PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822585

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822585

Generative AI in Automotive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

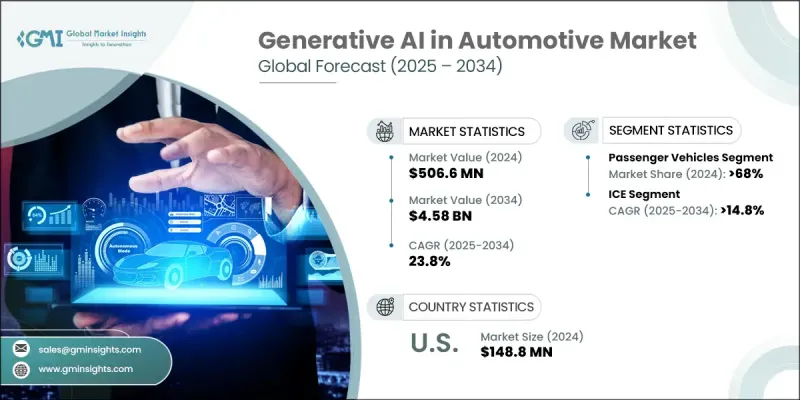

The Global Generative AI in Automotive Market was valued at USD 506.6 million in 2024 and is estimated to grow at a CAGR of 23.8% to reach USD 4.58 billion by 2034.

The industry is witnessing rapid transformation as automotive manufacturers increasingly integrate generative artificial intelligence to streamline autonomous systems, optimize design workflows, and simulate critical driving scenarios. Regulatory encouragement and supportive funding are fueling development across automakers, component suppliers, and mobility tech innovators. As digitalization deepens and vehicles become more intelligent and interconnected, generative AI is becoming central to vehicle development. It enables automakers to replicate rare or complex traffic events, drastically cutting the time and costs associated with safety verification. This advanced capability is creating new standards in simulation accuracy and contributing to faster development timelines. Automakers are now leveraging generative AI to enhance user interfaces, predict maintenance requirements, and fine-tune advanced driving assistance systems. As the automotive industry transitions to software-defined vehicles and connected platforms, AI is no longer an enhancement but a core enabler of next-gen mobility ecosystems. Collaborations between software firms and hardware developers are creating foundational infrastructure that supports seamless integration of AI across automotive environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $506.6 Million |

| Forecast Value | $4.58 Billion |

| CAGR | 23.8% |

In 2024, the passenger vehicle segment generated a 68% share driven by the widespread implementation of intelligent systems across vehicles. AI-enabled technologies are now deeply embedded in functions such as advanced infotainment, driver support features, and in-car safety systems. These tools are significantly elevating the driving experience by improving interaction through conversational interfaces, delivering personalized insights, and powering adaptive responses in real time. Automakers are focusing on AI tools that enhance safety and functionality, with features like proactive service notifications and context-aware driving suggestions. With ongoing enhancements in sensor technology and remote software updates, the application of generative AI in this segment is expected to rise steadily.

The internal combustion engine (ICE) vehicle segment is expected to grow at a CAGR of 14.8% from 2025 to 2034. While electric vehicle platforms are often at the forefront of technological adoption, ICE-powered cars are also integrating AI-driven systems to stay competitive. Automakers are upgrading existing ICE models with intelligent modules that support improved diagnostics, seamless connectivity, and immersive digital experiences. This evolution is being driven by the rising demand for smart functionality in premium ICE vehicles, where retrofitting with AI-based systems is now more accessible through over-the-air updates and scalable platform technologies. Enhanced onboard software allows traditional vehicle categories to benefit from advanced predictive capabilities without requiring major hardware redesigns.

United States Generative AI in Automotive Market generated USD 148.8 million in 2024. The US continues to hold a leadership position due to its strong innovation landscape, vast R&D capabilities, and collaborative efforts spanning academic institutions, technology providers, and government agencies. The integration of generative AI is advancing rapidly across both vehicle systems and the digital infrastructure supporting them. These factors position the US as a primary hub for the development and adoption of generative AI solutions, particularly in enhancing real-time driving intelligence, streamlining vehicle design processes, and facilitating smart mobility solutions.

Key players actively shaping Global Generative AI in Automotive Market include NVIDIA, Amazon Web Services (AWS), Bosch, Microsoft, Qualcomm, Aptiv, IBM, Continental, Intel, and Google. To maintain a competitive edge in the generative AI in automotive market, major players are focusing on strategic alliances, technological innovation, and platform development. Companies are forming long-term partnerships with automakers and tier-one suppliers to ensure seamless AI integration across vehicle systems. Investment in advanced simulation tools, real-time data processing, and edge AI computing is central to their growth approach. Key firms are also expanding their software ecosystems through SDKs and APIs, allowing developers to build AI-powered applications faster.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Technology

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 AI integration in vehicle design and ADAS

- 3.2.1.2 Increasing adoption of electric and connected vehicles

- 3.2.1.3 Cloud and edge AI deployment

- 3.2.1.4 OEM-tech company collaborations

- 3.2.1.5 Advancements in multimodal AI

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and cybersecurity

- 3.2.2.2 Integration with legacy systems

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of software-defined and autonomous vehicles

- 3.2.3.2 Collaborations with academic and research institutes

- 3.2.3.3 Emerging markets in Asia-Pacific and Latin America

- 3.2.3.4 Integration with mobility services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly Initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases and Applications

- 3.10.1 Vehicle design and engineering applications

- 3.10.2 Manufacturing and production applications

- 3.10.3 Autonomous driving and ADAS applications

- 3.10.4 Customer experience and service applications

- 3.11 Best-case scenario

- 3.12 Technology and Innovation landscape

- 3.12.1 Current technological trends

- 3.12.2 Emerging technologies

- 3.13 Generative AI technology foundation and evolution

- 3.13.1 Generative AI technology architecture and capabilities

- 3.13.2 Ai model development and training infrastructure

- 3.13.3 Automotive-specific AI model development

- 3.13.4 Technology evolution and future roadmap

- 3.14 Future technology roadmap and innovation timeline

- 3.14.1 Generative AI technology evolution (2024-2034)

- 3.14.2 Automotive AI application development timeline

- 3.14.3 Technology convergence and integration scenarios

- 3.14.4 Disruptive technology assessment and market impact

- 3.15 Automotive industry digital transformation context

- 3.15.1 Automotive industry technology disruption landscape

- 3.15.2 Digital twin and simulation technology integration

- 3.15.3 Data-driven decision making and analytics

- 3.15.4 Automotive software and platform ecosystem

- 3.16 Regulatory environment and standards framework

- 3.16.1 AI governance and regulatory landscape

- 3.16.2 Automotive safety standards and AI integration

- 3.16.3 International standards and harmonization efforts

- 3.16.4 Ethical AI and responsible development framework

- 3.17 Investment landscape and funding analysis

- 3.17.1 Global AI investment trends and automotive focus

- 3.17.2 Automotive industry AI investment patterns

- 3.17.3 Regional investment landscape and government support

- 3.17.4 Startup ecosystem and innovation hubs

- 3.18 Cybersecurity and risk management framework

- 3.18.1 AI security threats and vulnerability assessment

- 3.18.2 Automotive cybersecurity and AI integration

- 3.18.3 Security by design and development practices

- 3.18.4 Compliance and regulatory security requirements

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 5.1 Passenger vehicles

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 SUV

- 5.1.4 MPV

- 5.1.5 Electric passenger cars

- 5.2 Commercial vehicles

- 5.2.1 Light commercial vehicles

- 5.2.2 Heavy commercial vehicles

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 ICE

- 6.3 BEV

- 6.4 PHEV

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large language models (LLMs) and NLP

- 7.3 Computer vision and image generation

- 7.4 Multimodal AI and cross-domain integration

- 7.5 Generative AI platforms and tools

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Autonomous Driving and ADAS Applications

- 8.3 Vehicle Design and Engineering

- 8.4 Manufacturing and production optimization

- 8.5 Customer experience and personalization

- 8.6 Supply chain and logistics optimization

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Tier 1 automotive suppliers

- 9.4 Automotive software and technology companies

- 9.5 Mobility service providers and fleet operators

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Technology Leaders

- 11.1.1 Amazon Web Services (AWS)

- 11.1.2 Google

- 11.1.3 IBM

- 11.1.4 Intel

- 11.1.5 Microsoft

- 11.1.6 NVIDIA

- 11.1.7 OpenAI

- 11.1.8 Qualcomm

- 11.2 Automotive Technology Specialists

- 11.2.1 Aptiv

- 11.2.2 Bosch

- 11.2.3 Continental

- 11.2.4 DENSO

- 11.2.5 Magna International

- 11.2.6 Mobileye

- 11.2.7 Valeo

- 11.2.8 Waymo

- 11.2.9 ZF Friedrichshafen

- 11.3 Emerging AI Specialists and Startups

- 11.3.1 Argo AI

- 11.3.2 Aurora Innovation

- 11.3.3 Cruise

- 11.3.4 DeepRoute.ai

- 11.3.5 Einride

- 11.3.6 Ghost Autonomy

- 11.3.7 Innoviz Technologies

- 11.3.8 Motional

- 11.3.9 Plus

- 11.3.10 Pony.ai

- 11.3.11 Scale AI

- 11.3.12 WeRide

- 11.3.13 Zoox