PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833411

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833411

Conjugate Vaccine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

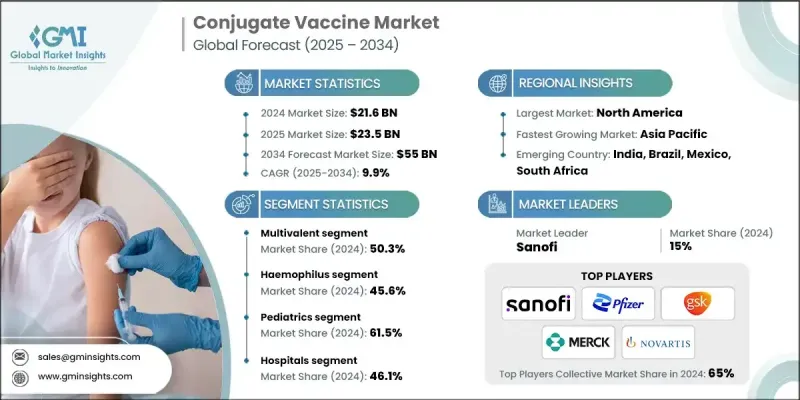

The Global Conjugate Vaccine Market was valued at USD 21.6 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 55 billion by 2034.

As the incidence of these diseases persists, the need for effective, preventive measures has become more urgent. Conjugate vaccines have emerged as a powerful solution, offering enhanced immunogenicity and longer-lasting protection compared to traditional polysaccharide vaccines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.6 Billion |

| Forecast Value | $55 Billion |

| CAGR | 9.9% |

Increasing Adoption Multivalent Sector

The multivalent segment is gaining significant momentum in the conjugate vaccine market due to its ability to target multiple strains of pathogens within a single formulation. This approach enhances broad-spectrum immunity, which is especially valuable in regions where multiple serotypes circulate simultaneously. By reducing the number of injections required, multivalent vaccines improve patient compliance and streamline immunization schedules. Manufacturers are actively investing in R&D to develop next-generation multivalent conjugate vaccines that provide stronger protection with fewer doses. As the healthcare industry increasingly emphasizes efficiency and coverage, this segment is expected to drive a substantial portion of future market growth, particularly in pediatric and public health vaccination programs.

Rising Prevalence of Haemophilus

The Haemophilus segment held a significant share in 2024. Hib infection is a leading cause of bacterial meningitis and pneumonia in young children, and widespread immunization has dramatically reduced its incidence in many parts of the world. The effectiveness of Hib conjugate vaccines in triggering strong immune responses, even in infants, has made them a cornerstone of early childhood immunization programs. As countries work to eliminate vaccine-preventable diseases and expand immunization coverage, the demand for Hib conjugate vaccines remains steady.

Increasing Demand in Pediatrics

The pediatrics segment held a robust share in 2024, driven by the critical need to protect infants and young children from life-threatening bacterial infections during their most vulnerable years. National immunization schedules across the globe prioritize conjugate vaccines in early childhood due to their proven safety, immunogenicity, and ability to induce long-lasting immunity. The convenience of integrating conjugate vaccines into combination shots further boosts uptake among pediatric populations.

North America to Emerge as a Propelling Region

North America conjugate vaccine market generated substantial revenues in 2024, supported by advanced healthcare infrastructure, proactive immunization programs, and a high level of public health awareness. Regulatory support from agencies like the CDC and FDA ensures timely approval and inclusion of conjugate vaccines in routine immunization schedules. The presence of major pharmaceutical companies and continued investment in research fuel innovation and market competitiveness.

Major players in the conjugate vaccine market are Serum Institute of India, Merck, SK Bioscience, Pfizer, Bio-Med, Novartis, Taj Pharmaceuticals, GlaxoSmithKline, Sanofi, and Bharat Biotech.

To strengthen their presence in the conjugate vaccine market, companies are focusing on a multi-pronged strategy that includes expanding vaccine portfolios, improving manufacturing scalability, and entering strategic partnerships. Leading manufacturers are developing multivalent and combination vaccines to enhance disease coverage and streamline immunization programs. Investments in new delivery platforms, such as pre-filled syringes and single-dose vials, are being made to improve user convenience and reduce wastage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Indication

- 2.2.4 Age group

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of infectious diseases

- 3.2.1.2 Growing geriatric and paediatric populations

- 3.2.1.3 Enhanced clinical awareness and immunization guidelines

- 3.2.1.4 Expansion of digital health and telemedicine platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded and biologic therapies

- 3.2.2.2 Safety concerns and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand in emerging markets

- 3.2.3.2 Shift toward personalized and combination therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Technology and innovation landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Multivalent

- 5.3 Monovalent

- 5.4 Pentavalent

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pneumococcal

- 6.3 Haemophilus

- 6.4 Meningococcal

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Pediatric clinics

- 8.4 Public health agencies

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bharat Biotech

- 10.2 Bio-Med

- 10.3 GlaxoSmithKline

- 10.4 Merck

- 10.5 Novartis

- 10.6 Pfizer

- 10.7 Sanofi

- 10.8 Serum Institute of India

- 10.9 SK Bioscience

- 10.10 Taj Pharmaceuticals