PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833417

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833417

North America Tank Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

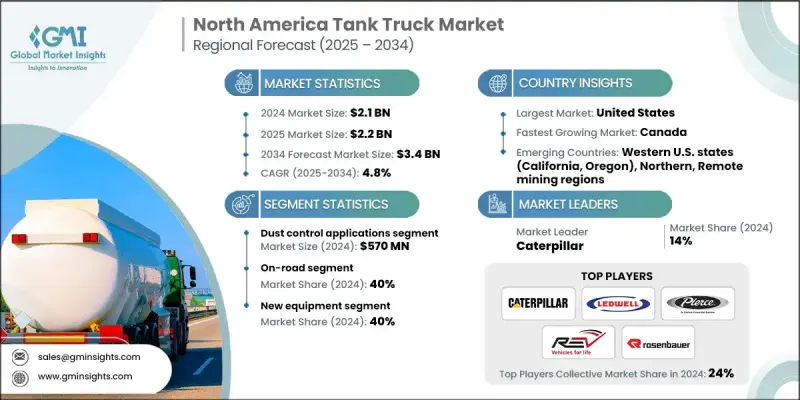

North America Tank Truck Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 3.4 billion by 2034.

North America strong energy and petrochemical industries continue to drive high demand for tank trucks, which are essential for transporting crude oil, refined petroleum products, and hazardous chemicals. The expansion of shale gas operations and chemical manufacturing hubs further supports this trend.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 4.8% |

Rising Adoption of Dust Control Applications

The dust control applications segment held significant share in 2024, driven by construction, mining, and municipal services, where airborne particulate matter poses environmental and operational challenges. Market growth is driven by increased infrastructure projects and stricter air quality regulations. Tank trucks designed for dust suppression are equipped with specialized spray systems and high-capacity water tanks, making them essential for maintaining compliance and visibility on job sites.

On-Road to Gain Traction

The on-road segment held sustainable share in 2024, backed by industries such as fuel transport, chemical logistics, and food-grade liquid distribution. Fleet operators prioritize vehicles with enhanced maneuverability, fuel efficiency, and advanced telematics to ensure regulatory compliance and operational transparency. With long-haul logistics continuing to evolve, the on-road segment is seeing consistent investment in safety upgrades and route optimization technologies.

New Equipment to Propel

The new equipment segment generated substantial share in 2024, fueled by outdated vehicles with advanced, more efficient tank trucks. Operators are favoring new units that come equipped with digital monitoring, GPS tracking, and improved load handling systems to meet customer expectations and regulatory demands. As a result, OEMs are focusing on faster production cycles, modular tank configurations, and post-sale service offerings to maintain a competitive edge.

United States Tank Truck Market

United States tank truck market will grow at a decent CAGR during 2025-2034 supported by a diverse industrial base that includes oil and gas, agriculture, chemicals, and water treatment. The push for domestic manufacturing and energy independence further fuels demand for specialized tankers capable of handling hazardous, flammable, and food-grade liquids. Regional and national fleets are expanding their capabilities through technology adoption, while local operators are investing in multi-purpose tank trucks to remain competitive in a dynamic logistics environment.

Major players in the North America tank truck market are Valew, Curry Supply Company, Knapheide Manufacturing Company, Load King, Ledwell & Son Enterprises, Amthor International, Tiger Manufacturing, Klein Products, Niece Equipment, Caterpillar.

To strengthen their position, leading North America tank truck manufacturers and service providers are focusing on fleet modernization, digital transformation, and regional partnerships. Companies are investing in telematics, route analytics, and predictive maintenance platforms to boost operational efficiency and minimize downtime. There's also a strong emphasis on customization, with OEMs offering modular tank designs tailored for specific applications such as dust suppression, chemical transport, and food-grade logistics.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Application

- 2.2.3 Product

- 2.2.4 Business model

- 2.3 TAM Analysis, 2025 2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in wildfire suppression initiatives

- 3.2.1.2 Expansion of construction and mining projects

- 3.2.1.3 Rising rental and secondary market adoption

- 3.2.1.4 Adoption of advanced water truck technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental and emission regulations

- 3.2.2.2 Seasonal and project-based demand fluctuations

- 3.2.3 Market opportunities

- 3.2.3.1 Smart fleet and telematics integration

- 3.2.3.2 Alternative fuel and hybrid water trucks

- 3.2.3.3 Expansion in remote Canadian and U.S. regions

- 3.2.3.4 Retrofitting and customized tank solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 US

- 3.4.2 Canada

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trend analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Cost breakdown analysis

- 3.10 Production statistics

- 3.10.1 Major import countries

- 3.10.2 Market export countries

- 3.11 Patent analysis

- 3.12 Supply Chain and Distribution Analysis

- 3.12.1 Supply Chain Structure

- 3.12.2 Distribution Channel Analysis

- 3.12.3 Supply Chain Risks and Mitigation

- 3.12.4 Distribution Optimization Opportunities

- 3.13 Production Statistics and Manufacturing Analysis

- 3.13.1 North American Production Capacity

- 3.13.2 Import/Export Analysis

- 3.13.3 Manufacturing Cost Structure

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco friendly Initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Pricing Analysis

- 3.15.1 New Equipment Pricing Trends

- 3.15.2 Used Vehicle Remarketing

- 3.15.3 Rental Rate Analysis

- 3.15.4 Parts and Service Pricing

- 3.16 Industry Life Cycle Analysis

- 3.16.1 Current Life Cycle Stage Assessment

- 3.16.2 Growth Stage Characteristics

- 3.16.3 Maturity Indicators and Implications

- 3.16.4 Future Evolution Predictions

- 3.16.5 Strategic Implications by Life Cycle Stage

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 US

- 4.2.2 Canada

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

- 4.7 Manufacturer-Dealer Relationships

- 4.7.1 Global Vs North America

- 4.8 Parts and services market opportunity

- 4.8.1 Aftermarket

- 4.8.2 Technology-driven service

- 4.8.3 Dealer Service Network Optimization

- 4.8.4 Parts Inventory Management Strategies

- 4.9 Strategic opportunity and dealer recommendations

- 4.9.1 Market Entry and Expansion Strategies

- 4.9.2 Application-Specific Positioning Recommendations

- 4.9.3 Regional Market Penetration Strategies

- 4.9.4 Revenue Diversification Opportunities

- 4.9.4.1 Rental fleet development

- 4.9.4.2 Service excellence programs

- 4.9.4.3 Parts optimization strategies

- 4.9.5 Technology Investment Priorities

- 4.9.6 Partnership and Alliance Opportunities

Chapter 5 Market Estimates & Forecast, By Application, 2021-2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Fire Suppression Applications

- 5.2.1 Municipal fire departments

- 5.2.2 Wildfire suppression operations

- 5.2.3 Industrial fire protection systems

- 5.3 Dust Control Applications

- 5.3.1 Construction site dust suppression

- 5.3.2 Mining operations dust control

- 5.3.3 Road construction and maintenance

- 5.4 Compaction Applications

- 5.5 Agricultural Applications

Chapter 6 Market Estimates & Forecast, By Product, 2021-2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 On-road

- 6.3 Articulated

- 6.4 Rigid frame

Chapter 7 Market Estimates & Forecast, By Business Model, 2021-2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 New equipment

- 7.3 Used equipment

- 7.4 Rental

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 US

- 8.2.1 Alabama

- 8.2.2 Alaska

- 8.2.3 Arizona

- 8.2.4 Arkansas

- 8.2.5 California

- 8.2.6 Colorado

- 8.2.7 Connecticut

- 8.2.8 Delaware

- 8.2.9 Florida

- 8.2.10 Georgia

- 8.2.11 Hawaii

- 8.2.12 Idaho

- 8.2.13 Illinois

- 8.2.14 Indiana

- 8.2.15 Iowa

- 8.2.16 Kansas

- 8.2.17 Kentucky

- 8.2.18 Louisiana

- 8.2.19 Maine

- 8.2.20 Maryland

- 8.2.21 Massachusetts

- 8.2.22 Michigan

- 8.2.23 Minnesota

- 8.2.24 Mississippi

- 8.2.25 Missouri

- 8.2.26 Montana

- 8.2.27 Nebraska

- 8.2.28 Nevada

- 8.2.29 New Hampshire

- 8.2.30 New Jersey

- 8.2.31 New Mexico

- 8.2.32 New York

- 8.2.33 North Carolina

- 8.2.34 North Dakota

- 8.2.35 Ohio

- 8.2.36 Oklahoma

- 8.2.37 Oregon

- 8.2.38 Pennsylvania

- 8.2.39 Rhode Island

- 8.2.40 South Carolina

- 8.2.41 South Dakota

- 8.2.42 Tennessee

- 8.2.43 Texas

- 8.2.44 Utah

- 8.2.45 Vermont

- 8.2.46 Virginia

- 8.2.47 Washington

- 8.2.48 West Virginia

- 8.2.49 Wisconsin

- 8.2.50 Wyoming

- 8.3 Canada

- 8.3.1 Alberta

- 8.3.2 British Columbia

- 8.3.3 Manitoba

- 8.3.4 New Brunswick

- 8.3.5 Newfoundland and Labrador

- 8.3.6 Nova Scotia

- 8.3.7 Ontario

- 8.3.8 Prince Edward Island

- 8.3.9 Quebec

- 8.3.10 Saskatchewan

- 8.3.11 Northwest Territories

- 8.3.12 Nunavut

- 8.3.13 Yukon

Chapter 9 Company Profiles

- 9.1 Global players

- 9.1.1 Caterpillar

- 9.1.2 Curry Supply Company

- 9.1.3 Knapheide Manufacturing Company

- 9.1.4 Ledwell & Son Enterprises

- 9.1.5 Oshkosh / Pierce Manufacturing

- 9.1.6 REV

- 9.1.7 Rosenbauer

- 9.2 Established & emerging players

- 9.2.1 Allquip Water Trucks

- 9.2.2 Amthor International

- 9.2.3 Beco Equipment Company

- 9.2.4 Hills Machinery

- 9.2.5 Hydex Solutions

- 9.2.6 Klein Products

- 9.2.7 Lonestar West

- 9.2.8 Mclellan Industries

- 9.2.9 ND Defense

- 9.2.10 Polar Tank Trailer

- 9.2.11 Smith Equipment and Welding

- 9.2.12 Tremcar

- 9.2.13 Unidex

- 9.2.14 West-Mark

- 9.2.15 Load King

- 9.2.16 Niece Equipment

- 9.2.17 Tiger Manufacturing

- 9.2.18 Valew

- 9.3 Emerging Players / Disruptors

- 9.3.1 Custom Truck One Source