PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822558

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822558

Neural Processor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

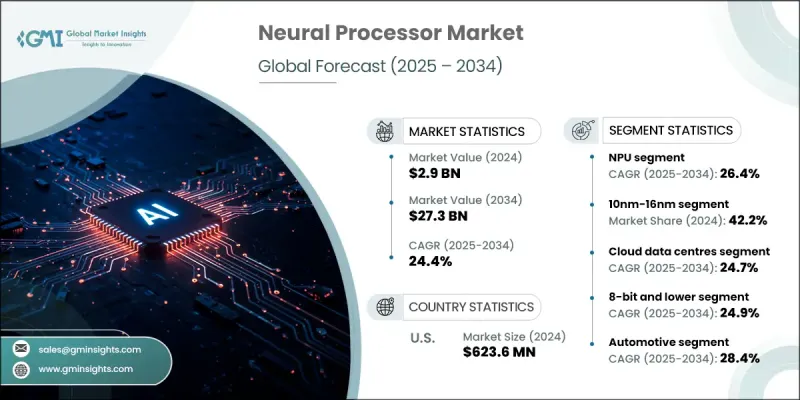

The Global Neural Processor Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 24.4% to reach USD 27.3 billion by 2034.

Experts attributed this rapid growth to the rising adoption of on-device AI capabilities in consumer electronics, increasing real-time computing needs across autonomous and connected vehicles, and the widespread implementation of AI across edge computing and enterprise environments. They said that as generative AI and large language models (LLMs) become more sophisticated, the demand for energy-efficient processors optimized for AI/ML workloads continues to surge. Companies noted that neural processors, with their ability to manage intensive computations, offer reduced latency and greater privacy by moving heavy ML tasks away from centralized cloud infrastructures. The growing reliance on these processors in automotive systems for object recognition and decision-making underlines their importance in high-speed, mission-critical environments. As organizations shift towards localized, real-time data processing-from smartphones to industrial sensors and enterprise data centers-industry professionals observed a sharp rise in demand for high-performance AI chips that minimize energy consumption while maximizing output.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $27.3 Billion |

| CAGR | 24.4% |

The graphics processing units (GPUs) segment was valued at USD 700 million in 2024, driven by their architecture, which is optimized for parallel processing. Industry insiders stated that GPUs dominate training phases of neural networks thanks to their ability to handle matrix-heavy tasks with unmatched efficiency. Compared to CPU configurations, GPUs dramatically accelerate model training, offering significant improvements in processing speed and overall AI performance. As deep learning models grow in complexity, stakeholders noted that the inherent design of GPUs continues to give them a distinct edge in the evolving AI ecosystem. Their flexibility and scalability make them a key asset in supporting neural processor performance in various commercial and industrial applications.

The 10nm-16nm node segment was valued at USD 1.2 billion in 2024, showing strong momentum within the neural processor landscape. Experts explained that this technology node is increasingly favored for its balance between performance and power efficiency, especially in high-volume AI inference workloads. These nodes offer sufficient transistor density to support parallel computing demands while keeping production costs lower than those associated with sub-7nm processes. Stakeholders emphasized that the maturity of manufacturing processes at this node level ensures both yield stability and cost effectiveness, making it a strategic choice for chip designers focused on delivering scalable AI performance at competitive price points.

United States Neural Processor Market was valued at USD 623.6 million in 2024. Analysts highlighted that rising demand across industries such as cloud infrastructure, consumer tech, automotive, and defense applications is fueling rapid growth in this regional market. Industry leaders stressed that companies aiming to remain competitive in the U.S. should begin by localizing their chip manufacturing operations in line with federal initiatives like the CHIPS and Science Act. Beyond fabrication, executives pointed out the need for investments in advanced packaging techniques and heterogeneous integration technologies to optimize power and performance.

Key players shaping the Global Neural Processor Market include AMD, ARM, Syntiant, Samsung Electronics, IBM, Google, Amazon (AWS Inferentia & Trainium), Hailo, Qualcomm, NVIDIA, Graphcore, Tenstorrent, Intel, MediaTek, and Cerebras Systems. These companies continue to lead advancements in AI compute technologies, enabling the market to evolve rapidly alongside global AI adoption trends. In the Neural Processor Market, companies are pursuing several key strategies to cement their market position. First, they are heavily investing in localized semiconductor manufacturing to mitigate geopolitical and supply chain risks. Second, firms are enhancing their R&D focus to design chips that support advanced AI features with improved efficiency and scalability. Third, market leaders are entering long-term collaborations with cloud providers, automotive OEMs, and defense contractors to create tailored solutions that align with specific industry needs. Another critical move involves the adoption of advanced packaging methods to boost chip performance while reducing thermal loads and power draw.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1. Type

- 2.2.2 Technology node

- 2.2.3 Deployment mode

- 2.2.4 Processing precision

- 2.2.5 Application

- 2.2.6 End use industry

- 2.2.7 North America

- 2.2.8 Europe

- 2.2.9 Asia Pacific

- 2.2.10 Latin America

- 2.2.11 Middle East & Africa

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspective: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 On-device AI acceleration in consumer electronics

- 3.2.1.2 Real-time processing for autonomous and connected vehicles

- 3.2.1.3 AI workload expansion across edge and enterprise

- 3.2.1.4 Growth of generative AI and large language models (LLMs)

- 3.2.1.5 Demand for energy-efficient and scalable AI compute

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fragmented software ecosystem and lack of standardization

- 3.2.2.2 Supply chain constraints and geopolitical dependencies

- 3.2.3 Market Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Cooling Type, 2021 - 2034 (USD Billion)

- 5.1 Application-specific integrated circuits (ASICs)

- 5.2 Graphics processing units (GPUs)

- 5.3 Field-programmable gate arrays (FPGAs)

- 5.4 Neural processing units (NPUs)

- 5.5 Digital signal processors (DSPs)

Chapter 6 Market estimates & forecast, By Technology Node, 2021 - 2034 (USD Billion)

- 6.1 Above 16nm

- 6.2 10nm-16nm

- 6.3 Below 10nm

Chapter 7 Market estimates & forecast, By Deployment Mode, 2021 - 2034 (USD Billion)

- 7.1 Edge devices

- 7.2 Cloud data centers

Chapter 8 Market Estimates & Forecast, By Processing Precision, 2021 - 2034 (USD Billion)

- 8.1 32-bit

- 8.2 16-bit

- 8.3 8-bit and lower

Chapter 9 Market estimates & forecast, By Application, 2021 - 2034 (USD Billion)

- 9.1 Natural language processing (NLP)

- 9.2 Computer vision

- 9.3 Predictive analytics

- 9.4 Speech recognition

- 9.5 Others

Chapter 10 Market estimates & forecast, By End Use Industry, 2021 - 2034 ( USD Billion )

- 10.1 Consumer electronics

- 10.2 Automotive

- 10.3 Healthcare

- 10.4 Robotics & drones

- 10.5 Industrial automation

- 10.6 Defense & aerospace

- 10.7 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 U.K.

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 ROE

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 South Korea

- 11.4.4 RoAPAC

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Other

- 11.6. Middle East & Africa

- 11.6.1. U.A.E.

- 11.6.2. Saudi Arabia

- 11.6.3. South Africa

- 11.6.4. RoMEA

Chapter 12 Company Profiles

- 12.1 AMD

- 12.2 Amazon (AWS Inferentia & Trainium)

- 12.3 ARM

- 12.4 Cerebras Systems

- 12.5 Google

- 12.6 Graphcore

- 12.7 Hailo

- 12.8 IBM

- 12.9 Intel

- 12.10 MediaTek

- 12.11 Microsoft

- 12.12 NVIDIA

- 12.13 Qualcomm

- 12.14 Samsung Electronics

- 12.15 Syntiant

- 12.16 Tenstorrent