PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822654

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822654

Gasoline Direct Injection (GDI) System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

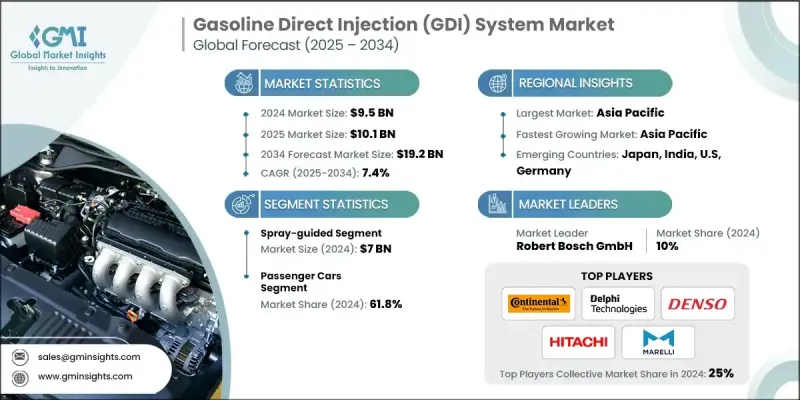

The Global Gasoline Direct Injection (GDI) System Market was valued at USD 9.5 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 19.2 billion by 2034 driven by continuous innovations in GDI technology and rising consumer preference for high-performance vehicles. Advancements in GDI systems, such as enhanced fuel injectors and improved combustion control, are driving greater engine efficiency and performance. Concurrently, consumers are increasingly prioritizing vehicles that deliver superior power, responsiveness, and fuel economy. This heightened demand for high-performance, efficient vehicles is propelling the adoption of GDI systems. In January 2024, GB Remanufacturing, Inc. bolstered its Gasoline Direct Injection program by introducing 17 new parts, including seal kits, multi-packs, injectors, and a premium seal replacement tool kit. This move underscores the industry's growing emphasis on maintaining and upgrading GDI systems.

The gasoline direct injection system industry share is segmented by component, application, and region. By 2032, the fuel injectors segment is poised for significant growth, thanks to their pivotal role in enhancing engine performance and fuel efficiency. Fuel injectors ensure precise fuel delivery into the combustion chamber, leading to better combustion control and minimized emissions. With automakers increasingly turning to GDI technology to adhere to stringent fuel efficiency and emission standards, the demand for advanced fuel injectors is on the rise. The commercial vehicle segment is set to offer substantial gains to the GDI system industry, driven by the escalating demand for fuel-efficient, high-performance engines in heavy-duty applications. GDI systems, known for their enhanced fuel economy and lower emissions, are perfectly suited for commercial vehicles that need robust engines while adhering to strict environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.5 Billion |

| Forecast Value | $19.2 Billion |

| CAGR | 7.4% |

As global logistics and transportation sectors expand, the push for advanced engine technologies in commercial vehicles amplifies the adoption of GDI systems. Through 2032, the Asia Pacific gasoline direct injection system market is expected to maintain a significant share, fueled by the region's thriving automotive sector and a growing appetite for fuel-efficient vehicles. The growth is driven by the presence of major automotive manufacturers and the swift adoption of cutting-edge engine technologies. Additionally, government initiatives championing fuel efficiency and emissions reduction further catalyze the uptake of GDI systems. With its robust manufacturing foundation and rapid technological advancements, Asia Pacific stands as a pivotal player in the global gasoline direct injection (GDI) system arena.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Component

- 2.2.4 Vehicle type

- 2.2.5 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of energy-efficient and high-performance vehicles

- 3.2.1.2 Stringent emission regulations

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Carbon buildup concerns

- 3.2.2.2 Emission concerns

- 3.2.3 Opportunities

- 3.2.3.1 Integration of advanced control systems

- 3.2.3.2 Compatibility with alternative fuels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Wall-guided

- 5.3 Spray-guided

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Fuel pump

- 6.3 Fuel injector

- 6.4 Electronic control unit

- 6.5 Fuel rail

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Vehicle Type, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Conventional gasoline-powered vehicles

- 7.3 Hybrid vehicles

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.3 Light commercial vehicles

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aisin Seiki Co Ltd

- 10.2 BorgWarner Inc

- 10.3 Continental AG

- 10.4 Delphi Technologies

- 10.5 Denso

- 10.6 Hitachi

- 10.7 Infineon Technologies AG

- 10.8 Keihin Corporation

- 10.9 Marelli

- 10.10 Park Ohio Holdings Corp

- 10.11 PHINIA

- 10.12 Robert Bosch GmbH

- 10.13 Stanadyne LLC

- 10.14 Standard Ignition

- 10.15 TI Fluid Systems