PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833413

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833413

Combat Drones Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

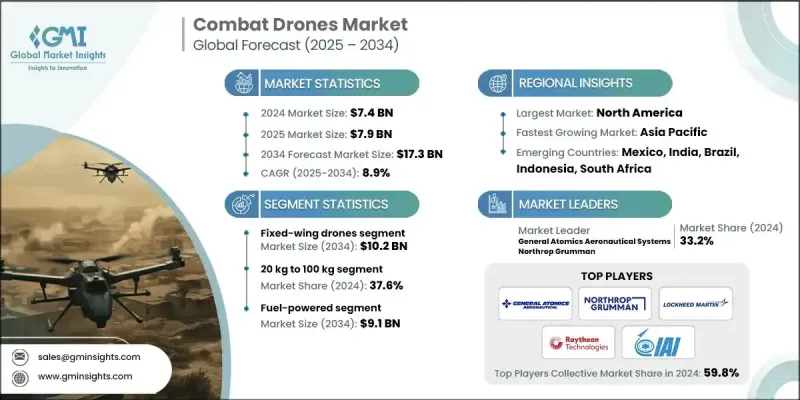

The Global Combat Drones Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 17.3 billion by 2034.

This surge is driven by several factors, including modernization efforts in military forces, increased defense spending, and rapid advancements in artificial intelligence (AI), sensors, and autonomous technologies. As emerging economies prioritize defense modernization, significant resources are being allocated for the development of unmanned combat aerial systems. These efforts allow nations to stay competitive with major military powers while benefiting from advanced drone technologies. Combat drones equipped with stealth and low-observable technologies are gaining traction, enabling military forces to operate in high-threat environments while evading detection by sophisticated air defense systems. Additionally, the use of swarm drone tactics is becoming increasingly popular, as coordinated UAVs can infiltrate and neutralize enemy defenses more effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $17.3 Billion |

| CAGR | 8.9% |

The fixed-wing drone segment is expected to reach USD 10.2 billion by 2034. Fixed-wing drones are particularly favored due to their longer operational range, enhanced payload capacity, and suitability for long-range strike and surveillance missions. The segment's adoption is expected to rise in regions like North America and Asia, where they are already used for border patrols and mass operations. Manufacturers must focus on enhancing stealth features and incorporating advanced intelligence, surveillance, and reconnaissance (ISR) payloads to remain competitive.

The 20 kg to 100 kg weight class segment held a 37.6% share in 2024. Drones within this weight range are increasingly used for tactical missions such as reconnaissance and precision strikes due to their portability and affordability. These systems are attractive to nations with limited defense budgets seeking cost-effective solutions for modernizing their armed forces. Manufacturers will need to focus on producing compact, AI-powered drones that are both effective and affordable for these developing markets.

United States Combat Drones Market generated USD 2.8 billion in 2024, driven by a robust defense budget, extensive use of drones, and ongoing innovation in the development of next-generation unmanned combat aerial vehicles (UCAVs). The U.S. also remains a leader in swarm technology and AI-driven autonomy in drones. Companies entering the market must align with U.S. defense modernization efforts, focusing on scalable drone systems that can integrate into both current and future military strategies.

Key players in the combat drones market include companies like Northrop Grumman, General Atomics Aeronautical Systems, Israel Aerospace Industries (IAI), Raytheon Technologies, Elbit Systems, Leonardo, Boeing, AeroVironment, and Airbus. These companies are at the forefront of developing cutting-edge drone technologies and meeting the growing demand for unmanned aerial systems in military operations. Their market strategies focus on incorporating innovative AI, autonomous capabilities, and stealth features into their products. Companies also invest heavily in R&D to stay ahead of evolving defense needs while fostering strategic partnerships with government agencies to align with national defense priorities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Drone type trends

- 2.2.2 Payload capacity trends

- 2.2.3 Power source trends

- 2.2.4 Technology trends

- 2.2.5 Application trends

- 2.2.6 Launching mode trends

- 2.2.7 End use application trends

- 2.2.8 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Force modernization and rising defense spending

- 3.2.1.2 Rapid technological advancements in AI, sensors, and autonomy

- 3.2.1.3 Escalating security threat landscape and geopolitical instability

- 3.2.1.4 Regulatory shifts and export liberalization

- 3.2.1.5 Strategic alliances and supply-chain expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and procurement costs

- 3.2.2.2 Stringent regulatory and export control restrictions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of artificial intelligence and machine learning

- 3.2.3.2 Expansion of swarm drone capabilities

- 3.2.3.3 Growing adoption of hybrid and stealth technologies

- 3.2.3.4 Export potential to emerging defense markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Drone Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed-wing drones

- 5.3 Rotary-wing drones

- 5.3.1 Single-rotor

- 5.3.2 Multi-rotor

- 5.4 Hybrid drones

Chapter 6 Market Estimates and Forecast, By Payload Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Up to 2 kg

- 6.3 2 kg to 19 kg

- 6.4 20 kg to 100 kg

- 6.5 Above 100 kg

Chapter 7 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Battery-powered

- 7.3 Hybrid-powered

- 7.4 Fuel-powered

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Remotely operated drones

- 8.3 Semi-autonomous drones

- 8.4 Fully autonomous drones

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Lethal combat drones

- 9.3 Stealth drones

- 9.4 Loitering munition drones

- 9.5 Target drones

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Launching Mode, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 Vertical take-off and landing (VTOL)

- 10.3 Automatic take-off and landing (ATOL)

- 10.4 Catapult-launched drones

- 10.5 Hand-launched drones

Chapter 11 Market Estimates and Forecast, By End Use Application, 2021 - 2034 (USD Million & Units)

- 11.1 Key trends

- 11.2 Military operations

- 11.2.1 Strategic surveillance

- 11.2.2 Tactical combat

- 11.2.3 Reconnaissance missions

- 11.3 Training & simulation

- 11.3.1 Combat training

- 11.3.2 Target practice

- 11.4 Border & maritime security

- 11.4.1 Coastal surveillance

- 11.4.2 Border patrol

- 11.5 Counter-terrorism & law enforcement

- 11.5.1 Urban surveillance

- 11.5.2 Tactical interventions

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Key Players

- 13.1.1 Northrop Grumman Corporation

- 13.1.2 Raytheon Technologies Corporation (RTX)

- 13.1.3 Lockheed Martin Corporation

- 13.2 Regional Key Players

- 13.2.1 North America

- 13.2.1.1 General Atomics Aeronautical Systems, Inc.

- 13.2.1.2 AeroVironment, Inc.

- 13.2.1.3 The Boeing Company (Insitu, Inc.)

- 13.2.2 Europe

- 13.2.2.1 Airbus SE

- 13.2.2.2 Leonardo S.p.A.

- 13.2.2.3 BAE Systems plc

- 13.2.3 APAC

- 13.2.3.1 Israel Aerospace Industries Ltd. (IAI)

- 13.2.3.2 Turkish Aerospace Industries, Inc. (TAI)

- 13.2.3.3 Safran SA

- 13.2.1 North America

- 13.3 Niche Players / Disruptors

- 13.3.1 Elbit Systems Ltd.

- 13.3.2 QinetiQ Group plc

- 13.3.3 Kratos Defense & Security Solutions, Inc.

- 13.3.4 Anduril Industries, Inc.

- 13.3.5 Textron Inc.

- 13.3.6 Thales Group

- 13.3.7 Griffon Aerospace

- 13.3.8 Sistemas de Control Remoto (SCR)