PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833445

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833445

ASEAN Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

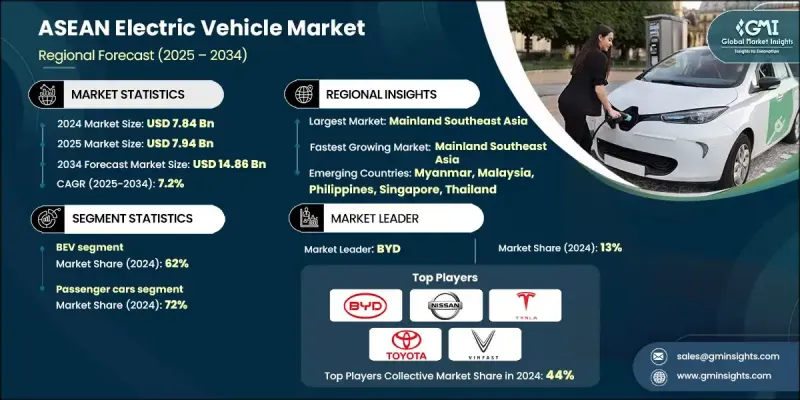

The ASEAN Electric Vehicle Market was valued at USD 7.84 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 14.86 billion by 2034.

The region's rapid urban growth and rising population have intensified the demand for cleaner, more sustainable modes of transportation. Governments across ASEAN are increasingly investing in renewable energy integration and electric vehicle infrastructure to align with decarbonization goals. Charging ecosystems, including battery-swapping stations and smart grid-enabled chargers, are gaining traction, particularly in regional markets where electrification is accelerating. Integrating EVs with renewable energy sources is proving to be effective, with studies showing the potential to cut lifecycle emissions by up to 30% compared to fossil fuel-based charging models.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.84 Billion |

| Forecast Value | $14.86 Billion |

| CAGR | 7.2% |

The shift in mobility behavior has driven up the demand for electric two-wheelers, last-mile EV delivery solutions, and shared fleet services across the ASEAN region. This shift has also fueled the adoption of AI-driven battery diagnostics, predictive fleet monitoring, and cashless charging systems. Meanwhile, the growth of EV manufacturing centers in countries like Vietnam, Thailand, and Indonesia has sparked a wave of investment into next-generation battery production. Local access to mineral resources is encouraging high-value manufacturing of lithium-ion and solid-state battery technologies, pushing the region closer to supply chain independence and advanced electrification.

The Battery electric vehicles (BEVs) segment is expected to grow at a CAGR of 7.6% through 2034. BEVs continue to gain popularity, supported by favorable regulatory frameworks, cost-efficient technology, and the rapid expansion of charging infrastructure. Regional governments have introduced tax reductions, consumer incentives, and infrastructure programs to make BEVs more accessible. With falling battery prices and the scaling of lithium-ion production, BEVs are becoming more affordable and appealing for consumers and businesses alike.

The passenger vehicles segment held a 72% share in 2024 and is projected to grow at a CAGR of 7% through 2034. Demand is rising in response to economic expansion, increasing urbanization, and regulatory support that encourages cleaner commuting options. Automakers such as Nissan, Honda, Hyundai, and BYD are launching compact and mid-range BEVs tailored to ASEAN's urban transportation needs. Incentive schemes and reduced registration fees in several countries are further accelerating the shift toward electric passenger vehicles.

Thailand ASEAN Electric Vehicle Market held a 48% share in 2024, generating USD 1.71 billion. This leadership is driven by an established automotive industry, robust government support, and extensive production capacity. National programs offering incentives, duty exemptions, and subsidy frameworks have attracted major EV brands to set up production and battery assembly operations. As a result, Thailand is becoming a key manufacturing hub for electric vehicles and components across the ASEAN region.

Leading companies shaping the ASEAN Electric Vehicle Market include Bosch, Toyota, Hyundai, VinFast, Tesla, BYD, BMW, Audi, Nissan, and Honda. To strengthen their competitive edge in the ASEAN electric vehicle market, companies are adopting a mix of localization, partnerships, and technology investments. They are expanding regional production facilities to cut logistics costs and meet government criteria for subsidies. Collaborations with local governments, energy firms, and technology providers are helping firms deploy smart charging networks and battery-swapping infrastructure. Automakers are also tailoring vehicle designs to match local consumer preferences, offering affordable models for city driving. Additionally, investments in advanced battery tech and AI-enabled fleet management systems are enhancing performance, safety, and value in both consumer and commercial segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Propulsion

- 2.2.3 Vehicle

- 2.2.4 Drivetrain

- 2.2.5 Battery

- 2.2.6 Kilometer Range

- 2.2.7 Price Range

- 2.2.8 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in government incentives & policy support

- 3.2.1.2 Surge in fuel prices & energy security concerns

- 3.2.1.3 Expansion of EV charging infrastructure

- 3.2.1.4 Rise in foreign direct investment & local manufacturing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront cost of EVs

- 3.2.2.2 Limited charging infrastructure in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Increase in battery manufacturing potential

- 3.2.3.2 Surge in demand for electric two-wheelers & micro-mobility

- 3.2.3.3 Growth in smart city & green mobility initiatives

- 3.2.3.4 Rise in export-oriented EV production

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 Mainland Southeast Asia

- 3.3.2 Maritime Southeast

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Profit margin analysis

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Electric vehicle technology evolution

- 3.11.1 Battery technology development

- 3.11.1.1 Lithium-ion battery chemistry evolution

- 3.11.1.2 Energy density and performance improvements

- 3.11.1.3 Fast charging capability development

- 3.11.1.4 Battery management system advances

- 3.11.1.5 Thermal management and safety systems

- 3.11.1.6 Cost reduction and manufacturing scale

- 3.11.1.7 Lifecycle and durability enhancements

- 3.11.2 Electric Drivetrain Technology

- 3.11.1 Battery technology development

- 3.12 Electric motor design and efficiency

- 3.12.1.1 Power electronics and inverters

- 3.12.1.2 Transmission and drivetrain integration

- 3.12.1.3 Regenerative braking systems

- 3.12.1.4 Vehicle control and management systems

- 3.12.1.5 Noise, vibration, and harshness (NVH)

- 3.12.1.6 Performance optimization and Tuning

- 3.12.2 Charging technology and standards

- 3.12.2.1 AC and DC charging protocols

- 3.12.2.2 Fast charging and ultra-fast charging

- 3.12.2.3 Wireless and inductive charging

- 3.12.2.4 Vehicle-to-Grid (V2G) technology

- 3.12.2.5 Smart charging and grid integration

- 3.12.2.6 Charging standards and interoperability

- 3.12.2.7 Mobile and portable charging solutions

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Mainland Southeast Asia

- 4.2.2 Maritime Southeast

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 BEV

- 5.3 HEV

- 5.4 PHEV

- 5.5 FCEV

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Two-wheelers

- 6.2.1 Electric scooters

- 6.2.2 E-bikes

- 6.2.3 Electric mopeds

- 6.3 Passenger cars

- 6.3.1 Sedan

- 6.3.2 SUV

- 6.3.3 Hatchback

- 6.4 Commercial vehicles

- 6.4.1 Light

- 6.4.2 Medium

- 6.4.3 Heavy

- 6.5 Specialty EVs

- 6.5.1 Off-road EVs

- 6.5.2 Golf carts

- 6.5.3 Utility EVs

Chapter 7 Market Estimates & Forecast, By Drivetrain, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Front-wheel drive

- 7.3 Rear-wheel drive

- 7.4 All-wheel drive

Chapter 8 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Sealed lead acid

- 8.3 Nickel metal hydride (NiMH)

- 8.4 Lithium Ion

Chapter 9 Market Estimates & Forecast, By Kilometer Range, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Less than 100 km

- 9.3 100 km to 200 km

- 9.4 200 km to 300 km

- 9.5 Above 300 km

Chapter 10 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Below USD 10,000

- 10.3 USD 10,000 to USD 30,000

- 10.4 USD 30,000 to USD 50,000

- 10.5 Above USD 50,000

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 Personal

- 11.3 Commercial

- 11.3.1 Ride-sharing & ride-hailing

- 11.3.2 Logistics & delivery

- 11.3.3 Corporate fleets

- 11.4 Government

- 11.4.1 Public transportation

- 11.4.2 Utility fleets

- 11.4.3 Law enforcement

- 11.5 Private

- 11.5.1 Universities

- 11.6 Industrial campuses

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 Mainland Southeast Asia

- 12.2.1 Cambodia

- 12.2.2 Laos

- 12.2.3 Myanmar

- 12.2.4 Thailand

- 12.2.5 Vietnam

- 12.3 Maritime Southeast Asia

- 12.3.1 Brunei

- 12.3.2 Indonesia

- 12.3.3 Malaysia

- 12.3.4 Philippines

- 12.3.5 Singapore

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 Audi

- 13.1.2 BMW

- 13.1.3 Bosch

- 13.1.4 BYD

- 13.1.5 Geely

- 13.1.6 Honda

- 13.1.7 Hyundai

- 13.1.8 Kia

- 13.1.9 Nissan

- 13.1.10 SAIC

- 13.1.11 Tesla

- 13.1.12 Toyota

- 13.1.13 VinFast

- 13.2 Regional Players

- 13.2.1 Contemporary Amperex Technology

- 13.2.2 Gogoro

- 13.2.3 Gojek

- 13.2.4 Grab

- 13.2.5 LG Energy

- 13.2.6 Perodua

- 13.2.7 Proton

- 13.2.8 Samsung

- 13.3 Emerging Players

- 13.3.1 ABB

- 13.3.2 Automotive Energy Supply

- 13.3.3 ChargePoint

- 13.3.4 Panasonic

- 13.3.5 Rivian Automotive

- 13.3.6 Schneider Electric

- 13.3.7 Shell

- 13.3.8 TotalEnergies