PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833401

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833401

North America Molecular Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

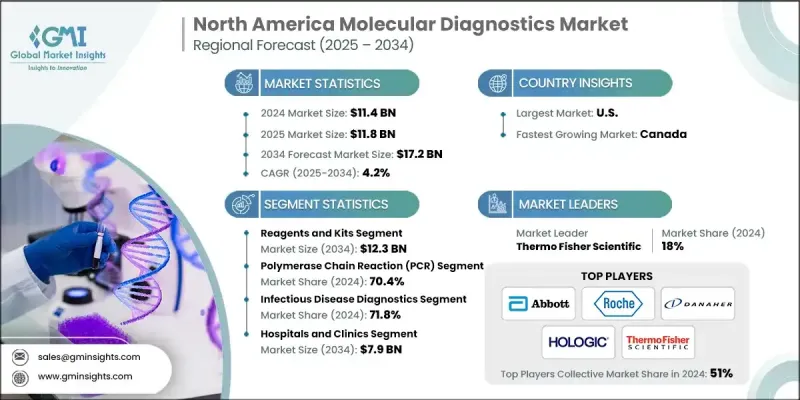

North America Molecular Diagnostics Market was valued at USD 11.4 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 17.2 billion by 2034.

This growth reflects a consistent rise in demand driven by the increasing prevalence of chronic and infectious diseases, rising advancements in diagnostic technologies, and the expanding use of point-of-care and at-home testing across the region. The rising elderly population significantly contributes to market expansion, as individuals over 65 are more susceptible to diseases requiring frequent testing. Molecular diagnostics is a highly accurate technique used to identify diseases by analyzing biological markers like DNA, RNA, and proteins. Its precision and speed in detecting conditions such as cancer, infectious diseases, and genetic disorders are elevating its demand. Ongoing innovations particularly in automation, device connectivity, and test miniaturization are making diagnostic tools more accessible, affordable, and portable. These advancements enable quicker and more reliable testing in decentralized settings, which continues to transform how healthcare systems respond to patient care and disease management throughout North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.4 Billion |

| Forecast Value | $17.2 Billion |

| CAGR | 4.2% |

The reagents and kits segment generated USD 8.2 billion in 2024 and is projected to hit USD 12.3 billion by 2034 at a CAGR of 4.1%. This segment comprises essential components like assay kits, probes, primers, and chemical reagents, all of which are critical for conducting accurate diagnostic tests. These materials are foundational to a wide array of molecular diagnostic procedures, allowing for the detection and quantification of disease-specific biomarkers. The precision offered by these products ensures consistent results, reducing errors and minimizing diagnostic uncertainty. Their growing demand is further supported by the rising need for reliable and repeatable test outcomes in both clinical and point-of-care environments.

The polymerase chain reaction (PCR) segment held a 70.4% share in 2024. The dominance of this segment can be attributed to PCR's unmatched ability to detect even minuscule amounts of genetic material with high speed and accuracy. PCR remains the gold standard in diagnosing a broad spectrum of conditions, from viral infections and hereditary diseases to oncology-related applications. Its wide applicability, reliability, and ongoing innovation keep it at the forefront of molecular testing platforms.

United States Molecular Diagnostics Market held a 91.1% share in 2024. Its dominance is closely tied to the rising burden of infectious diseases such as tuberculosis, HIV, influenza, hepatitis B and C, and other viral infections. As these health challenges persist, U.S. healthcare systems are increasingly investing in advanced diagnostic technologies. Molecular diagnostic tools are pivotal in enabling clinicians to deliver faster diagnoses, personalize treatment, and closely monitor disease progression.

Key companies shaping the North America Molecular Diagnostics Market include Qiagen, Thermo Fisher Scientific, Agilent Technologies, QuidelOrtho Corporation, Biocartis, Abbott Laboratories, Illumina, F. Hoffmann-La Roche, Siemens Healthineers, Hologic, Becton, Dickinson, and Company, Sysmex Corporation, Bio-Rad Laboratories, Biomerieux, and Danaher Corporation. Leading players in the North America molecular diagnostics market are leveraging a combination of innovation, partnerships, and product portfolio expansion to reinforce their presence. Companies are heavily investing in R&D to develop advanced, high-throughput diagnostic platforms that are faster, more portable, and cost-effective. Many firms are also forming strategic collaborations with diagnostic laboratories and healthcare providers to accelerate test deployment and expand regional access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product type trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of infectious diseases

- 3.2.1.2 Technological advancements of molecular diagnostics kits and instruments

- 3.2.1.3 Expansion of point of care and home-based testing across North America

- 3.2.1.4 Increasing geriatric population base

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of molecular diagnostic tests

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with telehealth and remote diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Patent analysis

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Reagents and kits

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polymerase chain reaction (PCR)

- 6.3 Hybridization

- 6.4 Sequencing

- 6.5 Isothermal nucleic acid amplification technology (INAAT)

- 6.6 Microarrays

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infectious disease diagnostics

- 7.2.1 COVID-19

- 7.2.2 Flu

- 7.2.3 Respiratory syncytial virus (RSV)

- 7.2.4 Tuberculosis

- 7.2.5 CT/NG

- 7.2.6 HIV

- 7.2.7 Hepatitis C

- 7.2.8 Hepatitis B

- 7.2.9 Other infectious disease diagnostics

- 7.3 Genetic disease testing

- 7.4 Oncology testing

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Diagnostic laboratories

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson, and Company

- 10.4 Biocartis

- 10.5 Biomerieux

- 10.6 Bio-Rad Laboratories

- 10.7 Danaher Corporation

- 10.8 F. Hoffmann-La Roche

- 10.9 Hologic

- 10.10 Illumina

- 10.11 Qiagen

- 10.12 QuidelOrtho Corporation

- 10.13 Siemens Healthineers

- 10.14 Sysmex Corporation

- 10.15 Thermo Fisher Scientific