PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892745

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892745

Agriculture Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

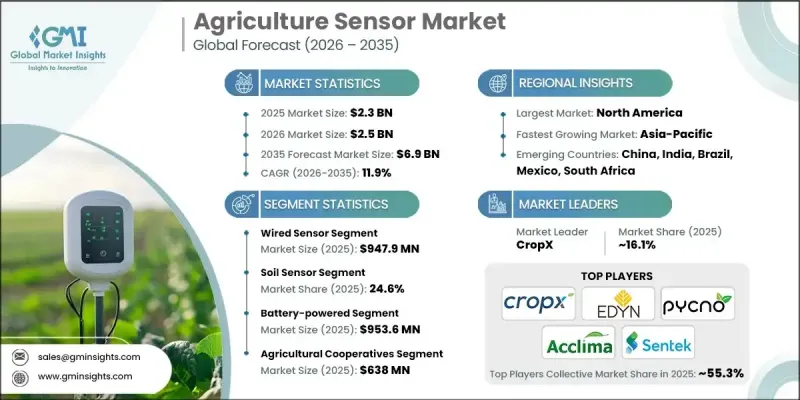

The Global Agriculture Sensor Market was valued at USD 2.3 billion in 2025 and is estimated to grow at a CAGR of 11.9% to reach USD 6.9 billion by 2035.

Precision farming is transforming traditional agriculture by shifting from uniform field practices to site-specific crop management. As global food demand rises and arable land becomes more limited, farmers are under increasing pressure to produce more with fewer resources. This has led to the widespread adoption of data-driven technologies, enabling smarter decision-making.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.3 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 11.9% |

The wireless sensors segment generated USD 947.9 million in 2025, driven by its ease of deployment and ability to support real-time data collection without the need for extensive cabling infrastructure. These sensors enable farmers to monitor environmental conditions, crop status, and irrigation systems remotely, helping them make faster and more informed decisions. With the rise of precision farming and IoT integration, wireless solutions are in high demand across both large-scale commercial farms and smallholder operations.

The soil sensors segment held a significant share of 24.6% in 2025, driven by vital insights into soil moisture, temperature, salinity, and nutrient content. Farmers rely on these sensors to fine-tune irrigation schedules, prevent over-fertilization, and enhance overall crop productivity. As water conservation and sustainability become top priorities across global agriculture, soil sensors are gaining traction in both developed and emerging markets. These tools are especially valuable in regions facing drought or soil degradation.

North America Agriculture Sensor Market held a 34.3% share in 2024. High levels of mechanization, large farm sizes, and strong investment in agri-tech have made the region a leader in adopting precision farming practices. Farmers in the United States and Canada are increasingly integrating sensor-based technologies to monitor soil conditions, optimize irrigation, and automate crop management.

Major players in the Global Agriculture Sensor Market are Libelium Comunicaciones Distribuidas SL, Acuity Agriculture, Pycno, Caipos GmbH, dol-sensors A/S, Monnit Corporation, Wevolver, Changsha Zoko Link Technology Co., Ltd., Bosch Sensortec, Sensoterra, CropX Inc., Auroras (Auroras s.r.l.), Sensaphone, John Deere, Aker Technology Co., Ltd., Texas Instruments Incorporated, AquaSpy Inc., Sentek Ltd, Lindsay Corporation, Hunan Rika Electronic Tech Co., Ltd., Acclima Inc., Decagon Devices (METER Group), AgSmarts Inc., OMRON Electronic Components, Teralytic, Honde Technology Co., Ltd. To strengthen their position, companies in the agriculture sensor market are focusing on product innovation, affordability, and data integration. Many are investing in R&D to develop multi-functional sensors that can track multiple variables simultaneously while minimizing energy consumption. Strategic partnerships with agri-tech startups, irrigation system manufacturers, and agri-software providers are helping companies offer end-to-end solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Sensor Type Trends

- 2.2.2 Connectivity Trends

- 2.2.3 Power Source Trends

- 2.2.4 End use Trends

- 2.2.5 Region

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of precision agriculture and smart farming

- 3.2.1.2 Government subsidies & policies promoting digital agriculture

- 3.2.1.3 Growing need for sustainable farming practices

- 3.2.1.4 Expansion of IoT, AI, and wireless connectivity in rural areas

- 3.2.1.5 Rising global food demand with shrinking arable land

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs and lack of affordability for smallholder farmers

- 3.2.2.2 Limited digital infrastructure and data literacy in rural economies

- 3.2.3 Market Opportunities

- 3.2.3.1 Integration with AI, big data, and farm management software

- 3.2.3.2 Growth of vertical farming and controlled-environment agriculture

- 3.2.3.3 Expansion of agricultural drone and robotics applications

- 3.2.3.4 Development of low-cost, solar-powered and wireless sensors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 Soil sensors

- 5.3 Water sensors

- 5.4 Climate/weather sensors

- 5.5 Location sensors

- 5.6 Optical sensors

- 5.7 Mechanical sensors

- 5.8 Biosensors

- 5.9 Other specialized sensors

Chapter 6 Market estimates & forecast, By Connectivity, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Wired sensors

- 6.3 Wireless sensors

Chapter 7 Market estimates & forecast, By Power Source, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Battery-powered

- 7.3 Solar-powered

- 7.4 Hybrid

Chapter 8 Market estimates & forecast, By End Use, 2022-2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Farmers/individual growers

- 8.3 Agricultural cooperatives

- 8.4 Research institutes & universities

- 8.5 Agribusiness corporations

- 8.6 Government & public agencies

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East & Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profile

- 10.1 Acclima Inc.

- 10.2 Acquity Agriculture

- 10.3 Agsmarts Inc.

- 10.4 Aker Technology Co., Ltd.

- 10.5 AquaSpy Inc.

- 10.6 Auroras (Auroras s.r.l.)

- 10.7 Bosch Sensortec

- 10.8 Caipos GmbH

- 10.9 Changsha Zoko Link Technology Co., Ltd.

- 10.10 CropX Inc.

- 10.11 Decagon Devices (METER Group)

- 10.12 dol-sensors A/S

- 10.13 Honde Technology Co., Ltd.

- 10.14 Hunan Rika Electronic Tech Co., Ltd.

- 10.15 John Deere

- 10.16 Libelium Comunicaciones Distribuidas SL

- 10.17 Lindsay Corporation

- 10.18 Monnit Corporation

- 10.19 OMRON Electronic Components

- 10.20 Pycno

- 10.21 Sensaphone

- 10.22 Sensoterra

- 10.23 Sentek Ltd

- 10.24 Teralytic

- 10.25 Texas Instruments Incorporated

- 10.26 Vegetronix Inc.

- 10.27 Wevolver