PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822566

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822566

Professional Tissue Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

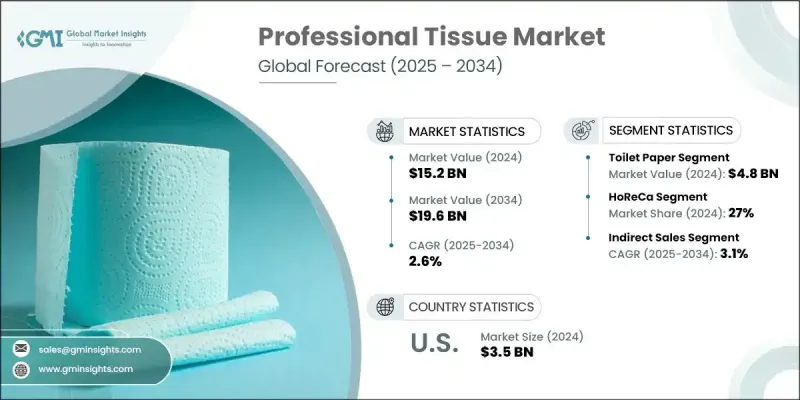

The Global Professional Tissue Market was valued at USD 15.2 billion in 2024 and is estimated to grow at a CAGR of 2.6% to reach USD 19.6 billion by 2034.

Stricter hygiene regulations in sectors like healthcare, hospitality, food service, and education are increasing the demand for professional tissue products such as paper towels, toilet tissue, and napkins. Organizations are prioritizing cleanliness to ensure safety and compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.2 Billion |

| Forecast Value | $19.6 Billion |

| CAGR | 2.6% |

Rising Adoption of the Toilet Paper Segment

The toilet paper segment held a notable share in 2024, driven by high-traffic environments such as office buildings, airports, hospitals, and educational institutions. Consistent demand for hygiene maintenance, combined with increasing footfall in public and commercial spaces, continues to drive volume growth. Businesses are prioritizing bulk purchasing of soft, high-capacity rolls that reduce the frequency of maintenance and restocking. Suppliers are also responding with innovations such as coreless rolls and jumbo dispensers, further optimizing product usage and minimizing waste.

HoReCa to Gain Traction

The HoReCa segment generated a significant share in 2024, backed by premium-quality professional tissue products. Customer-facing environments require functional and aesthetically pleasing hygiene solutions, including napkins, hand towels, and facial tissues. Operators are seeking products that balance luxury and sustainability, pushing tissue suppliers to offer environmentally friendly solutions without compromising performance or presentation.

Increasing Demand for the Indirect Segment

The indirect sales segment held a notable share in 2024, fueled by intermediaries such as distributors, wholesalers, and facility management companies. This channel offers scale and efficiency, especially for reaching small and medium-sized enterprises that may not purchase directly from manufacturers. The indirect segment continues to grow due to its ability to serve fragmented markets, offering tailored solutions and flexible supply models.

Regional Insights

North America to Emerge as a Propelling Region

North America professional tissue market generated a sizeable share in 2024, driven by heightened awareness around hygiene, expanding commercial infrastructure, and increasingly stringent sanitation standards. Demand is fueled by sectors such as healthcare, education, food service, and office spaces-all requiring consistent and safe hygiene solutions. Growth is further supported by a shift toward sustainable practices, prompting institutional buyers to seek recycled and FSC-certified products. Rising focus on health and cleanliness has transformed tissue products from commodities to critical operational essentials.

Major players involved in the professional tissue market are Pro-Gest, Kimberly-Clark, CMPC, WEPA Hygieneprodukte, Cascades, Procter & Gamble, Metsa Tissue, Kruger, Renova, Sofidel, Lucart, Ontex, Industrie Celtex, Georgia-Pacific, and Essity.

To reinforce their market presence, companies in the professional tissue market are adopting a combination of sustainability innovation, product differentiation, and digital transformation. They are expanding eco-friendly product lines using recycled content, bamboo fiber, and biodegradable packaging to align with growing environmental regulations and customer expectations. In parallel, many are developing dispenser systems that reduce waste, enhance hygiene, and encourage brand loyalty in commercial spaces. Strong distributor networks, investments in automated production, and integrated B2B ordering platforms have become crucial in ensuring fast delivery and operational efficiency.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By product type

- 2.2.3 By source

- 2.2.4 By price

- 2.2.5 By end use industry

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Raw material analysis

- 3.9 Trade statistics

- 3.9.1 Major importing countries

- 3.9.2 Major exporting countries

- 3.10 Porter's five forces analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behavior

- 3.12.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Toilet paper

- 5.2.1 Single ply

- 5.2.2 Double ply

- 5.2.3 Others (triple ply, etc.)

- 5.3 Facial tissues

- 5.4 Paper towels

- 5.4.1 Roll towels

- 5.4.2 Folded towels

- 5.4.3 Others (center-pull towels, etc.)

- 5.5 Napkins

- 5.6 Wet wipes

- 5.7 Others (medicinal paper, kitchen paper, etc.)

Chapter 6 Market Estimates & Forecast, By Source, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled paper

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use industry, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 HoReCa

- 8.4 Corporate offices

- 8.5 Industries & manufacturing

- 8.6 Transport & logistics

- 8.7 Public sector

- 8.8 Education

- 8.9 Others (facility management etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Cascades

- 11.2 CMPC

- 11.3 Essity

- 11.4 Georgia-Pacific

- 11.5 Industrie Celtex

- 11.6 Kimberly-Clark

- 11.7 Kruger

- 11.8 Lucart

- 11.9 Metsa Tissue

- 11.10 Ontex

- 11.11 Procter & Gamble

- 11.12 Pro-Gest

- 11.13 Renova

- 11.14 Sofidel

- 11.15 WEPA Hygieneprodukte