PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833440

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833440

Latin America Over the Counter (OTC) Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

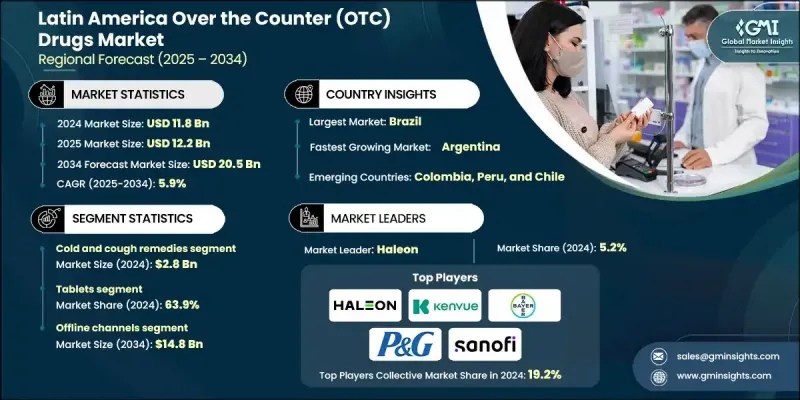

The Latin America Over the Counter (OTC) Drugs Market was valued at USD 11.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 20.5 billion by 2034.

The rising preference for self-medication among consumers is accelerating the adoption of OTC medications across the region. These products, which can be purchased without a physician's prescription, are widely used to address common health concerns like allergies, mild pain, gastrointestinal discomfort, and other minor ailments. The expansion of e-commerce platforms and online pharmacies is significantly contributing to market growth by improving product accessibility and convenience for consumers. Regulatory oversight ensures these medications remain safe, effective, and of high quality. Available in forms such as tablets, sprays, creams, and solutions, OTC drugs offer flexible and easy-to-use options for consumers. Additionally, rising public awareness of personal wellness and health autonomy is leading more individuals to use OTC products for minor ailments rather than seeking immediate clinical consultation, fueling overall market expansion across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.8 Billion |

| Forecast Value | $20.5 Billion |

| CAGR | 5.9% |

The vitamins and supplements segment will grow at a CAGR of 6.5% from 2025 to 2034. Growing interest in preventive healthcare and rising consciousness about immune health and nutritional balance are key factors boosting this segment. Many individuals are turning to dietary supplements to compensate for lifestyle-induced deficiencies, manage fatigue, and improve general well-being. The strong demand for immunity-enhancing formulations continues to drive the production and innovation of OTC supplements in the market.

In 2024, the tablet segment held a 63.9% share and is expected to grow at a CAGR of 6.1% through 2034. The popularity of tablets stems from their convenience, longer shelf life, and ability to be stored and transported easily without refrigeration or special handling. Their practicality makes them suitable for frequent use, and they provide accurate dosages for consumers seeking quick relief. Tablets also cater to a wide range of therapeutic needs, including digestion, sleep support, pain relief, and nutritional supplementation. This diverse functionality continues to make tablets the preferred choice among Latin American consumers seeking OTC treatments for everyday health conditions.

Brazil Over the Counter (OTC) Drugs Market was valued at USD 4.61 billion in 2024. The country's advanced pharmaceutical retail network, featuring a mix of large pharmacy chains and independent drugstores, ensures broad access to a wide range of OTC products. This well-established infrastructure facilitates efficient product distribution across both urban and rural areas. In Brazil, the trend of self-treatment is gaining momentum, particularly for frequently occurring conditions such as headaches, seasonal allergies, digestive discomfort, and mild infections.

Some of the prominent companies shaping the Latin America Over the Counter (OTC) Drugs Market include Reckitt, Haleon, Abbott Laboratories, Alkem Laboratories, Himalaya Wellness Company, Cipla, EMS, Sanofi, Kenvue, Glenmark Pharmaceuticals, Bayer, Dr. Reddy's Laboratories, Laboratorios Bago S.A., Teva Pharmaceutical, Eurofarma, Procter & Gamble Company, Stada Arzneimittel, and Sun Pharma. These industry players are contributing to product innovation, widespread distribution, and enhanced customer engagement across key markets. Key players in the Latin America Over the Counter (OTC) Drugs Market are adopting a blend of innovation, localization, and strategic expansion to strengthen their foothold. Many are investing in R&D to introduce new formulations tailored to regional health concerns, such as digestive aids and immune boosters. Companies are also expanding their digital presence by partnering with online pharmacies and e-commerce platforms, making OTC products more accessible to remote areas.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Country trends

- 2.2.3 Drug category trends

- 2.2.4 Formulation type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of self-care practices among consumers

- 3.2.1.2 Rapid penetration of e-commerce and digital health platforms

- 3.2.1.3 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions are affecting product availability

- 3.2.2.2 Increased concern towards misuse or drug abuse

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into underserved rural and remote areas with localized distribution

- 3.2.3.2 Innovation in natural, herbal, and plant-based OTC product lines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Prescription to nonprescription switch list

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Drug Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cold and cough remedies

- 5.3 Vitamins and supplements

- 5.4 Digestive and intestinal remedies

- 5.5 Skin treatment

- 5.6 Analgesics

- 5.7 Sleeping aids

- 5.8 Other drug categories

Chapter 6 Market Estimates and Forecast, By Formulation Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tablets

- 6.3 Liquids

- 6.4 Ointments

- 6.5 Sprays

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online channels

- 7.3 Offline channels

- 7.3.1 Hospital pharmacies

- 7.3.2 Retail pharmacies

- 7.3.3 Other offline channels

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Brazil

- 8.3 Mexico

- 8.4 Argentina

- 8.5 Colombia

- 8.6 Peru

- 8.7 Chile

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Alkem Laboratories

- 9.3 Bayer

- 9.4 Cipla

- 9.5 Dr. Reddy’s Laboratories

- 9.6 Eurofarma

- 9.7 EMS

- 9.8 Glenmark Pharmaceuticals

- 9.9 Haleon

- 9.10 Himalaya Wellness Company

- 9.11 Kenvue

- 9.12 Laboratorios Bago S.A.

- 9.13 Procter & Gamble Company

- 9.14 Reckitt

- 9.15 Sanofi

- 9.16 Stada Arzneimittel

- 9.17 Sun Pharma

- 9.18 Teva Pharmaceutical