PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833408

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833408

Aviation Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

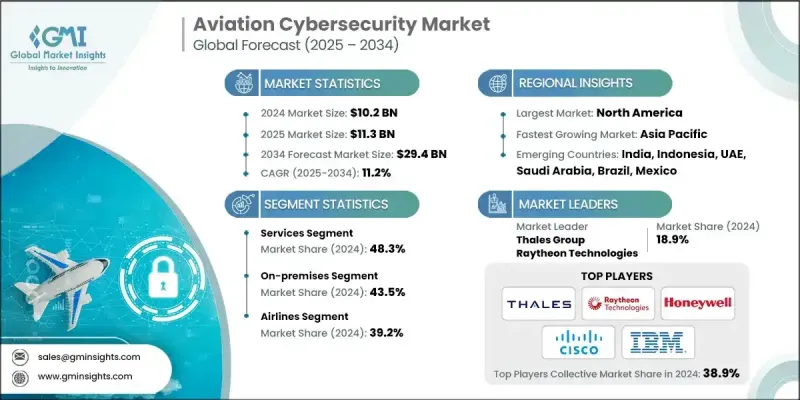

The Global Aviation Cybersecurity Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 29.4 billion by 2034.

The growth is driven by the growing cyber threats as its systems become more interconnected. Regulatory bodies demand strict security protocols; aircraft systems, airports, and airline operations are increasingly relying on connected technologies that expose new vulnerabilities. Ransomware and malware incidents grow dramatically, pushing operators to adopt sophisticated cybersecurity tools to protect data, operations, and passenger safety. As commercial aviation and air traffic expand, complexity rises, creating more entry points for attackers. Regulatory compliance from domestic civil aviation authorities to international organizations requires encryption, intrusion detection, identity management, and continuous monitoring. Service providers and solution developers must evolve to meet both safety and compliance demands in a fast-changing threat landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 billion |

| Forecast Value | $29.4 billion |

| CAGR | 11.2% |

The services segment held a 48.3% share in 2024, dominating due to the rising need for expert-driven solutions amid the growing complexity of threats. Airlines, airports, aircraft OEMs, and aviation service providers increasingly rely on third-party vendors to handle managed security services, including 24/7 threat monitoring, incident response, compliance audits, risk assessments, and cybersecurity training. With aviation operations becoming more data-intensive and interconnected, outsourcing these services allows organizations to access advanced threat intelligence, reduce internal overhead, and stay aligned with rapidly evolving global regulations.

The on-premises segment held a 43.5% share in 2024 as many aviation players prefer to retain full control over security operations and critical systems. For large airports, air navigation service providers, and aerospace OEMs, managing infrastructure internally helps ensure end-to-end visibility, custom configuration, and better responsiveness to sector-specific compliance requirements. These entities often host proprietary systems, legacy equipment, and sensitive passenger or national security data that must be protected under strict confidentiality policies.

U.S. Aviation Cybersecurity Market was valued at USD 3.5 billion in 2024, underpinned by the presence of over a thousand commercial airports, stringent cybersecurity mandates, and the expanding use of connected aircraft technologies. Federal regulations and industry-specific compliance frameworks set by authorities such as the FAA, TSA, and CISA mandate rigorous protection of communication networks, air traffic management systems, and passenger information databases.

Major firms in the Aviation Cybersecurity Market, such as IBM Corporation, Honeywell International Inc., Airbus, Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, Thales Group, Leidos, and Cisco Systems, play significant roles in developing, deploying, and maintaining secure architecture across the aviation sector globally. Companies in the Aviation Cybersecurity Market are pursuing several key strategies. They emphasize investment in AI-powered threat detection, anomaly mining, and predictive analytics to stay ahead of cyberattacks. They forge partnerships with regulatory bodies and aviation organizations to ensure compliance frameworks are built into their solutions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Solution trends

- 2.2.2 Security type trends

- 2.2.3 Deployment mode trends

- 2.2.4 End Use trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of connected aircraft systems

- 3.2.1.2 Rising cyber threats targeting aviation

- 3.2.1.3 Stringent regulatory compliance requirements

- 3.2.1.4 Growth in commercial aviation and air traffic

- 3.2.1.5 Integration of AI and IoT in aviation operations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cybersecurity solutions

- 3.2.2.2 Lack of skilled cybersecurity professionals in aviation

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of cybersecurity services in emerging markets

- 3.2.3.2 Development of AI-driven cybersecurity solutions

- 3.2.3.3 Demand for cloud-based aviation cybersecurity platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on Industry Growth

- 3.14.2 Defense Budgets by Country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Solution, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Security Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Network security

- 6.2.1 Firewalls

- 6.2.2 Intrusion Detection/Prevention Systems (IDS/IPS)

- 6.2.3 Virtual Private Networks (VPNs)

- 6.2.4 Others

- 6.3 Application & cloud security

- 6.3.1 Web & mobile application security

- 6.3.2 Cloud security platforms

- 6.3.3 Secure software development

- 6.3.4 Others

- 6.4 Endpoint & identity security

- 6.4.1 Endpoint detection & response (EDR/XDR)

- 6.4.2 Anti-malware / Anti-ransomware Tools

- 6.4.3 Identity & access management

- 6.4.4 Others

- 6.5 Data Security & encryption

- 6.5.1 Data loss prevention (DLP)

- 6.5.2 Database security

- 6.5.3 Encryption & key management

- 6.5.4 Others

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Hybrid

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Airlines

- 8.3 Airports & ground operators

- 8.4 Air traffic control authorities

- 8.5 Aircraft manufacturers & OEMs

- 8.6 MRO providers

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Airbus

- 10.1.2 BAE Systems

- 10.1.3 Honeywell International Inc.

- 10.1.4 IBM Corporation

- 10.1.5 Thales Group

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Cisco Systems

- 10.2.1.2 Lockheed Martin

- 10.2.1.3 Northrop Grumman

- 10.2.1.4 Raytheon Technologies

- 10.2.1.5 Leidos

- 10.2.1.6 Optiv Security

- 10.2.1.7 Aviation SecOps

- 10.2.2 Europe

- 10.2.2.1 Rohde & Schwarz

- 10.2.2.2 SITA

- 10.2.2.3 The Boeing Company

- 10.2.2.4 Cyviation

- 10.2.2.5 Darktrace

- 10.2.3 Asia Pacific

- 10.2.3.1 Wattlecorp Cybersecurity Labs LLP

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Darktrace

- 10.3.2 Dionach