennessee

- 13.4.11 Arkansas

- 13.4.12 Louisiana

- 13.4.13 Oklahoma

- 13.4.14 Texas

- 13.5 West

- 13.5.1 Arizona

- 13.5.2 Colorado

- 13.5.3 Idaho

- 13.5.4 Montana

- 13.5.5 Nevada

- 13.5.6 New Mexico

- 13.5.7 Utah

- 13.5.8 Wyoming

- 13.5.9 Alaska

- 13.5.10 California

- 13.5.11 Oregon

- 13.5.12 Washington

Chapter 14 Company Profiles

- 14.1 Automotive OEMs

- 14.1.1 BMW

- 14.1.2 Chevrolet

- 14.1.3 Ford

- 14.1.4 Hyundai

- 14.1.5 Mercedes-Benz

- 14.1.6 Nissan

- 14.1.7 Volkswagen

- 14.2 Regional players

- 14.2.1 Harley-Davidson

- 14.2.2 Proterra

- 14.2.3 Zero Motorcycles

- 14.3 Emerging players

- 14.3.1 Arcimoto

- 14.3.2 Bollinger Motors

- 14.3.3 Canoo

- 14.3.4 Fisker Automotive

- 14.3.5 Lordstown Motors

- 14.3.6 Lucid Motors

- 14.3.7 Nikola

- 14.3.8 Rivian

- 14.3.9 Tesla

- 14.3.10 Workhorse