PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822644

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822644

Hospital Information System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

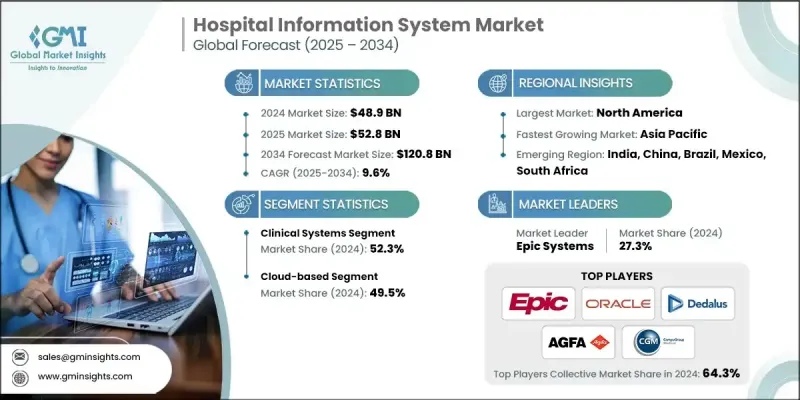

The global hospital information system (HIS) market was valued at USD 48.9 billion in 2024 and is projected to grow from USD 52.8 billion in 2025 to USD 120.8 billion by 2034, expanding at a CAGR of 9.6%, according to the latest report published by Global Market Insights, Inc.

Growing healthcare digitization, increasing requirements for interoperable solutions, and mounting need for optimized clinical workflows are driving the adoption of HIS around the world. Hospitals are increasingly opting for integrated software systems to handle patient records, clinical information, medical billing, and regulatory adherence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.9 Billion |

| Forecast Value | $120.8 Billion |

| CAGR | 9.6% |

Key Drivers:

1. Requirement for integrated clinical and administrative data management: Hospitals are implementing HIS in order to integrate disparate workflows across departments.

2. Increased burden of chronic diseases and aging population: Effective patient tracking and optimized treatment require advanced health information platforms.

3. Cloud and AI-based systems' adoption: Cloud adoption is becoming popular with lower IT infrastructure expense, flexibility, and remote access.

4. Compliance and data security: International and regional regulations are forcing hospitals to implement compliant, secure, and auditable systems.

Key Players:

- Epic dominates the hospital information system market with a 27.3% market share in 2024.

- Oracle is harnessing its purchase of Cerner's established HIS/EHR position together with its respective strengths in cloud computing, data analytics, and AI.

- Dedalus is a European market leader with a strong focus on interoperability and open digital health ecosystems.

Key Challenges:

- Interoperability constraints: HIS integration with legacy systems, labs, imaging, and third-party platforms continues to be challenging.

- High training and implementation expenses: Initial investments in customization, migration, and employee onboarding can be high.

- Security and data privacy threats: Increasing fears of health data breaches and ransomware are driving increased compliance and secure cloud deployments.

1. By System Component - Clinical Systems on the Rise

Clinical system components made up the largest share of the HIS market at approximately 66% in 2024. The clinical system components represented by EMR, CPOE, LIS, and RIS are the hard-working foundations of daily hospital operations.

2. By Deployment - Cloud-Based Solutions on the Rise

Cloud-based HIS deployability is accelerating due to the increased scalability, lower capital expenditures to support the infrastructure, and increased access to remote applications. The hospitals in the Regions are deploying cloud solutions to improve operations, collaboration, and continuum of care.

3. By Region - North America Remains Strong

North America continued to have the largest market share in 2024, maintaining their lead with strong government support, very high levels of digital literacy, and strong uptake in both public and private hospitals. North America maintains its dominance in the hospital information system market with strong healthcare infrastructure, prevalent adoption of EHR, government regulations like HIPAA and HITECH, and increasing presence of cloud-based health IT solutions. American hospitals and health networks are quickly integrating clinical decision support, population health analytics, and remote care modules into their core hospital systems.

Some of the major players in the hospital information system market are AGFA Healthcare, CAMBIO, ChipSoft, CompuGroup Medical, Dedalus, Docaposte, Engineering Ingegneria Informatica, Epic Systems, InterSystems, Meierhofer AG, NextGen, Nexus, Oracle, SECTRA, and Veradigm.

Key HIS players in the market are employing cloud integration, expansions into other geographies, AI-enabled modules, and collaboration agreements with healthcare leaders to create a competitive edge.;Epic Systems continues to lead the North American market with long-term deals with top-performing health systems. Dedalus and InterSystems are growing their cloud platforms and adding interoperability features. CompuGroup Medical and AGFA Healthcare are integrating decision support capabilities into their HIS platforms. Oracle is incorporating its integrated cloud and data analytics capabilities after acquiring Cerner to ultimately produce more valuable modules for EHR and population health.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 System component trends

- 2.2.3 Deployment trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of digital health solutions

- 3.2.1.2 Government initiatives and regulations

- 3.2.1.3 Rising expenditure on healthcare

- 3.2.1.4 Surging demand for integrated healthcare systems

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation and maintenance costs

- 3.2.2.2 Data security and privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing government healthcare digitization initiatives

- 3.2.3.2 Growing demand for analytics and business intelligence tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behaviour and trends

- 3.8 No. of hospitals, by Region

- 3.9 Overview of hospital digital ecosystem

- 3.9.1 Electronic medical records (EMR)/electronic health records (EHR)

- 3.9.2 Telemedicine and remote patient monitoring

- 3.9.3 Cybersecurity and data protection

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Integration of AI in EMR

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America & MEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By System Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clinical systems

- 5.2.1 Electronic medical records (EMR)/electronic health records (EHR)

- 5.2.2 Radiology information system (RIS)

- 5.2.3 Pharmacy information system

- 5.2.4 Laboratory information system (LIS)

- 5.2.5 Other clinical systems

- 5.3 Administrative/back-office systems

- 5.3.1 Finance and billing

- 5.3.2 Supply chain management

- 5.3.3 Facilities management/Human resources

- 5.4 Operational systems

- 5.4.1 Admission, discharge, and transfer (ADT)/bed management systems (BMS)

- 5.4.2 Operational standards support/scheduling systems

- 5.5 Patient-facing technologies

- 5.5.1 Mobile health applications

- 5.5.2 Patient portals

- 5.6 Integration layer

- 5.6.1 Interface engines/APIs

- 5.6.2 Health information exchange (HIE)

- 5.7 Data and security

- 5.7.1 Clinical data repository

- 5.7.2 Identity and access management (IAM)

- 5.7.3 General data protection regulation (GDPR)

Chapter 6 Market Estimates and Forecast, By Deployment, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 Web-based

- 6.4 On-premise

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AGFA Healthcare

- 8.2 CAMBIO

- 8.3 ChipSoft

- 8.4 CompuGroup Medical

- 8.5 Dedalus

- 8.6 Docaposte

- 8.7 Engineering Ingegneria Informatica

- 8.8 Epic Systems

- 8.9 InterSystems

- 8.10 Meierhofer AG

- 8.11 NextGen

- 8.12 Nexus

- 8.13 Oracle

- 8.14 SECTRA

- 8.15 Veradigm