PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822604

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822604

Yacht Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

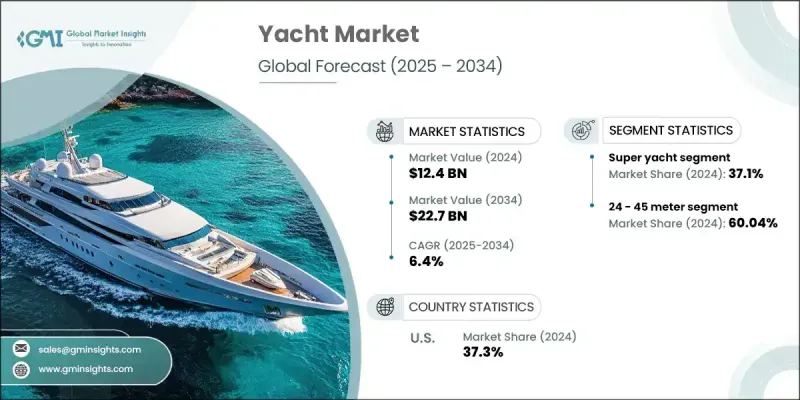

The Global Yacht market was valued at USD 12.4 billion and is estimated to grow at a CAGR of 6.4% to reach USD 22.7 billion by 2034, driven by increasing disposable incomes and the rising popularity of luxury and recreational activities. With the expanding global wealth, particularly among high-net-worth individuals, there is growing demand for luxury yachts as symbols of prestige and personal indulgence. The allure of private cruising experiences, combined with the customization options available in modern yacht designs are making yachts an attractive lifestyle choice for affluent individuals. For instance, in July 2024, Italian shipyard Cantiere delle Marche launched a "one off" 42.6-metre explorer yacht B2. Innovations in yacht engineering, such as enhanced fuel efficiency, improved navigation systems, and eco-friendly technologies, are further turning yachts more appealing to buyers.

The incorporation of cutting-edge amenities and sustainable features, such as hybrid propulsion systems and energy-efficient designs to cater to the evolving preferences of modern consumers who prioritize both luxury and environmental responsibility will drive the market growth. The overall yacht industry is segmented into type, length, propulsion, and region. Based on type, the market size from the sports yacht segment is anticipated to witness growth through 2032. Sports yachts, equipped with advanced technology and aerodynamics, offer superior sailing experiences and are often featured in prestigious regattas and sailing competitions. The increasing interest in sailing sports and high-profile events, coupled with advancements in yacht design and materials, are further enhancing the desirability of sports yachts among affluent buyers and racing aficionados.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.4 Billion |

| Forecast Value | $22.7 Billion |

| CAGR | 6.4% |

Yacht market from the sail propulsion segment is predicted to record notable gains up to 2032 due to traditional and eco-friendly aspects of sailing. Moreover, sailing yachts offer a unique combination of elegance, performance, and sustainability, appealing to buyers who appreciate the skill and experience involved in navigating by wind power. The growing emphasis on environmental consciousness and reduced carbon footprints has also increased the interest in sailing as a greener alternative to motorized yachting. Asia Pacific yacht industry size will grow significantly through 2032. This is attributed to rising middle and high-net-worth population, particularly in countries like China, India, and Australia, where increasing affluence is fueling the demand for luxury recreational assets. The expansion of coastal infrastructure, including marinas and yacht clubs, is further enhancing the appeal of yacht ownership by providing better facilities and access to sailing opportunities in the region.

Table of Contents

Chapter 1 Methodology

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.1.6 GMI proprietary AI system

- 1.1.6.1 AI-Powered research enhancement

- 1.1.6.2 Source consistency protocol

- 1.1.6.3 AI accuracy metrics

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario Analysis Framework

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid Sources

- 1.5.1.2 Public Sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Research Trail & Confidence Scoring

- 1.6.1 Research Trail Components:

- 1.6.2 Scoring Components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Length

- 2.2.4 Propulsion

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Yacht manufacturers and builders

- 3.1.1.2 Marina and infrastructure providers

- 3.1.1.3 Charter and management companies

- 3.1.1.4 Maintenance and refit services

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.1 Supplier landscape

- 3.2 Economic impact assessment

- 3.2.1 Direct and indirect economic contributions

- 3.2.1.1 GDP contribution by region

- 3.2.1.2 Employment generation analysis

- 3.2.1.3 Tax revenue and government income

- 3.2.1.4 Trade balance and export impact

- 3.2.2 Employment generation and skills development

- 3.2.2.1 Direct employment in manufacturing

- 3.2.2.2 Indirect employment in services

- 3.2.2.3 Skill development and training programs

- 3.2.2.4 Career pathway and advancement opportunities

- 3.2.3 Tourism and hospitality sector linkages

- 3.2.3.1 Destination tourism impact

- 3.2.3.2 Hotel and restaurant integration

- 3.2.3.3 Local service provider benefits

- 3.2.3.4 Cultural and environmental impact

- 3.2.1 Direct and indirect economic contributions

- 3.3 Market evolution and historical development

- 3.3.1 Industry genesis and early development

- 3.3.2 Key historical milestones and turning points

- 3.3.3 Technology evolution timeline

- 3.3.4 Market maturation phases

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising wealth and high net-worth individuals (HNWIs)

- 3.4.1.2 Growing popularity of luxury tourism and leisure activities

- 3.4.1.3 Technological advancements and customization

- 3.4.1.4 Expansion of yacht charter market

- 3.4.1.5 Increasing coastal infrastructure development

- 3.4.2 Industry pitfalls and challenges

- 3.4.2.1 High maintenance and operating costs

- 3.4.2.2 Economic and market volatility

- 3.4.3 Market opportunities

- 3.4.3.1 Emerging markets and increasing wealth in Asia-Pacific

- 3.4.3.2 Eco-friendly and sustainable yachts

- 3.4.3.3 Digitalization and smart yacht technologies

- 3.4.3.4 Growth of yacht sharing and fractional ownership models

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Production statistics

- 3.7 Regulatory landscape

- 3.7.1 International maritime regulations

- 3.7.1.1 MARPOL convention compliance

- 3.7.1.2 IMO greenhouse gas strategy

- 3.7.1.3 NOX tier III emissions standards

- 3.7.2 Regional Regulatory Frameworks

- 3.7.2.1 European union regulations

- 3.7.2.2 Mediterranean mooring regulations

- 3.7.2.3 U.S. marine emissions rules

- 3.7.2.4 Asia-Pacific regulatory developments

- 3.7.3 Environmental compliance requirements

- 3.7.3.1 Carbon emission reduction targets

- 3.7.3.2 Waste management and treatment standards

- 3.7.3.3 Marine protected area restrictions

- 3.7.3.4 Sustainability reporting requirements

- 3.7.4 Safety and security regulations

- 3.7.4.1 Maritime labour convention (MLC 2006)

- 3.7.4.2 Cybersecurity standards for smart yachts

- 3.7.4.3 Flag state compliance requirements

- 3.7.5 Tax and Legal Considerations

- 3.7.5.1 VAT structures and implications

- 3.7.5.2 Ownership and registration requirements

- 3.7.5.3 Charter license and operating permits

- 3.7.1 International maritime regulations

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Technology and innovation landscape

- 3.11.1 Sustainable propulsion systems

- 3.11.1.1 Electric and hybrid yacht technologies

- 3.11.1.2 Hydrogen fuel cell integration

- 3.11.1.3 Alternative energy sources (solar, wind)

- 3.11.1.4 Fuel efficiency optimization

- 3.11.2 Smart yacht technologies

- 3.11.2.1 Internet of things (IoT) integration

- 3.11.2.2 Artificial intelligence and automation

- 3.11.2.3 Advanced navigation and safety systems

- 3.11.2.4 Connectivity solutions (Starlink, 5G)

- 3.11.3 Design and materials innovation

- 3.11.3.1 Advanced composite materials

- 3.11.3.2 Lightweight construction technologies

- 3.11.3.3 Eco-friendly material applications

- 3.11.3.4 Modular and customizable design concepts

- 3.11.4 Digital transformation in yachting

- 3.11.4.1 Virtual reality and augmented reality applications

- 3.11.4.2 Digital booking and charter platforms

- 3.11.4.3 Predictive maintenance technologies

- 3.11.4.4 Blockchain applications in yacht transactions

- 3.11.1 Sustainable propulsion systems

- 3.12 Patent analysis

- 3.13 Supply Chain And Manufacturing Analysis

- 3.13.1 Global manufacturing landscape

- 3.13.2 Supply chain structure and dynamics

- 3.13.3 Manufacturing capacity and utilization

- 3.13.4 Supply chain challenges and opportunities

- 3.14 Use cases

- 3.15 Best-case scenario

- 3.16 Consumer behaviour analysis

- 3.17 Sustainability and Environmental Aspects

- 3.17.1 Sustainable practices

- 3.17.2 Waste reduction strategies

- 3.17.3 Energy efficiency in production

- 3.17.4 Eco-friendly Initiatives

- 3.17.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Emerging competitive threats

- 4.6.1 New market entrants

- 4.6.2 Technology disruptors

- 4.6.3 Alternative business models

- 4.6.4 Competitive intelligence framework

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Flybridge Yacht

- 5.3 Sport Yacht

- 5.4 Super Yachts

- 5.5 Others (Long Range, Cruisers, Expedition Yachts)

Chapter 6 Market Estimates & Forecast, By Length, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Below 24 meter

- 6.3 24 - 45 meter

- 6.4 Above 45 meter

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Motor

- 7.3 Sail

- 7.4 Hybrid/electric

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 Abeking & Rasmussen

- 9.1.2 Amels / Damen Yachting

- 9.1.3 Benetti

- 9.1.4 CRN

- 9.1.5 Feadship

- 9.1.6 Ferretti Group

- 9.1.7 Fincantieri

- 9.1.8 Group Beneteau

- 9.1.9 Heesen Yachts

- 9.1.10 Lurssen

- 9.1.11 Malibu Boats

- 9.1.12 MasterCraft Boat Holdings

- 9.1.13 Oceanco

- 9.1.14 Princess Yachts

- 9.1.15 Sanlorenzo

- 9.1.16 Sea Ray

- 9.1.17 The Italian Sea Group

- 9.1.18 Sunseeker International

- 9.1.19 Viking Yachts

- 9.1.20 Yamaha Marine

- 9.2 Regional Players

- 9.2.1 Turquoise Yachts

- 9.2.2 Nimbus Group

- 9.2.3 Cheoy Lee Shipyards

- 9.2.4 Boston Whaler

- 9.2.5 Hatteras Yachts

- 9.2.6 Nobiskrug

- 9.2.7 Nautique Boat Company

- 9.3 Emerging Players / Disruptors

- 9.3.1 Malibu Boats

- 9.3.2 Turquoise Yachts