PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822549

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822549

India Sustainable Flooring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

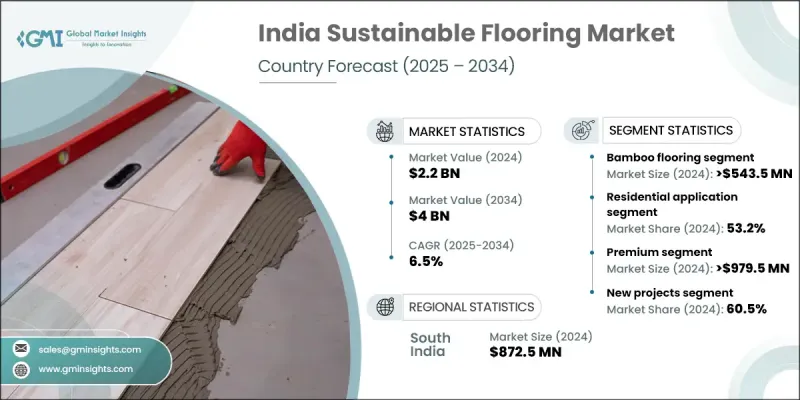

India Sustainable Flooring Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 4 billion by 2034.

This significant growth reflects the nation's shift toward environmentally responsible construction practices, influenced by increasing consumer awareness, rising disposable income, and government efforts to promote green building norms. As sustainability becomes central to India's urban and infrastructure development, demand has surged for flooring materials like recycled wood, eco-ceramics, cork, and bamboo. These materials provide durability, improved thermal insulation, and better indoor air quality, making them a preferred option across residential, commercial, and institutional spaces. The push toward green building certifications and stricter environmental codes has led builders and architects to integrate sustainable flooring solutions into their design strategies. The Indian construction ecosystem is aligning with global environmental standards and embracing eco-conscious materials, encouraging innovation in renewable and recycled product manufacturing. This widespread adoption not only supports environmental conservation but also contributes to long-term cost efficiency, making sustainable flooring a critical component of India's green building journey.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4 Billion |

| CAGR | 6.5% |

The bamboo flooring segment generated USD 543.5 million in 2024 and is set to grow at a CAGR of 6.6% through 2034. Bamboo is rapidly becoming the go-to sustainable material thanks to its quick regrowth rate, aesthetic appeal, and natural resilience. Its affordability and adaptability have made it an attractive choice for both commercial developments and individual homeowners seeking functional and elegant solutions. As environmental concerns and design preferences evolve, bamboo continues to gain ground as a core material in India sustainable flooring market. Its increasing visibility is a direct result of the shift toward renewable materials that balance style, strength, and sustainability.

In 2024, the residential sector held a 53.2% share, and it is expected to grow at a CAGR of 6.7% from 2025 to 2034. Rising consumer interest in health-conscious and eco-friendly interiors is driving growth in this category. With a broader push from housing developers and policy-driven incentives toward green residential construction, demand for low-VOC and recyclable floor materials like linoleum, cork, and bamboo is on the rise. More homeowners are making conscious decisions in favor of flooring that offers both environmental and health benefits, reshaping the Indian residential flooring landscape with products that are long-lasting, aesthetically pleasing, and compliant with green standards.

South India Sustainable Flooring Market with a 40.2% share and generated USD 872.5 million in 2024. This regional dominance is fueled by a booming real estate market, increased green building certifications, and heightened awareness of environmentally responsible construction practices. The southern region has become a hub for sustainable architecture, accelerating the adoption of green flooring materials in urban and suburban developments alike. The use of materials such as cork, bamboo, and recycled content flooring in public and private projects has grown significantly, reinforcing South India's leadership in this segment. Urban centers in the region are setting benchmarks in sustainable interior design, encouraging other regions to follow suit.

Key companies active in the India Sustainable Flooring Market include Tarkett Group, Mohawk Industries, Shaw Industries, Square Foot, Forbo Flooring Systems, Armstrong Flooring, Indiana, MUTHA INDUSTRIES, RAK Ceramics, and Classic Floors. To gain a competitive edge in India's sustainable flooring market, leading companies are adopting innovation-led approaches and expanding their product lines to include a wider variety of eco-conscious materials. Many players are forming partnerships with architects, developers, and green building councils to boost awareness and adoption of their flooring solutions. Focused investment in research and development helps refine manufacturing processes and develop durable, low-impact products like bamboo and cork tiles. Additionally, companies are enhancing supply chain efficiency and increasing their presence in regional markets through strategic distribution networks. Educational campaigns targeting end users and industry stakeholders are being launched to emphasize the environmental and health advantages of sustainable flooring, creating brand loyalty and expanding market reach simultaneously.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Material type

- 2.2.3 Application

- 2.2.4 Price range

- 2.2.5 Project type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Million Square Feet)

- 5.1 Key trend

- 5.2 Bamboo flooring

- 5.2.1 Solid bamboo flooring

- 5.2.2 Engineered bamboo flooring

- 5.2.3 Bamboo composite and hybrid products

- 5.3 Cork flooring

- 5.4 Reclaimed and recycled wood flooring

- 5.5 Bio-based and composite materials

- 5.6 Recycled content flooring

- 5.7 Linoleum and natural fiber flooring

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Square Feet)

- 6.1 Key trends

- 6.2 Residential applications

- 6.2.1 Single-family homes and apartments

- 6.2.2 Luxury housing and premium segments

- 6.2.3 Affordable housing projects

- 6.3 Commercial applications

- 6.3.1 Office buildings and corporate spaces

- 6.3.2 Retail and shopping centers

- 6.3.3 Hospitality and hotels

- 6.3.4 Healthcare facilities

- 6.3.5 Educational institutions

- 6.4 Industrial applications

- 6.4.1 Manufacturing facilities

- 6.4.2 Warehouses and logistics centers

- 6.4.3 Specialized industrial requirements

- 6.5 Institutional applications

- 6.5.1 Government buildings

- 6.5.2 Public infrastructure projects

Chapter 7 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Million Square Feet)

- 7.1 Key trend

- 7.2 Premium segment

- 7.3 Mid-range segment

- 7.4 Budget segment

Chapter 8 Market Estimates & Forecast, By Project Type, 2021-2034 (USD Billion) (Million Square Feet)

- 8.1 Key trend

- 8.2 New project

- 8.3 Renovation project

Chapter 9 Market Estimates & Forecast, By States, 2021-2034 (USD Billion) (Million Square Feet)

- 9.1 Key trends

- 9.2 India

- 9.2.1 North India

- 9.2.1.1 Delhi NCR

- 9.2.1.2 Punjab

- 9.2.1.3 Haryana

- 9.2.1.4 Rajasthan

- 9.2.1.5 Uttar Pradesh

- 9.2.2 West India

- 9.2.2.1 Maharashtra

- 9.2.2.2 Gujarat

- 9.2.2.3 Goa

- 9.2.3 South India

- 9.2.3.1 Karnataka

- 9.2.3.2 Tamil Nadu

- 9.2.3.3 Andhra Pradesh

- 9.2.3.4 Telangana

- 9.2.3.5 Kerala

- 9.2.4 East India

- 9.2.4.1 West Bengal

- 9.2.4.2 Odisha

- 9.2.4.3 Northeast States

- 9.2.5 Central India

- 9.2.5.1 Madhya Pradesh

- 9.2.5.2 Chhattisgarh

- 9.2.1 North India

Chapter 10 Company Profiles

- 10.1 Armstrong Flooring

- 10.2 Classic Floors

- 10.3 Forbo Flooring Systems

- 10.4 Indiana

- 10.5 Mohawk Industries

- 10.6 MUTHA INDUSTRIES

- 10.7 RAK Ceramics

- 10.8 Shaw Industries

- 10.9 Square Foot

- 10.10 Tarkett Group