PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833400

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833400

Industrial Display Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

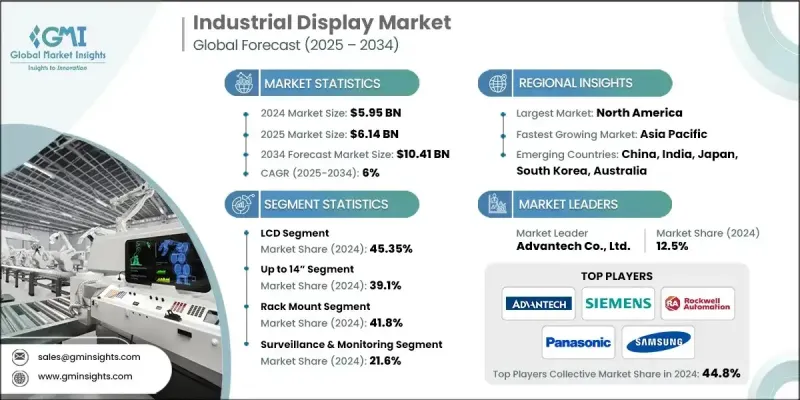

The Global Industrial Display Market was valued at USD 5.95 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 10.41 billion by 2034.

The growing reliance on automation and digital control across manufacturing, oil & gas, automotive, and energy industries is boosting demand for industrial displays as essential components of HMI systems. These interfaces help operators monitor, control, and troubleshoot equipment in real time, improving efficiency and safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.95 billion |

| Forecast Value | $10.41 billion |

| CAGR | 6% |

Rising Demand for LCD

The LCD segment held a significant share in 2024, owing to its cost-efficiency, visual clarity, and adaptability across a wide range of industrial environments. LCD technology remains a popular choice due to its availability in various sizes, energy efficiency, and compatibility with both legacy and modern systems. Manufacturers are enhancing their LCD offerings with features such as touch capability, sunlight readability, and rugged enclosures to support mission-critical applications across harsh operating conditions.

Increasing Shift towards 14" inches Display

The displays up to 14 inches segment held a sustainable share in 2024, fueled by their compact form factor and suitability for space-constrained installations. These smaller screens are increasingly used in embedded systems, where clarity, reliability, and low power consumption are essential. Companies in this segment are focusing on high-resolution panels, edge-to-edge glass designs, and fanless integration to appeal to OEMs looking for sleek and durable display solutions.

Rack Mount to Gain Traction

The rack mount segment generated sizeable growth in 2024, backed by server rooms, automation control centers, and military applications. The growth is fueled by the need for space-efficient displays that can be securely mounted within standardized enclosures. These displays are favored for their robust design, simplified maintenance, and ease of integration with rack-based systems.

North America to Emerge as a Propelling Region

North America industrial display market held a substantial share in 2024. The region's strong base of industrial automation, aerospace, energy, and manufacturing sectors drives consistent demand for reliable and high-performance display solutions. Growth is further supported by increased adoption of Industry 4.0 technologies and rising investments in smart infrastructure. In addition to the U.S., Canada also plays a key role in expanding applications in transportation and mining.

Major players in the industrial display market are Schneider Electric SE, Winmate Inc., BOE Technology Group Co., Ltd., Kontron AG, Rockwell Automation, Inc., LG Display Co., Ltd., Pepperl+Fuchs SE, EIZO Corporation, Panasonic Holdings Corporation, Beijer Electronics Group AB, Siemens AG, Sparton Corporation, Samsung Electronics Co., Ltd., Mitsubishi Electric Corporation, Advantech Co., Ltd., AU Optronics Corporation.

To solidify their foothold in the industrial display market, companies are prioritizing product customization, modular design, and software integration. A major focus is on developing ruggedized displays that can withstand vibration, temperature extremes, and contamination, making them ideal for harsh industrial settings. Firms are also investing in touchscreen innovations, multi-language interfaces, and remote display monitoring to enhance user experience and reduce maintenance needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Display type trends

- 2.2.3 Panel size trends

- 2.2.4 Mounting type trends

- 2.2.5 Application trends

- 2.2.6 Verticals trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspective: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising automation in manufacturing and industrial processes

- 3.2.1.2 Cost-effectiveness and durability in industrial operations

- 3.2.1.3 Rapid urbanization and infrastructure development

- 3.2.1.4 Expansion of smart factories and IIOT deployments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of advanced display technologies

- 3.2.2.2 Compatibility and integration issues with legacy systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Display Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 LCD (Liquid Crystal Display)

- 5.3 LED (Light Emitting Diode)

- 5.4 OLED (Organic LED)

- 5.5 E-paper displays

- 5.6 CRT (Cathode Ray Tube)

Chapter 6 Market Estimates and Forecast, By Panel Size, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Up to 14”

- 6.3 14” - 21”

- 6.4 21” - 40”

- 6.5 Above 40”

Chapter 7 Market Estimates and Forecast, By Mounting Type 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Rack mount

- 7.3 Panel mount

- 7.4 Open frame

- 7.5 Wall mount

- 7.6 VESA mount

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 HMI (Human-Machine Interface)

- 8.3 Digital signage

- 8.4 Surveillance & monitoring

- 8.5 Interactive kiosks

- 8.6 Control rooms

- 8.7 Industrial automation

- 8.8 Medical equipment displays

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Verticals, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.2.1 Automotive

- 9.2.2 Electronics & semiconductors

- 9.2.3 Machinery & equipment

- 9.2.4 Textiles

- 9.2.5 Others

- 9.3 Oil & gas

- 9.4 Energy & power

- 9.5 Mining & metals

- 9.6 Transportation & logistics (industrial operations)

- 9.7 Food & beverage processing

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Advantech Co., Ltd.

- 11.1.2 AU Optronics Corporation

- 11.1.3 BOE Technology Group Co., Ltd.

- 11.1.4 Dell Technologies Inc.

- 11.1.5 EIZO Corporation

- 11.1.6 Hewlett-Packard Enterprise (HPE)

- 11.1.7 Kontron AG

- 11.1.8 Kyocera Corporation

- 11.1.9 LG Display Co., Ltd.

- 11.1.10 Mitsubishi Electric Corporation

- 11.1.11 Panasonic Holdings Corporation

- 11.1.12 Pepperl+Fuchs SE

- 11.1.13 Rockwell Automation, Inc.

- 11.1.14 Samsung Electronics Co., Ltd.

- 11.1.15 Schneider Electric SE

- 11.1.16 Siemens AG

- 11.2 Regional Players

- 11.2.1 Axiomtek Co., Ltd.

- 11.2.2 Beijer Electronics Group AB

- 11.2.3 Crystal Group, Inc.

- 11.2.4 Hope Industrial Systems, Inc.

- 11.2.5 IBASE Technology Inc.

- 11.2.6 Sparton Corporation

- 11.2.7 Winmate Inc.

- 11.3 Emerging Players

- 11.3.1 Litemax Electronics Inc.

- 11.3.2 Touch International, Inc.