PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822629

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822629

Asia Pacific Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

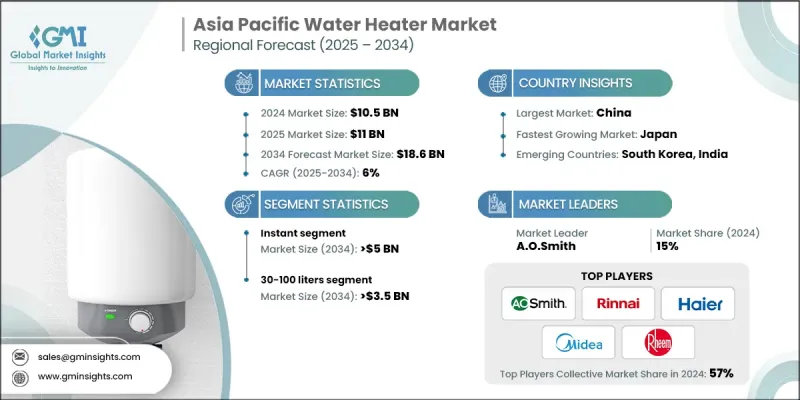

Asia Pacific water heater market was estimated at USD 10.5 billion in 2024 and is expected to grow from USD 11 billion in 2025 to USD 18.6 billion by 2034, at a CAGR of 6%, according to a report published by Global Market Insights, Inc.

The fast-paced development of urban infrastructure and residential housing across countries like China, India, and Southeast Asia is significantly increasing demand for domestic water heating systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.5 Billion |

| Forecast Value | $18.6 Billion |

| CAGR | 6% |

Rising Adoption of Instant Heaters

The instant water heater segment held a notable share in 2024, driven by urban households and compact apartments where space and efficiency are top priorities. These heaters offer quick heating capabilities without the need for large storage tanks, making them ideal for on-demand usage in bathrooms and kitchens. Their low energy consumption, fast operation, and modern design appeal to the lifestyle needs of today's city dwellers. In regions with rising electricity costs and sustainability goals, instant water heaters are becoming a preferred solution for reducing energy waste while maintaining user convenience.

Rising Prevalence of 30-100 Liters

The 30-100 liters water heater segment held significant revenues in 2024 due to its suitability for medium-sized families and commercial spaces like guest houses and small hotels. These systems offer a balance between storage capacity and energy efficiency, making them versatile for various hot water needs throughout the day. In countries with colder climates or seasonal winters, this segment provides reliable performance and consistent heating, even during high usage periods.

Regional Insights

China to Emerge as a Propelling Region

China water heater market held a robust share in 2024, driven by rapid urban development, increasing disposable income, and strong government support for energy-efficient appliances. Consumer preferences are shifting toward tankless and solar-powered models, influenced by environmental awareness and the government's push for greener technologies. Tier-1 and Tier-2 cities are witnessing high penetration of branded, technologically advanced units, while rural areas are gradually transitioning from traditional heating methods.

Major players in the Asia Pacific water heater market are FERROLI, Haier, Jaquar India, GE Appliances, State Industries, Vaillant, Ariston Holding, Racold, Linuo Ritter International, Rheem Manufacturing Company, Bosch Industriekessel, A. O. Smith, AQUAMAX AUSTRALIA, Rinnai Corporation, Stiebel Eltron, Viessmann Climate Solutions SE, Hubbell Heaters, and Bajaj.

To strengthen their presence in the Asia Pacific water heater market, companies are focusing on innovation, regional expansion, and consumer-centric design. Leading brands are investing in R&D to develop energy-efficient, compact, and smart-enabled models that cater to modern lifestyle needs. Strategic localization-adapting products to match regional voltage standards, water pressure variations, and space limitations-has become essential to appeal to diverse markets. In addition, companies are forming distribution partnerships, expanding after-sales service networks, and leveraging e-commerce channels to boost reach and visibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Technology trends

- 2.5 Application trends

- 2.6 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Price trend analysis, 2021-2034 (USD/Unit)

- 3.3.1 By capacity

- 3.3.2 By region

- 3.4 Import/Export analysis

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 China

- 4.2.2 Japan

- 4.2.3 South Korea

- 4.2.4 India

- 4.2.5 Australia

- 4.2.6 Indonesia

- 4.2.7 Malaysia

- 4.2.8 Singapore

- 4.2.9 Thailand

- 4.2.10 New Zealand

- 4.2.11 Philippines

- 4.2.12 Vietnam

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 <30 liters

- 6.3 30-100 liters

- 6.4 100-250 liters

- 6.5 250-400 liters

- 6.6 >400 liters

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 Residential

- 7.2.1 Shower

- 7.2.2 Dishwashing

- 7.2.3 Washing Machine

- 7.2.4 Others

- 7.3 Commercial

- 7.3.1 College/University

- 7.3.2 Office Buildings

- 7.3.3 Government Buildings

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Energy Source, 2021 - 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Electric

- 8.3 Gas

- 8.3.1 Natural Gas

- 8.3.2 LPG

Chapter 9 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 China

- 9.3 Japan

- 9.4 South Korea

- 9.5 India

- 9.6 Australia

- 9.7 Indonesia

- 9.8 Malaysia

- 9.9 Singapore

- 9.10 Thailand

- 9.11 New Zealand

- 9.12 Philippines

- 9.13 Vietnam

Chapter 10 Company Profiles

- 10.1 AQUAMAX AUSTRALIA

- 10.2 A. O. Smith

- 10.3 Ariston Holding

- 10.4 Bajaj Electricals Ltd

- 10.5 Bosch Industriekessel

- 10.6 Bradford White Corporation

- 10.7 FERROLI

- 10.8 GE Appliances

- 10.9 Haier

- 10.10 Havells India

- 10.11 Hubbell Heaters

- 10.12 Jaquar India

- 10.13 Linuo Ritter International

- 10.14 Racold

- 10.15 Rheem Manufacturing Company

- 10.16 Rinnai Corporation

- 10.17 State Industries

- 10.18 Stiebel Eltron

- 10.19 Viessmann Climate Solutions SE

- 10.20 Vaillant