PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822605

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822605

Veterinary Injectable Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

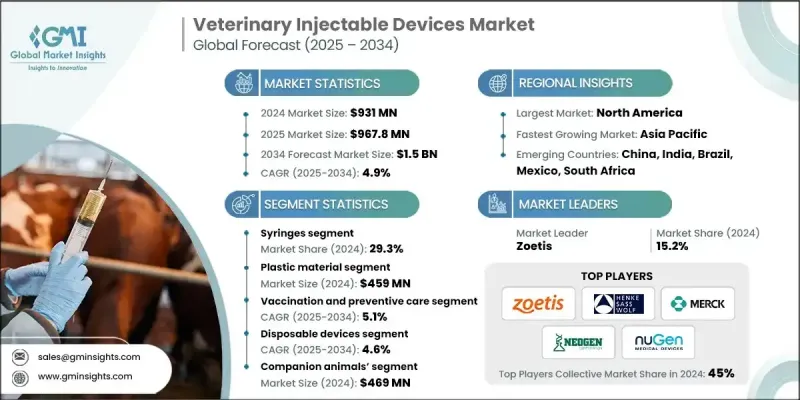

The Global Veterinary Injectable Devices Market was valued at USD 931 million in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 1.5 billion by 2034.

With more households adopting pets and treating them as family members, there is a significant rise in veterinary visits and preventive care spending-boosting demand for efficient, safe injectable devices for vaccinations, treatments, and therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $931 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 4.9% |

Rising adoption of Syringes

The syringes segment held a notable share in 2024, driven by its wide applicability in administering medications, vaccines, and nutrients to both companion and livestock animals. These devices are valued for their precision, ease of use, and compatibility with a range of needle gauges and volumes. As infection control remains a priority, the industry is witnessing increased production of pre-sterilized and safety-enhanced syringes tailored for veterinary use.

Plastic Material to Gain Traction

The plastic materials generated a significant share in 2024 owing to their cost-effectiveness, lightweight nature, and flexibility in design. From disposable syringes to multi-dose injectors, plastic offers a balance of durability and safety. The market growth is driven by high-volume production needs and the rising demand for single-use devices that support hygienic practices in both clinics and farm environments. Manufacturers are also exploring eco-friendly bioplastics and recyclable polymers to address growing environmental concerns and align with sustainability goals.

Rising Demand for Vaccination and Preventive Care

The vaccination and preventive care segment generated significant revenues in 2024, fueled by increasing awareness of disease prevention in both pets and livestock. Veterinarians and animal health programs are prioritizing injectable vaccines for their fast action and high efficacy, especially for diseases like rabies, foot-and-mouth, and parvovirus. Injectable devices designed for speed, accuracy, and reduced stress on animals are in high demand, particularly in large-scale vaccination drives.

Regional Insights

North America to Emerge as a Propelling Region

North America veterinary injectable devices market held a substantial share in 2024, backed by advanced veterinary healthcare systems, high pet ownership rates, and strong livestock management practices. Growth is supported by increased investments in animal wellness, widespread adoption of preventive care protocols, and a favorable regulatory environment. The presence of key players and ongoing R&D efforts also contributes to the region's dominance, with a focus on precision devices and digital tracking systems for dosage accuracy.

Major players involved in the veterinary injectable devices market are Neogen Corporation, Terumo Medical Corporation, Hamilton Company, Serumwerk Bernburg, Allflex USA, Medtronic plc, Zoetis, Henke-Sass, Wolf, Baxter International, NuGen Medical Devices, B. Braun Melsungen, Merck & Co., Micrel Medical Devices.

To strengthen their market position, leading companies in the veterinary injectable devices space are focusing on innovation, geographic expansion, and strategic collaborations. Product development is centered around ergonomic designs, needle-free injectors, and automated dosing systems to reduce human error and animal stress. Many players are expanding into emerging markets by setting up local manufacturing and distribution partnerships to lower costs and improve reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 Clinical applications trends

- 2.2.5 Usage trends

- 2.2.6 Animal type trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet population and humanization of companion animals

- 3.2.1.2 Growing animal health spending and large animal production needs

- 3.2.1.3 Rising prevalence of zoonotic and infectious disease control programs

- 3.2.1.4 Increasing veterinary infrastructure and service access in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and treatment

- 3.2.2.2 Risk of needle-stick injuries and cross-contamination

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of prefilled syringes and autoinjectors in veterinary care

- 3.2.3.2 Rising pet insurance and willingness to spend by pet owners

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Syringes

- 5.3 Needles

- 5.4 Remote injectable devices

- 5.4.1 Pole syringes

- 5.4.2 Darts

- 5.5 Needle free injector systems

- 5.5.1 Spring-loaded

- 5.5.2 Battery-powered

- 5.5.3 Gas powered jet injector

- 5.6 Auto-injectors

- 5.7 Other injectable devices

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Glass

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By Clinical Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Vaccination and preventive care

- 7.3 Anti-infectives

- 7.4 Anesthesia and analgesia

- 7.5 Fertility and reproduction

- 7.6 Other clinical applications

Chapter 8 Market Estimates and Forecast, By Usage, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Disposable devices

- 8.3 Reusable devices

Chapter 9 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Companion animals

- 9.3 Livestock animals

- 9.4 Other animals

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospitals

- 10.3 Veterinary clinics

- 10.4 Academic and research institutes

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Allflex USA

- 12.2 Baxter International

- 12.3 B. Braun Melsungen

- 12.4 Hamilton Company

- 12.5 Henke-Sass, Wolf

- 12.6 Merck & Co.

- 12.7 Medtronic plc

- 12.8 Micrel Medical Devices

- 12.9 Neogen Corporation

- 12.10 NuGen Medical Devices

- 12.11 Serumwerk Bernburg

- 12.12 Terumo Medical Corporation

- 12.13 Zoetis