PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822660

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822660

Algae Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

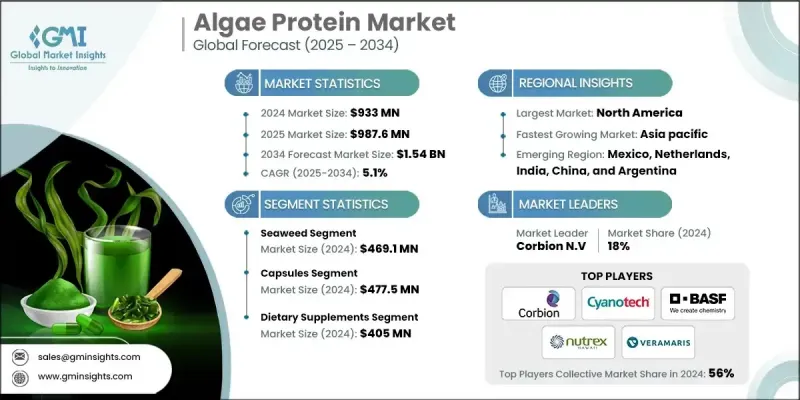

The global algae protein market was valued at USD 933 million in 2024 and is projected to grow from USD 987.6 million in 2025 to USD 1.54 billion by 2034, expanding at a CAGR of 5.1%, according to the latest report published by Global Market Insights, Inc. The global movement toward plant-based diets, sustainably sourced products, and the functional health benefits of algae-based products are the key forces defining the direction of the market.

Seaweed and microalgal protein-especially from spirulina and chlorella-are increasingly commonplace in food and beverage, dietary supplements, and nutraceuticals. It has one of the highest bioavailable proteins, is nutritionally complete with essential amino acids, and benefits immunity, energy, and muscle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $933 Million |

| Forecast Value | $1.54 Billion |

| CAGR | 5.1% |

Key Drivers:

- The plant-based and vegan way of life is becoming increasingly common: Individuals are actively seeking sustainable, cruelty-free, and whole protein foods.

- The real-world benefits of algae protein: Algae ingredients support energy, metabolism, and immune system function and have anti-inflammatory effects.

- Cultured and very minimal space use: Algae needs fewer natural resources to produce, which aligns with global sustainability initiatives.

- Increased uses in food & beverage and dietary supplement applications: Algae protein has substantially increased uses in the production of capsules, powders, and fortified foods, especially in applications for sports and nutritional health.

Key Players:

The algae protein market is dominated by the top 7 players: Corbion N.V, Cyanotech Corporation, BASF SE, Nutrex Hawaii Inc., Veramaris, ENERGYbits Inc. and Roquette Freres, which together comprise approximately 56% of the market share in 2024, with the following key challenges:

Key Challenges:

- Low consumer awareness in certain geography: Raising consumer awareness of the health and sustainability benefits of algae is a key challenge to overcome.

- Flavor and texture: Certain algae proteins have earthy or oceanic flavors that are sometimes unsuitable for certain food applications.

- Geographical regulatory complexities: Algae is classified as a novel food in some geographies, and this is holding it up in the market.

1. By Source - Seaweed Dominates the Market

Seaweed proteins lead the algae protein market in 2024 because of their natural prevalence, sustainable production and multiple applications in food and nutraceutical sectors. Both red and brown seaweeds are particularly rich in protein and bioactive components that assist in metabolic health.

2. By Dosage Form - Capsules Maintain Strong Share

Capsules became the favored format in the algae protein supplement market. Capsules provide convenience, improved shelf life, and precise dosing-drivers of consumer trust and adherence to wellness regimens.

3. By Application - Dietary Supplements Lead

Dietary supplements held the largest application share in 2024. The continual introduction of algae protein into the nutrition space as a natural product and concentrated nutrients has opened even more applications in multivitamins, immunity boosters and sports nutrition.;

4. By Region - North America Topped the Market;

The North America region remains the leading regional market for algae protein because of the growing health-conscious consumer segment, the rising demand for clean-label and sustainable products, and the growing presence of algae-based supplement brands in retail and e-commerce.

Key players in the algae protein industry are AlgalR NutraPharms Pvt Ltd, BASF SE, Corbion, Cyanotech Corporation, ENERGYbits Inc, Far East Bio-Tec Co. Ltd, Fuqing King Dnarmsa Spirulina Co., Ltd, Heliae Development LLC, JUNE Spirulina, Nutrex Hawaii Inc, Roquette Freres, and Veramaris.

Incumbent players are investing in R&D, geographic expansion, and vertical integration to increase algae culture, extraction technologies, and product quality. Roquette Freres and Veramaris are emphasizing seaweed cultivation based on sustainability and protein quality extraction for supplement-grade usage. ENERGYbits Inc. and Cyanotech Corporation are developing capsule product offerings for athletes and health enthusiasts. Collaborations with food tech ventures and the inclusion of algae in ready-to-consume formats are further driving market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Dosage Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing global demand for sustainable and eco-friendly protein sources.

- 3.2.1.2 Rising prevalence of veganism and plant-based diets.

- 3.2.1.3 Government initiatives to boost algae products production.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and scalability limitations in algae protein cultivation.

- 3.2.2.2 Low consumer awareness and limited familiarity with algae-based nutrition.

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for sustainable and plant-based protein alternatives.

- 3.2.3.2 Advancements in biotechnology and cultivation techniques.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Seaweed

- 5.2.1 Brown algae

- 5.2.2 Green algae

- 5.2.3 Red algae

- 5.3 Micro algae

- 5.3.1 Spirulina (blue-green algae)

- 5.3.2 Chlorella (green algae)

- 5.3.3 Others

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Capsules

- 6.3 Liquid

- 6.4 Powder

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dietary supplements

- 7.3 Food & beverage

- 7.3.1 Bakery & confectionery

- 7.3.2 Protein drinks

- 7.3.3 Breakfast cereals

- 7.3.4 Snacks

- 7.4 Animal feed

- 7.5 Cosmetics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AlgalR NutraPharms Pvt Ltd

- 9.2 BASF SE

- 9.3 Corbion

- 9.4 Cyanotech Corporation

- 9.5 ENERGYbits Inc

- 9.6 Far East Bio-Tec Co. Ltd

- 9.7 Fuqing King Dnarmsa Spirulina Co., Ltd

- 9.8 Heliae Development LLC

- 9.9 JUNE Spirulina

- 9.10 Nutrex Hawaii Inc

- 9.11 Roquette Freres

- 9.12 Veramaris