PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822545

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822545

Europe Pet Therapeutic Diet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

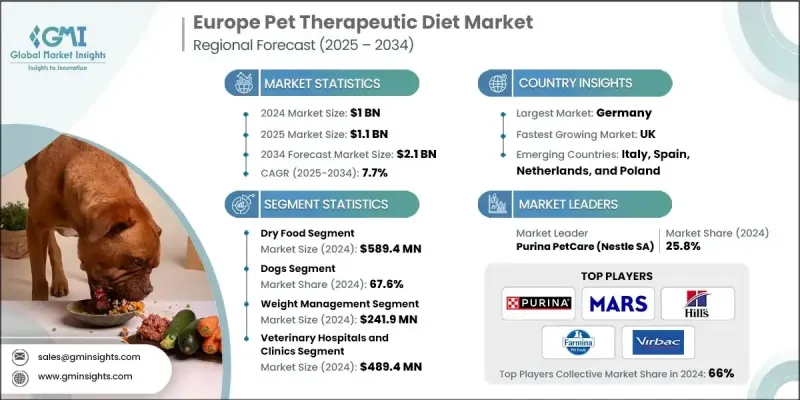

The Europe Pet Therapeutic Diet Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 2.1 billion by 2034.

A combination of overfeeding, lack of exercise, and highly processed pet foods has contributed to rising chronic diseases. As a result, pet owners are increasingly turning to therapeutic diets formulated with targeted nutrients and controlled ingredient profiles to manage these chronic conditions and improve their pets' quality of life.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 7.7% |

Dry Food to Gain Traction

The dry food segment held sizeable growth in 2024 owing to the convenience, affordability, and longer shelf life compared to wet or fresh alternatives. Pet owners prefer dry formulations because they are easier to store and administer for pets requiring long-term dietary management. These products often incorporate targeted nutrients for conditions like joint support, renal care, or weight control while maintaining palatability. Manufacturers are investing in premium ingredients, improved texture, and functional kibble designs to enhance acceptance and nutritional delivery.

Rising Adoption of Dogs

The dogs segment held a significant share in 2024, driven by higher rates of veterinary visits and chronic conditions among dogs compared to other companion animals. European dog owners are increasingly prioritizing health and preventive care, leading to a surge in demand for specialized diets that address obesity, digestive sensitivities, joint issues, and allergies.

Rising Shift Towards Weight Management

The weight management segment will grow at a decent CAGR during 2025-2034, driven by widespread concern across Europe. With nearly half of household pets classified as overweight or obese, there is an urgent need for diets that offer controlled calorie intake while still satisfying hunger. Therapeutic weight management products are being formulated with high protein, low fat, and added fiber to promote satiety and gradual weight loss. Companies are differentiating their offerings through clinical backing, visible results, and compatibility with other health concerns like diabetes or arthritis.

Regional Insights

Germany to Emerge as a Lucrative Region

Germany pet therapeutic diet market held a sizeable share in 2024, backed by high pet ownership rates, strong veterinary infrastructure, and growing interest in premium pet nutrition. German consumers are particularly health-conscious and responsive to science-based products, making the market favorable for brands that emphasize clinical efficacy, ingredient transparency, and sustainability.

Major players in the Europe pet therapeutic diet market are Farmina Pet Foods, EmerAid, JustFoodForDogs, VNG, Mars, Incorporated, Eden Holistic Pet Foods, Husse, Diamond Pet Foods (Schell & Kampeter, Inc.), Blue Buffalo (General Mills), Ziwi Pets, Hill's Pet Nutrition (Colgate Palmolive), Drools Pet Food, Stella and Chewy's, Purina PetCare (Nestle SA), Open Farm, and Virbac.

To strengthen their foothold in the Europe pet therapeutic diet market, companies are focusing on multi-channel distribution, product innovation, and veterinary collaboration. Many brands are expanding their presence in e-commerce and pet specialty retail to improve accessibility and reach untapped customer segments. Innovation remains a priority, with ongoing investment in condition-specific formulations, functional ingredients, and tailored nutrition based on breed, size, and life stage. Strategic alliances with veterinary clinics and pet insurance providers help promote therapeutic diets as part of holistic care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product type

- 2.2.3 Animal type

- 2.2.4 Health condition

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of pet health disorders

- 3.2.1.2 Increased role of veterinarians in dietary recommendations

- 3.2.1.3 Expansion of retail and online channels

- 3.2.1.4 Premiumization and innovation in formulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of therapeutic diets

- 3.2.2.2 Limited consumer awareness outside major urban centers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of therapeutic diets into preventive care

- 3.2.3.2 Integration of digital platforms and telehealth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological and innovation landscape

- 3.6 Pet population, by country

- 3.7 Number of veterinarians, by country

- 3.8 Future market trends

- 3.9 Pricing analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dry food

- 5.3 Wet/ canned food

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cats

- 6.3 Dogs

- 6.4 Other animals

Chapter 7 Market Estimates and Forecast, By Health Condition, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Renal health

- 7.3 Gastrointestinal health

- 7.4 Skin and coat health

- 7.5 Cardiovascular health

- 7.6 Weight management

- 7.7 Joint care

- 7.8 Other health conditions

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 E-commerce

- 8.4 Retail pharmacies

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Germany

- 9.3 UK

- 9.4 France

- 9.5 Spain

- 9.6 Italy

- 9.7 Netherlands

- 9.8 Poland

Chapter 10 Company Profiles

- 10.1 Blue Buffalo (General Mills)

- 10.2 Diamond Pet Foods (Schell & Kampeter, Inc.)

- 10.3 Drools Pet Food

- 10.4 Eden Holistic Pet Foods

- 10.5 EmerAid

- 10.6 Farmina Pet Foods

- 10.7 Hill's Pet Nutrition (Colgate Palmolive)

- 10.8 Husse

- 10.9 JustFoodForDogs

- 10.10 Mars, Incorporated

- 10.11 Open Farm

- 10.12 Purina PetCare (Nestle SA)

- 10.13 Stella and Chewy’s

- 10.14 Virbac

- 10.15 VNG

- 10.16 Ziwi Pets