PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822625

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822625

North America Non-Residential Polished Concrete Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

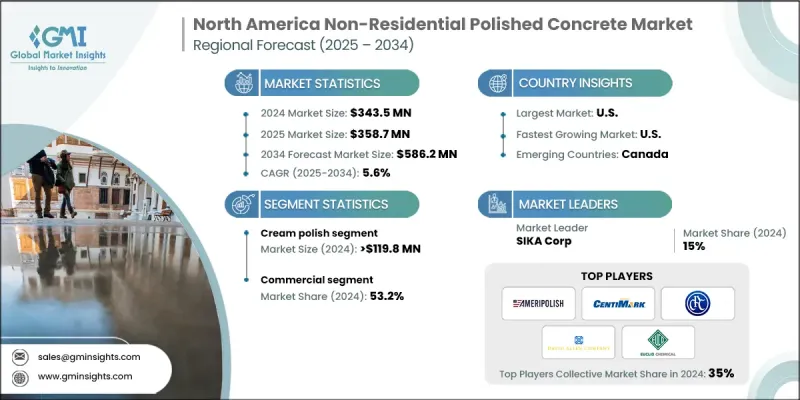

North America non-residential polished concrete market was estimated at USD 343.5 million in 2024 and is expected to grow from USD 358.7 million in 2025 to USD 586.2 million in 2034, at a CAGR of 5.6%, according to the latest report published by Global Market Insights Inc.

The steady increase in commercial construction projects across North America non-residential polished concrete market is a significant driver. As developers build new retail outlets, office complexes, hotels, healthcare facilities, and logistics centers, there's a growing demand for durable, low-maintenance, and visually appealing flooring solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $343.5 Million |

| Forecast Value | $586.2 Million |

| CAGR | 5.6% |

Cream Polish to Gain Traction

The cream polish segment held a strong position in 2024, driven by its ability to deliver a smooth, high-gloss finish while maintaining the surface's natural appearance. This type of polish is achieved by lightly grinding the surface, preserving the top cream layer of the concrete, and then polishing it to a desired shine. It's particularly favored in commercial spaces like retail stores, showrooms, and office lobbies where aesthetics and light reflectivity are important.

Rising Adoption in the Commercial Segment

The commercial segment generated significant revenues in 2024, fueled by the ongoing development of office buildings, retail centers, and public facilities. Property owners and developers increasingly prefer polished concrete due to its durability, ease of maintenance, and modern, professional look. Whether used in high-traffic corridors or open retail floors, it offers a long-lasting surface that resists staining and abrasion while supporting sustainability goals.

U.S. to Emerge as a Propelling Region

U.S. non-residential polished concrete market will witness consistent growth through 2034, supported by robust commercial construction activity and a shift toward sustainable building materials. The market benefits from strong demand in education, healthcare, retail, and hospitality sectors. Contractors and facility managers alike appreciate polished concrete for its performance under pressure, literally and figuratively offering both aesthetic value and functional resilience. As more businesses look to upgrade or build new spaces with longevity in mind, the adoption of polished concrete is expected to accelerate, particularly in urban centers and tech-driven commercial hubs.

Major players involved in the North America non-residential polished concrete market are Duracryl, SIKA Corp, The Floor Company, CPC Floor Coatings, Concrete Surfaces Inc, West Pacific Coatings, Ameripolish, Polished Concrete Floors LLC, CentiMark Corporation, SINTOKOGIO Ltd, Euclid Chemical Company, David Allen Company, Black Bear Coatings and Concrete, CoGri USA Inc, Duracon.

To strengthen their market foothold, companies in North America non-residential polished concrete market are focusing on service differentiation, advanced polishing technologies, and sustainable product offerings. Many are investing in training programs to upskill their workforce, ensuring consistent quality and faster project delivery. Expanding regional service coverage through acquisitions or franchise models is also a key tactic to tap into underserved markets. Additionally, companies are collaborating with architects and general contractors early in the design process to integrate polished concrete solutions from the ground up. Emphasizing eco-friendly materials and offering customizable finishes has also proven effective in appealing to both LEED-certified projects and design-driven clients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Finishing type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Emphasis on sustainability and green building practices

- 3.2.1.2 Demand for low-maintenance and cost-effective flooring solutions

- 3.2.1.3 Technological advancements and improved aesthetic appeal

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Need for skilled workforce

- 3.2.3 Opportunities

- 3.2.3.1 Growing green building initiatives

- 3.2.3.2 Expanding application across new sectors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By country

- 3.6.2 By finishing type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Finishing Type, 2021 - 2034 (USD Million) (Thousand Square Feet)

- 5.1 Key trends

- 5.2 Cream polish

- 5.3 Salt and pepper

- 5.4 Aggregate exposure

- 5.5 Stained concrete

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Square Feet)

- 6.1 Key trends

- 6.2 New floors

- 6.3 Retrofit floors

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Thousand Square Feet)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

- 7.4 Institutional

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Square Feet)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

Chapter 9 Company Profiles

- 9.1 Ameripolish

- 9.2 Black Bear Coatings and Concrete

- 9.3 CentiMark Corporation

- 9.4 CoGri USA Inc

- 9.5 Concrete Surfaces Inc

- 9.6 CPC Floor Coatings

- 9.7 David Allen Company

- 9.8 Duracon

- 9.9 Duracryl

- 9.10 Euclid Chemical Company

- 9.11 Polished Concrete Floors LLC

- 9.12 SIKA Corp

- 9.13 SINTOKOGIO Ltd

- 9.14 The Floor Company

- 9.15 West Pacific Coatings