PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822574

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822574

Liquid and Paste Filling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

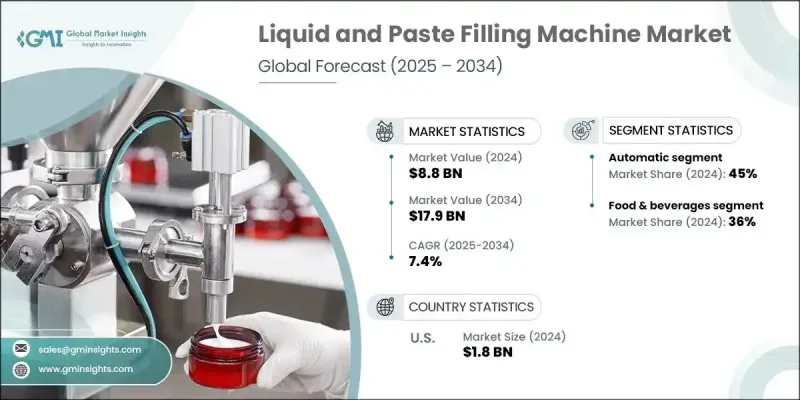

The Global Liquid and Paste Filling Machines Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 17.9 billion by 2034.

This growth is largely fueled by rising demand for packaged consumer goods worldwide, driven by urbanization and shifts in lifestyle, especially within emerging economies. Manufacturers are investing heavily in developing more efficient filling solutions to handle larger production volumes while adhering to stringent hygiene standards, which is significantly boosting market growth. Another major force behind this expansion is the growing focus on sustainability and eco-friendly packaging. Both regulators and consumers are demanding that manufacturers adopt recyclable, biodegradable, or compostable materials. Consequently, manufacturers need filling machines that can accommodate these materials and innovate packaging processes to reduce energy consumption and minimize waste. Within the market, automatic filling machines dominate due to their accuracy, cost-effectiveness, and scalability. They offer higher throughput, better fill precision, and lower labor costs compared to semi-automatic or manual alternatives, making them indispensable for large-scale food processing and other core industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $17.9 Billion |

| CAGR | 7.4% |

In 2024, the automatic segment held a 45% share and is expected to grow at a CAGR of 7.8% through 2034. This segment's dominance is attributed to the growing need for high-volume production and precise, efficient filling across key sectors such as pharmaceuticals, cosmetics, and food and beverage. Automatic machines provide enhanced output, fill accuracy, and labor savings, and they integrate seamlessly with broader automation systems to improve production line efficiency and enable data-driven reporting. These factors make automatic filling machines vital in production environments that require strict quality control and high-speed packaging.

The food & beverage segment held a 36% share in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2034. This sector leads due to the extensive variety and volume of liquid, paste, and viscous products requiring precise, hygienic packaging. Products like beverages, dairy items, sauces, and prepared meals demand fast, reliable, and often aseptic filling solutions, driving demand for advanced filling machines tailored to their unique needs.

United States Liquid and Paste Filling Machines Market generated USD 1.8 billion in 2024. The country's strong commercial base, especially in pharmaceuticals, food and beverage, and chemicals, coupled with stringent regulatory oversight, drives consistent demand for accurate and sterile packaging solutions. Early adoption of automation technologies and a focus on high-speed, efficient filling processes further bolster North America's position as a leading regional market.

The leading players shaping the Global Liquid and Paste Filling Machines Market include Krones AG, Tetra Pak International S.A., Sidel Group, GEA Group AG, and KHS GmbH. To reinforce their market positions, companies in the liquid and paste filling machines sector are focusing on several strategic approaches. Investing in research and development is critical to introducing machines that deliver higher speed, precision, and versatility while supporting sustainable packaging materials. Firms prioritize integrating smart automation and IoT-enabled technologies to enhance production line efficiency and data analytics capabilities. Building strategic partnerships with packaging and manufacturing companies helps expand their customer base and tailor solutions to evolving industry needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Operation

- 2.2.4 Process

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Demand for Packaged Beverages

- 3.2.1.2 Technological Advancements in Liquid and paste filling machines

- 3.2.1.3 Stringent Quality and Safety Regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Investment Costs

- 3.2.2.2 Fluctuating Raw Material Prices

- 3.2.3 Opportunities

- 3.2.3.1 Emerging Markets Growth

- 3.2.3.2 Customization and Flexibility

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Operation

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Rotary fillers

- 5.3 Aseptic fillers

- 5.4 Volumetric fillers

- 5.5 Net weight fillers

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-Automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By Process, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Hot fill

- 7.3 Cold fill

- 7.4 Aseptic fill

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceutical

- 8.3 Food & beverage

- 8.4 Chemical

- 8.5 Cosmetics and personal care

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Krones AG

- 11.2 Tetra Pak International S.A.

- 11.3 Sidel Group

- 11.4 KHS GmbH

- 11.5 GEA Group AG

- 11.6 Serac Group

- 11.7 ProMach Inc.

- 11.8 CFT Group

- 11.9 IMA Group

- 11.10 SMI S.p.A.

- 11.11 Ronchi Mario S.p.A.

- 11.12 Accutek Packaging Equipment Companies, Inc.

- 11.13 Coesia S.p.A.

- 11.14 Zhangjiagang King Machine Co., Ltd.

- 11.15 Romaco