PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822599

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822599

India Natural Fiber Insulation Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

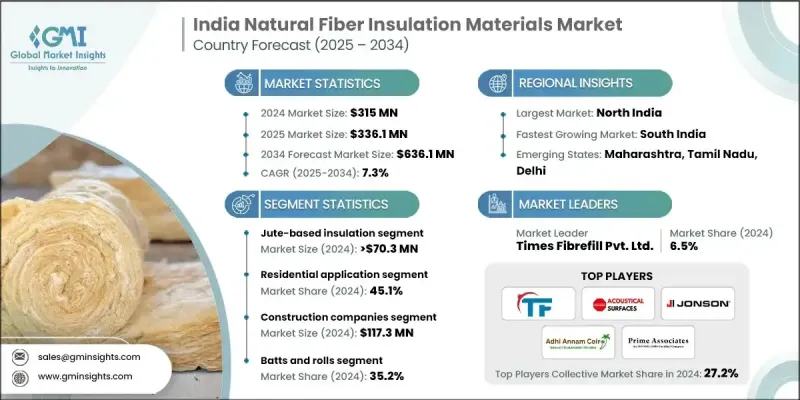

India natural fiber insulation materials market was valued at USD 315 million in 2024 and is projected to grow from USD 336.1 million in 2025 to USD 636.1 million by 2034, at a CAGR of 7.3%, according to the latest report published by Global Market Insights, Inc.

Healthy growth is coming from increasing demand for green building materials, energy efficiency in buildings, and sustainable thermal and acoustical insulation products. Government priorities relating to jute, coir, and other vegetable fibers, combined with our green building agenda and extremely rapid city renewal programs, mean that urban and rural housing schemes using insulation, jute, and coir are going to be implemented in all parts of India.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $315 Million |

| Forecast Value | $636.1 Million |

| CAGR | 7.3% |

Key Drivers:

- Strict regulations for energy efficiency and green buildings: Initiatives such as ECO Niwas Samhita and BEE Star Ratings are fostering the need for sustainable insulation.

- Easy supply of natural fibers: India is the largest producer of jute and coir in the world, and there is a supply of raw materials.

- Low carbon profile and recyclability: Natural fibers provide a safe, renewable, and biodegradable option compared to man-made insulation materials.

- Growing demand in rural and affordable housing: Affordability and thermal performance make coir and jute-based insulation perfect for PMAY and other housing programs.

Key Players:

Times Fibrefill Pvt. Ltd. is a company specializing in natural fiber-based insulation products. The firm has market with a market share of 6.5% in 2024.

The top 7 companies are Times Fibrefill Pvt. Ltd., Acoustical Surfaces, Godson Tapes Private Limited, Adhi Annam Coir Comforts, Prime Associates, Owens Corning, and Saint-Gobain. These are some of the major companies in this market that operate in their regions, accounting for 38.9% of the market share.

Key Challenges:

- There is insufficient awareness of availability. Natural fiber insulation still has low representation in urban retail outlets and low visibility in relation to synthetic products.

- Problems with maintenance and moisture-sensitivity: certain fibers can be compromised by humid conditions if proper vapor barriers or treatments are not used.

- Lack of standardized performance levels: There are no standardized Indian standards set for R-values, fire resistance, and durability, so there is no confidence from developers and contractors.

1. By Fiber Type - Jute-Based Insulation Leads

The highest market share was jute-based insulation in 2024, largely due to India's ability to produce jute and the fact that it is well-suited to thermal insulation applications in roofs and walls. The fiber is durable, inexpensive, and naturally pest-resistant.

2.By Application - Residential Sector Leads the market

In 2024, the largest tracked market share is allocated to residential. Residential applications using biodegradable insulation such as cellulose, wood fiber, cotton, and wool are showing considerable demand for urban residential buildings, eco-villages, and low-income housing stock. Biodegradable insulation is recognised for its benefit of comfort and reduction in overall energy usage.

3. By End User - Construction Industry Leads

Construction firms were the largest end use in 2024, employing fiber insulation in new homes, environmentally friendly resorts, and public centers. Developers are specifying more natural insulation in green-certified buildings to enjoy regulatory and brand benefits.

4. By Form - Batts and Rolls Dominate

Batts and rolls were the most popular type in 2024, with simple handling, value-for-money installation, and compatibility with conventional building practice. These are used extensively in wall cavities, attics, and under-roof applications throughout India's climatic regions.

North India became the largest regional market in 2024 due to substantial government stimulus for green affordability housing, higher awareness among consumers of eco-insulation, and the easy availability of raw materials and jute and coir processing facilities. To this end, North India faces considerable demand for natural fibre insulation in urban residential real estate and public sector buildings.

Key players in the market are Times Fibrefill Pvt. Ltd., Godson Tapes Private Limited, Adhi Annam Coir Comforts, Prime Associates, Acoustical Surfaces, BASF, Owens Corning, Saint-Gobain, and Knauf Insulation, among others.

The major players in India use strategies such as vertical integration, product localization, and collaboration with housing boards for expanding into India. Times Fibrefill has boosted its jute insulation manufacturing capacity to respond to rising demand, and Adhi Annam Coir Comforts is collaborating with state housing authorities to bring coir-based batts to affordable housing. Global companies such as Knauf Insulation and Saint-Gobain are adding plant-based blends and hybrid solutions to meet India's sustainability objectives. Most of these companies are also emphasizing skills training among local contractors and masons to promote mass adoption in rural markets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Fiber type

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Form

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trend

- 5.2 Rice-based insulation materials

- 5.2.1 Rice husk insulation

- 5.2.2 Rice straw insulation panels

- 5.3 Cotton-based insulation materials

- 5.3.1 Cotton stalk fiber insulation

- 5.3.2 Recycled cotton textile insulation

- 5.4 Jute-based insulation materials

- 5.4.1 Jute fiber insulation batts

- 5.4.2 Jute nonwoven insulation materials

- 5.5 Coir-based insulation materials

- 5.5.1 Coconut coir fiber insulation

- 5.5.2 Coir composite panels

- 5.6 Sugarcane bagasse insulation materials

- 5.7 Hemp-based insulation materials

- 5.7.1 Industrial hemp fiber insulation

- 5.7.2 Hemp composite materials

- 5.8 Bamboo-based insulation materials

- 5.8.1 Bamboo fiber insulation panels

- 5.8.2 Bamboo composite insulation

- 5.9 Other natural fiber types

- 5.9.1 Wheat straw insulation

- 5.9.2 Flax and kenaf fiber insulation

- 5.9.3 Palm fiber and banana fiber insulation

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Residential buildings

- 6.2.1 Individual houses and bungalows

- 6.2.2 Apartment complexes and housing societies

- 6.2.3 Affordable housing projects (PMAY)

- 6.3 Commercial buildings

- 6.3.1 Office buildings and it parks

- 6.3.2 Retail and shopping centers

- 6.3.3 Hotels and hospitality sector

- 6.3.4 Educational institutions and schools

- 6.3.5 Healthcare facilities and hospitals

- 6.4 Industrial applications

- 6.4.1 Manufacturing facilities and warehouses

- 6.4.2 Cold storage and food processing

- 6.4.3 Textile and garment industries

- 6.4.4 Chemical and pharmaceutical plants

- 6.5 Infrastructure projects

- 6.5.1 Smart cities development

- 6.5.2 Transportation infrastructure

- 6.5.3 Government and public buildings

- 6.5.4 Agricultural infrastructure and storage

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Tons)

- 7.1 Key trend

- 7.2 Construction companies

- 7.3 Building material manufacturers and distributors

- 7.4 Government and public sector

- 7.5 Industrial end use

- 7.5.1 Manufacturing companies

- 7.5.2 Food processing and cold chain

- 7.5.3 Textile and apparel industry

- 7.5.4 Chemical and process industries

Chapter 8 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 8.1 Key trend

- 8.2 Batts and rolls

- 8.2.1 Flexible insulation batts

- 8.2.2 Continuous roll insulation

- 8.2.3 Pre-cut insulation panels

- 8.3 Boards and panels

- 8.3.1 Rigid insulation boards

- 8.3.2 Semi-rigid panels

- 8.3.3 Composite insulation panels

- 8.4 Loose-fill insulation

- 8.4.1 Blown-in insulation

- 8.4.2 Poured insulation

- 8.4.3 Spray-applied insulation

- 8.5 Specialty forms

- 8.5.1 Pipe insulation

- 8.5.2 Duct insulation

- 8.5.3 Reflective insulation systems

Chapter 9 Market Estimates & Forecast, By States, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North India

- 9.2.1 Delhi NCR

- 9.2.2 Punjab

- 9.2.3 Haryana

- 9.2.4 Uttar Pradesh

- 9.2.5 Uttarakhand

- 9.2.6 Himachal Pradesh

- 9.2.7 Jammu & Kashmir

- 9.3 West India

- 9.3.1 Maharashtra

- 9.3.2 Gujarat

- 9.3.3 Rajasthan

- 9.3.4 Goa

- 9.4 South India

- 9.4.1 Tamil Nadu

- 9.4.2 Karnataka

- 9.4.3 Kerala

- 9.4.4 Andhra Pradesh and Telangana

- 9.5 East India

- 9.5.1 West Bengal

- 9.5.2 Odisha

- 9.5.3 Jharkhand

- 9.5.4 Bihar

- 9.5.5 Northeast States

- 9.6 Central India

- 9.6.1 Madhya Pradesh

- 9.6.2 Chhattisgarh

Chapter 10 Company Profiles

- 10.1 Times Fibrefill Pvt. Ltd.

- 10.2 Acoustical Surfaces

- 10.3 Godson Tapes Private Limited

- 10.4 Adhi Annam Coir Comforts

- 10.5 Prime Associates

- 10.6 BASF

- 10.7 Owens Corning

- 10.8 Saint-Gobain

- 10.9 Knauf Insulation