PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822594

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822594

China Natural Fiber Insulation Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

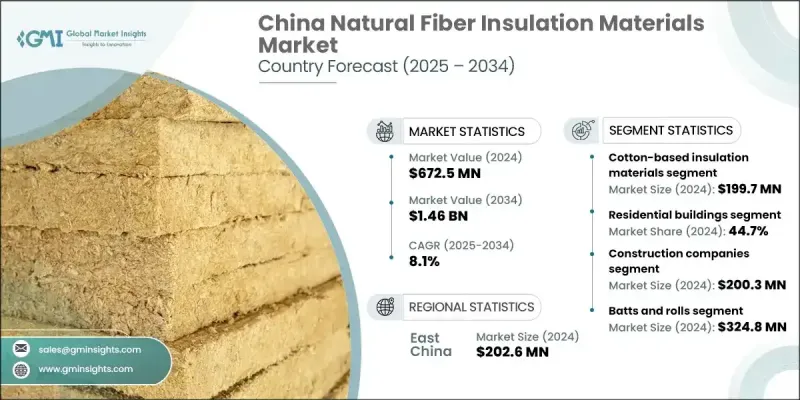

China Natural Fiber Insulation Materials Market was valued at USD 672.5 million in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 1.46 billion by 2034.

This growth mirrors China's stronger commitment to energy efficiency and sustainable construction. As green development becomes central to national priorities, natural fiber insulation has started to gain ground due to its renewable origins and lower ecological footprint. Materials like jute, flax, hemp, bamboo, and cotton are rapidly becoming favored alternatives to synthetic insulation options. Their biodegradability, thermal performance, and contribution to better indoor air quality align with ongoing green building standards. The government's push for low-carbon building practices and eco-conscious development strategies is creating fertile ground for increased usage of energy-efficient insulation. With the rise of urbanization, demand for environmentally friendly building materials is climbing, and insulation made from natural fibers fits seamlessly into this transition. Builders and developers are now exploring these alternatives not just for compliance but also to appeal to consumers prioritizing healthy living spaces. These materials are also becoming key in helping construction projects meet both national and international green certification benchmarks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $672.5 million |

| Forecast Value | $1.46 billion |

| CAGR | 8.1% |

The cotton-based insulation was valued at USD 199.7 million in 2024. Cotton insulation products are gaining popularity because of their non-toxic nature, ease of handling, and excellent performance in regulating temperature and sound. They are particularly suitable for indoor spaces such as residences, offices, and educational buildings where comfort, air quality, and acoustic control are critical. As energy efficiency becomes a design priority, the adoption of cotton insulation continues to rise for its versatility and user-friendly installation.

The residential buildings segment accounted for a 44.7% share in 2024, driven by the growing adoption of green insulation solutions in housing developments. Developers and homeowners are gravitating toward natural fiber insulation due to its breathability, safety, and energy-saving capabilities. Materials like hemp, cotton, and cellulose offer superior humidity regulation and thermal comfort, which contribute to a healthier indoor environment. These properties make them highly valued in urban residential projects. Additionally, the use of natural fibers helps developers meet green building mandates while offering long-term energy savings. With cost-efficiency and sustainability merging, natural fiber insulation is becoming a go-to solution in new housing construction.

Eastern China Natural Fiber Insulation Materials Market generated USD 202.6 million in 2024. This area benefits from well-established industrial zones and access to advanced infrastructure, including strong transportation networks. The region's cities-such as Suzhou, Shanghai, and Hangzhou-are leading innovation and green building trends, supporting the uptake of sustainable insulation products. Their proximity to major logistics hubs further facilitates supply chain efficiency for manufacturers and distributors. Demand is increasing as major developments in the region incorporate environmentally responsible materials, with Eastern China becoming a prominent launchpad for green construction solutions.

Leading companies involved in the China Natural Fiber Insulation Materials Market include Hebei Derek Chemical Limited, Jiangsu Huilong International Corporation, Wuxi Powermax Renewable Energy Technology Co., Ltd., BANGSHANG INTERNATIONAL Co., LTD, Chengdu Igoods Technology Co., Ltd., Jiangsu Aidefu Latex Products Co., Ltd., Hubei Green Forest New Material Co., Ltd., Dongguan Aconic Fabric Co., Ltd., Ginni Spectra Private Limited, and Anhui Evosil Nanomaterials Technology Co., Ltd. Major companies in China natural fiber insulation materials market are deploying innovation-based approaches to strengthen their presence. Many are investing in R&D to develop high-performance insulation with improved thermal and acoustic properties while maintaining eco-friendly profiles. These firms are also aligning their products with China's evolving building codes and green certification standards to ensure widespread acceptance in new developments. Partnerships with green construction developers and local governments are helping accelerate product integration into residential and commercial infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Fiber type trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.2.4 Form trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Fiber Category, 2021-2034 (USD Million) (Kilo tons)

- 5.1 Key trends

- 5.2 Cotton-based insulation materials

- 5.2.1 Cotton stalk fiber insulation

- 5.2.2 Recycled cotton insulation

- 5.2.3 Market size and growth projections

- 5.2.4 Key applications and end use

- 5.3 Cellulose-based insulation materials

- 5.3.1 Recycled paper cellulose

- 5.3.2 Wood cellulose insulation

- 5.3.3 Market dynamics and trends

- 5.4 Rice-based insulation materials

- 5.4.1 Rice husk insulation

- 5.4.2 Rice straw insulation

- 5.4.3 Regional production and consumption analysis

- 5.5 Hemp-based insulation materials

- 5.5.1 Industrial hemp fiber insulation

- 5.5.2 Hemp composite materials

- 5.5.3 Regulatory impact and market potential

- 5.6 Bamboo-based insulation materials

- 5.6.1 Bamboo fiber insulation panels

- 5.6.2 Bamboo composite insulation

- 5.6.3 Export-import dynamics

- 5.7 Wood fiber insulation materials

- 5.7.1 Softwood fiber insulation

- 5.7.2 Hardwood waste insulation

- 5.7.3 Forestry residue utilization

- 5.8 Other natural fiber types

- 5.8.1 Flax fiber insulation

- 5.8.2 Jute and kenaf insulation

- 5.8.3 Coconut coir insulation

- 5.8.4 Wool-based insulation

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo tons)

- 6.1 Key trends

- 6.2 Residential buildings

- 6.2.1 Single-family homes

- 6.2.2 Multi-family housing

- 6.2.3 Rural housing renovation

- 6.2.4 Urban apartment complexes

- 6.3 Commercial buildings

- 6.3.1 Office buildings

- 6.3.2 Retail and shopping centers

- 6.3.3 Hotels and hospitality

- 6.3.4 Educational institutions

- 6.3.5 Healthcare facilities

- 6.4 Industrial applications

- 6.4.1 Manufacturing facilities

- 6.4.2 Warehouses and storage

- 6.4.3 Cold storage and refrigeration

- 6.4.4 Process industry insulation

- 6.5 Infrastructure projects

- 6.5.1 Transportation infrastructure

- 6.5.2 Public buildings

- 6.5.3 Agricultural facilities

- 6.5.4 Energy infrastructure

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Kilo tons)

- 7.1 Key trends

- 7.2 Construction companies

- 7.2.1 Large-scale developers

- 7.2.2 Regional construction firms

- 7.2.3 Specialty insulation contractors

- 7.3 Building material distributors

- 7.3.1 National distribution networks

- 7.3.2 Regional wholesalers

- 7.3.3 Specialty material suppliers

- 7.4 Government and public sector

- 7.4.1 Central government projects

- 7.4.2 Provincial government initiatives

- 7.4.3 Municipal development programs

- 7.5 Industrial end use

- 7.5.1 Manufacturing companies

- 7.5.2 Energy and utilities

- 7.5.3 Food processing industry

- 7.5.4 Chemical and petrochemical sector

Chapter 8 Market Estimates and Forecast, By Form, 2021-2034 (USD Million) (Kilo tons)

- 8.1 Key trends

- 8.2 Batts and rolls

- 8.2.1 Flexible insulation batts

- 8.2.2 Continuous roll insulation

- 8.2.3 Pre-cut insulation panels

- 8.3 Boards and panels

- 8.3.1 Rigid insulation boards

- 8.3.2 Semi-rigid panels

- 8.3.3 Composite insulation panels

- 8.4 Loose-fill insulation

- 8.4.1 Blown-in insulation

- 8.4.2 Poured insulation

- 8.4.3 Spray-applied insulation

- 8.5 Specialty forms

- 8.5.1 Pipe insulation

- 8.5.2 Duct insulation

- 8.5.3 Reflective insulation systems

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo tons)

- 9.1 Key trends

- 9.2 East China

- 9.3 South China

- 9.4 Central China

- 9.5 North China

- 9.6 Southwest China

- 9.7 Northwest China

- 9.8 Northeast China

Chapter 10 Company Profiles

- 10.1 BANGSHANG INTERNATIONAL Co., LTD

- 10.2 Hubei Green Forest New Material Co., Ltd.

- 10.3 Chengdu Igoods Technology Co., Ltd.

- 10.4 Wuxi Powermax Renewable Energy Technology Co., Ltd.

- 10.5 Jiangsu Aidefu Latex Products Co., Ltd.

- 10.6 Ginni Spectra Private Limited

- 10.7 Dongguan Aconic Fabric Co., Ltd.

- 10.8 Anhui Evosil Nanomaterials Technology Co., Ltd.

- 10.9 Jiangsu Huilong International Corporation

- 10.10 Hebei Derek Chemical Limited