PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822614

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822614

Building Thermal Insulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

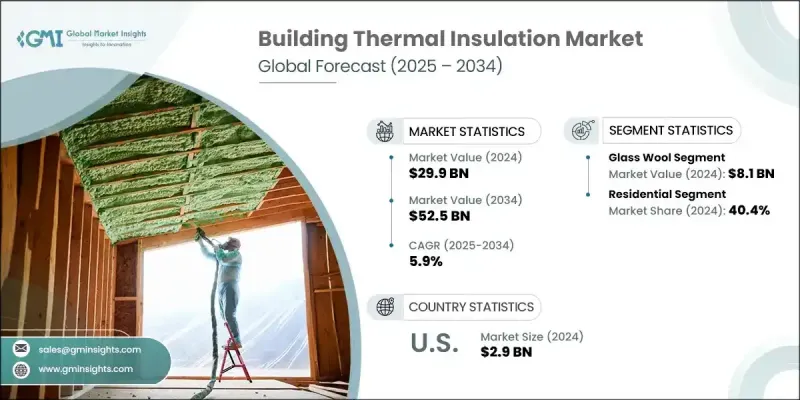

The global building thermal insulation market was valued at USD 29.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 52.5 billion by 2034. Growing environmental awareness and concerns about climate change are driving the demand for energy-efficient solutions in construction. Buildings account for substantial energy consumption, and insulation reduces the need for heating and cooling, effectively lowering greenhouse gas emissions. This aligns with global sustainability initiatives and fuels the adoption of eco-friendly insulation materials.

Consumers, developers, and contractors increasingly prefer sustainable and energy-efficient options, spurring demand for products made from natural or recycled materials. Regulatory frameworks and green building certifications, such as LEED and BREEAM, further promote energy-efficient insulation, while financial incentives like tax rebates encourage adoption. As a result, investment in energy-efficient homes and commercial structures continues to rise, making insulation a critical component in reducing energy costs and minimizing environmental impact. The market's growth reflects a collective focus on building more sustainable structures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.9 Billion |

| Forecast Value | $52.5 Billion |

| CAGR | 5.9% |

The market is segmented by material into open-cell and closed-cell types. Open-cell materials have gained substantial traction, contributing USD 12.96 billion in 2024 and projected to reach USD 23.84 billion by 2034. These materials are cost-effective and widely adopted in residential and commercial applications, especially in budget-conscious projects. They also enhance soundproofing and support green construction with eco-friendly options made from recycled materials. Open-cell materials are favored for their ease of installation and strong thermal performance, making them a preferred choice for retrofitting older buildings to improve energy efficiency.

By distribution channel, the market is divided into direct and indirect sales. Indirect channels led the market with a 45.01% share in 2024 and are expected to reach USD 19.69 billion by 2034. Manufacturers benefit from the extensive networks of distributors, wholesalers, and retailers, who streamline product availability and customer reach. These intermediaries reduce logistical challenges and improve market penetration, helping manufacturers focus on product development and branding. Indirect channels also cater to the growing demand through online platforms, enhancing accessibility and convenience for buyers.

The United States accounted for 53.5% of the global market's revenue in 2024 and is projected to grow at a CAGR of 6.3% through 2034. The nation's diverse construction industry and stringent energy-efficiency regulations drive demand for advanced insulation solutions. Government initiatives, including tax credits and green certifications, further support the use of thermal insulation. The country's emphasis on innovation in insulation technologies and the need for energy-saving solutions across varying climate zones continue to bolster market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising energy efficiency regulations

- 3.2.1.2 Growing construction and urbanization

- 3.2.1.3 Environmental concerns and sustainability initiatives

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Availability of alternative technologies

- 3.2.3 Opportunities

- 3.2.3.1 Development of eco-friendly and recycled materials

- 3.2.3.2 Retrofitting and renovation market growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By material

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 5.1 Key trends

- 5.2 Glass wool

- 5.3 Stone wool

- 5.4 Expanded polystyrene

- 5.5 Extruded polystyrene

- 5.6 Polyurethanes

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 6.1 Key trends

- 6.2 Blankets

- 6.3 Panels

- 6.4 Foam

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 7.1 Key trends

- 7.2 Wall insulation

- 7.2.1 Internal wall

- 7.2.2 External wall

- 7.2.3 Cavity wall

- 7.2.4 Curtain wall

- 7.3 Roof insulation

- 7.3.1 Flat roof

- 7.3.2 Pitch roof

- 7.4 Floor/Slab

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Square Meters)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Armacell

- 11.2 Burnett & Co

- 11.3 Firestone Building Products

- 11.4 GLT Products

- 11.5 Johns Manville

- 11.6 Kingspan Group

- 11.7 Knauf Insulation

- 11.8 Mapei

- 11.9 NICHIAS Corporation

- 11.10 Owens Corning

- 11.11 Recticel Insulation

- 11.12 Rockwool International

- 11.13 Saint-Gobain Isover

- 11.14 Siltherm

- 11.15 URSA