PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822631

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822631

North America Flexible Foam Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

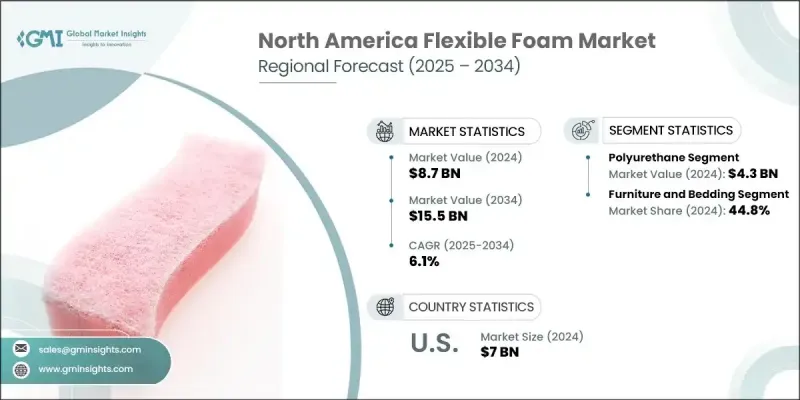

North America flexible foam market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 15.5 billion by 2034. This growth is driven by the increasing demand for comfort-centric products across various sectors. Consumers are gravitating towards ergonomic designs and high-quality materials, especially in furniture and bedding. As a result, the use of flexible foams such as memory foam, high-resilience foam, and latex foam is on the rise. This trend is further fueled by the growing preference for premium mattresses and pillows designed to enhance sleep quality and overall comfort.

The automotive sector is another key contributor to the expanding market for flexible foam in North America. Automakers are increasingly adopting lightweight materials like flexible foams to improve fuel efficiency and meet stringent emissions regulations. These foams are extensively used in vehicle interiors, including seats, armrests, and headrests, to provide comfort while reducing weight. The need for better insulation and soundproofing within vehicles also drives the use of flexible foams in interior panels and other components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 Billion |

| Forecast Value | $15.5 Billion |

| CAGR | 6.1% |

E-commerce growth has also boosted the demand for protective packaging solutions as online retailers prioritize safe and secure shipping. Flexible foams, particularly polyurethane (PU) and polyethylene (PE) foams are commonly used for cushioning fragile goods and protecting them from damage during transit. This trend is especially prevalent in the electronics and consumer goods industries.

Polyurethane foam, which generated approximately USD 4.1 billion in revenue in 2023, is expected to grow at a CAGR of 6.1% through 2032. Known for its versatility and flexibility, polyurethane foam is widely used in custom packaging, furniture, and automotive applications. Its ability to be cut, shaped, and glued makes it a popular choice across various industries. Additionally, its availability in different densities, colors, and fire-retardant options adds to its appeal.

In contrast, polyethylene foam is valued for its resilience and ability to withstand compression, making it ideal for cushioning heavy and delicate items. Its closed-cell structure resists moisture and chemicals, ensuring durability and preventing mold growth. The material's lightweight and shock-absorbing properties make it a preferred choice for packaging applications.

The U.S. market, which surpassed USD 6.7 billion in 2023, is expected to maintain steady growth due to increasing demand in the furniture, automotive, and e-commerce sectors. The shift towards sustainable and recyclable foams is also gaining momentum, driven by consumer and regulatory pressures for eco-friendly solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 North America

- 1.3.1.1 U.S.

- 1.3.1 North America

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Country trends

- 2.2.3 Foam type trends

- 2.2.4 Density type trends

- 2.2.5 Thickness trends

- 2.2.6 Application trends

- 2.2.7 End use trends

- 2.2.8 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in the furniture and bedding sectors

- 3.2.1.2 Rapid expansion in e-commerce and packaging

- 3.2.1.3 Surge in demand from the automotive sector

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Raw material price fluctuations

- 3.2.2.2 Competition of substitute materials

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of bio based flexible foams

- 3.2.3.2 Expansion in packaging applications driven by e-commerce

- 3.2.3.3 Growth in automotive use for lightweight & insulative interiors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS Code- 3909.50)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Foam Type, 2021-2034 (USD Billion) (Thousand Square Meters)

- 5.1 Key trends

- 5.2 Polyethylene

- 5.3 Polyurethane

- 5.4 Polystyrene

- 5.5 Polyvinyl chloride

- 5.6 Ethylene vinyl acetate

- 5.7 Others (melamine, neoprene etc.)

Chapter 6 Market Estimates & Forecast, By Density, 2021-2034 (USD Billion) (Thousand Square Meters)

- 6.1 Key trends

- 6.2 Low density foam

- 6.3 Medium density foam

- 6.4 High density foam

Chapter 7 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Billion) (Thousand Square Meters)

- 7.1 Key trends

- 7.2 Thin panels (below 8 mm)

- 7.3 Medium panels (between 8-18 mm)

- 7.4 Thick panels (more than 18 mm)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Square Meters)

- 8.1 Key trends

- 8.2 Furniture and bedding

- 8.3 Automotive

- 8.4 Packaging

- 8.5 Textile & fiber

- 8.6 Construction and insulation

- 8.7 Others (health and sanitary products etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Square Meters)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021-2034, (USD Billion) (Thousand Square Meters)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Country, 2021-2034, (USD Billion) (Thousand Square Meters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

Chapter 12 Company Profiles

- 12.1 American Excelsior

- 12.2 BASF

- 12.3 Covestro

- 12.4 Dow

- 12.5 Foam Creations

- 12.6 Foamco

- 12.7 General Plastics

- 12.8 Heubach

- 12.9 Huntsman

- 12.10 Poly Labs

- 12.11 Recticel

- 12.12 Rogers Foam

- 12.13 Saint-Gobain

- 12.14 VPC Group

- 12.15 Wisconsin Foam Products