PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822613

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822613

Audiology Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

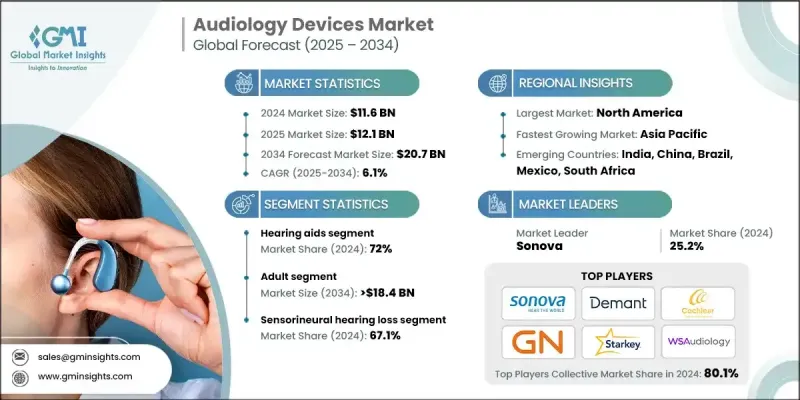

The global audiology devices market was estimated at USD 11.6 billion in 2024 and is expected to grow from USD 12.1 billion in 2025 to USD 20.7 billion by 2034, at a CAGR of 6.1%, according to the latest report published by Global Market Insights Inc.

The growing incidence of hearing loss worldwide is a primary driver of the audiology devices market. Age-related hearing impairment, also known as presbycusis, is becoming increasingly common as life expectancy rises and the global population continues to age.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.6 Billion |

| Forecast Value | $20.7 Billion |

| CAGR | 6.1% |

Rising Demand for Hearing Aids

The hearing aids segment held a notable share in 2024, driven by continuous technological innovation and rising demand for discreet, user-friendly products. Modern hearing aids now feature advanced functionalities such as Bluetooth connectivity, AI-based sound enhancement, noise cancellation, and rechargeable batteries. These features appeal to tech-savvy consumers looking for seamless integration with digital lifestyles.

Adults to Gain Traction

The adult segment generated significant revenues in 2024, owing to the high prevalence of age-related hearing loss. As more adults seek solutions that support active lifestyles, there is a growing demand for high-performance, low-maintenance devices that offer natural sound quality and long battery life. Adults are also more likely to engage in regular hearing assessments, leading to higher diagnosis and treatment rates. Manufacturers are targeting this demographic with marketing that emphasizes independence, communication, and quality of life.

Increasing Prevalence of Sensorineural Hearing Loss

The sensorineural hearing loss segment generated sustainable revenues in 2024. This condition, typically caused by damage to the inner ear or auditory nerve, is often irreversible and requires long-term device support. Hearing aids and cochlear implants are the primary solutions, with device performance tailored to different degrees of severity. Companies are investing heavily in research and development to produce devices that better mimic natural hearing and adapt to complex sound environments. Innovations in speech recognition and real-time sound processing are helping users experience improved clarity and comfort in noisy settings.

Regional Insights

North America to Emerge as a Propelling Region

North America audiology devices market held a sizeable share in 2024, driven by advanced healthcare infrastructure, favorable reimbursement policies, and a strong culture of early hearing loss diagnosis. The United States dominates the regional market, with a value exceeding USD 3 billion and steady annual growth fueled by the aging population and rising consumer awareness. Companies are strengthening their position in North America by expanding audiology clinic networks, enhancing online retail platforms, and integrating telehealth solutions into the hearing care journey.

Major players in the audiology devices market are EARGO, Demant, NUROTRON, ENVOY MEDICAL, WS Audiology, Medtronic, GN Store Nord, MAICO, RION, EARTECHNIC, MED-EL Medical, Starkey, Cochlear, American Diagnostic Corporation, and Sonova.

To solidify their presence, leading companies in the audiology devices market are adopting a multi-pronged approach. Innovation remains central, with ongoing investments in miniaturization, AI-based audio processing, and wireless connectivity to meet evolving user expectations. Many companies are entering strategic alliances with telehealth providers and retail pharmacy chains to broaden their distribution footprint. Additionally, customer experience is prioritized through personalized fitting technology, mobile apps for device control, and lifetime service plans.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Patient trends

- 2.2.4 Hearing loss trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of hearing loss globally

- 3.2.1.2 Growing preference for e-commerce channels

- 3.2.1.3 Technological advancements in audiology devices

- 3.2.1.4 Favorable reimbursement policies in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced audiology devices

- 3.2.2.2 Lack of awareness in low-income countries

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and machine learning in hearing devices

- 3.2.3.2 Growing demand for tele-audiology and remote hearing services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis, by region

- 3.8 Consumer pathway

- 3.8.1 Conventional pathway

- 3.8.2 Need for new pathway

- 3.8.3 Hybrid pathway

- 3.9 Consumer insights

- 3.10 Policy landscape

- 3.11 Gap analysis

- 3.12 Risk management analysis

- 3.12.1 Research and development

- 3.12.2 Operations

- 3.12.3 Marketing and sales

- 3.12.4 Quality

- 3.12.5 Intellectual property rights

- 3.12.6 Regulatory

- 3.12.7 Information technology

- 3.12.8 Climate

- 3.12.9 Financial

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Future market trends

- 3.16 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1.4 Latin America

- 4.3.1.5 MEA

- 4.3.1 By region

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Hearing aids

- 5.2.1 By Type

- 5.2.1.1 Behind-the-ear (BTE)

- 5.2.1.2 Receiver in the ear/receiver in canal (RITE/RIC)

- 5.2.1.3 Completely-in-the-canal/invisible-in-canal (CIC/IIC)

- 5.2.1.4 In-the-ear (ITE)

- 5.2.1.5 In-the-canal (ITC)

- 5.2.2 By Distribution Channel

- 5.2.2.1 Brick and mortar

- 5.2.2.2 E-commerce

- 5.2.1 By Type

- 5.3 Cochlear implants

- 5.3.1 Unilateral implants

- 5.3.2 Bilateral implants

- 5.4 Diagnostic devices

- 5.4.1 Tympanometers

- 5.4.2 Audiometer

- 5.4.3 Otoscopes

- 5.5 Bone-anchored hearing aids (BAHA)

- 5.6 Middle ear implants (MEI)

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Hearing Loss, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Sensorineural hearing loss

- 7.3 Conductive hearing loss

- 7.4 Mixed hearing loss

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 American Diagnostic Corporation

- 9.2 Cochlear

- 9.3 Demant

- 9.4 EARGO

- 9.5 EARTECHNIC

- 9.6 ENVOY MEDICAL

- 9.7 GN Store Nord

- 9.8 MAICO

- 9.9 MED-EL Medical

- 9.10 Medtronic

- 9.11 NUROTRON

- 9.12 RION

- 9.13 sonova

- 9.14 Starkey

- 9.15 WS Audiology