PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833454

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833454

Network Probe Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

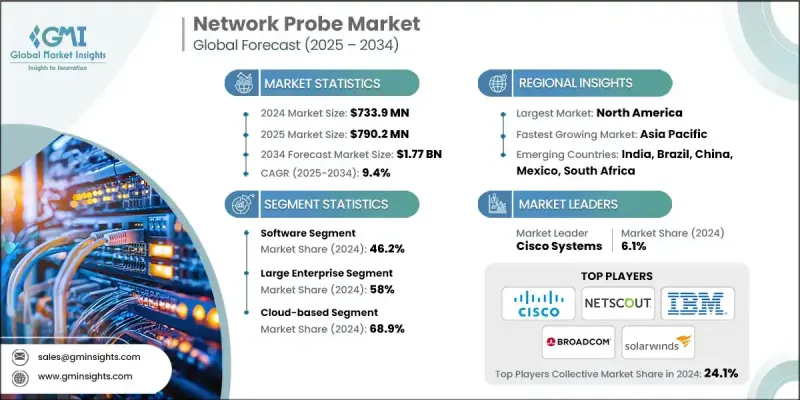

The Global Network Probe Market was valued at USD 733.9 million in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 1.77 billion by 2034.

The increasing adoption of digital technologies, 5G networks, IoT ecosystems, and cloud-based infrastructure is significantly increasing data traffic across complex, distributed IT and telecom networks. This shift is fueling demand for network probes, which provide in-depth monitoring, performance diagnostics, and real-time analytics. Organizations require these tools to manage congestion, detect irregularities, and ensure high-performance connectivity. As cyber threats grow more frequent and sophisticated, companies are prioritizing end-to-end visibility to safeguard critical systems and reduce downtime. Network probes support compliance efforts, optimize uptime, and deliver proactive security alerts, becoming a vital part of enterprise infrastructure. The transition to software-defined and cloud-native networks further accelerates probe adoption, as businesses demand scalable, remotely deployable solutions that work across hybrid and multi-cloud environments. Network visibility has become foundational for digital transformation, particularly in regions like North America, where hyperscale cloud growth, AI adoption, and next-gen computing are reshaping enterprise infrastructure needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $733.9 Million |

| Forecast Value | $1.77 Billion |

| CAGR | 9.4% |

The software-based network probes segment held a 46.2% share in 2024. These solutions are gaining traction due to their scalability, remote management capabilities, and integration with AI-powered analytics platforms. Unlike traditional hardware, cloud-native software probes enable real-time diagnostics, deliver predictive insights, and offer cost efficiency for businesses managing large-scale, distributed networks. They are increasingly used to streamline network operations, boost security, and enhance agility without burdening IT teams.

The cloud-based deployment segment held a 68.9% share in 2024. Their popularity stems from quick deployment, reduced hardware dependency, and the inclusion of advanced features like machine learning-driven anomaly detection and predictive analytics. This supports proactive network management and faster resolution of issues across diverse enterprise environments.

North America Network Probe Market held a 40.3% share and generated USD 295.8 million in 2024. The region's leadership in 5G rollout, AI integration, and IoT expansion requires continuous monitoring of high-speed, data-rich networks. Probes play a critical role in supporting reliable performance and rapid threat response. Major tech companies across North America are investing in large-scale data centers to handle growing demand for cloud services and AI applications, further driving the need for intelligent monitoring tools to manage performance and cybersecurity.

Key players in the Global Network Probe Industry include Juniper Networks, Cisco Systems, Broadcom, IBM, Riverbed Technology, SolarWinds Worldwide, NETSCOUT Systems, Paessler, ManageEngine (Zoho Corporation), and Dynatrace. Companies in the network probe industry are actively investing in AI-driven analytics to enhance real-time threat detection, automate network diagnostics, and optimize performance monitoring. They are also developing cloud-native, software-based probe solutions that are easy to scale, deploy, and integrate with multi-cloud and hybrid IT environments. Strategic alliances with cloud service providers and telecom companies are helping expand service portfolios.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Organization size

- 2.2.3 Deployment mode

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Network Traffic

- 3.2.1.2 Cybersecurity Concerns

- 3.2.1.3 Cloud & Software-Defined Networks

- 3.2.1.4 Growth of 5G & Edge Computing

- 3.2.1.5 Industry-Specific Adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data Privacy & Regulatory Concerns

- 3.2.2.2 Limited Skilled Workforce

- 3.2.3 Market opportunities

- 3.2.3.1 Growing Cloud Adoption

- 3.2.3.2 Expansion in 5G and IoT Networks

- 3.2.3.3 Industry-Specific Solutions

- 3.2.3.4 Integration with AI & Analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Technology and Innovation landscape

- 3.10.1 Active Probing Technologies

- 3.10.1.1 Synthetic Transaction Monitoring Evolution

- 3.10.1.2 Application Layer Testing Methodologies

- 3.10.1.3 Network Quality Assessment Algorithms

- 3.10.1.4 Performance Baseline Establishment Techniques

- 3.10.2 Passive Monitoring Technologies

- 3.10.2.1 Deep Packet Inspection (DPI) Evolution

- 3.10.2.2 Flow-based Analysis Methodologies

- 3.10.2.3 Metadata Extraction & Analysis Techniques

- 3.10.2.4 Real-time Stream Processing Technologies

- 3.10.3 Hybrid & Intelligent Monitoring

- 3.10.3.1 AI/ML-Enhanced Detection Algorithms

- 3.10.3.2 Behavioral Analytics & Anomaly Detection

- 3.10.3.3 Predictive Failure Analysis Capabilities

- 3.10.3.4 Automated Response & Remediation Systems

- 3.10.4 Next-Generation Technologies

- 3.10.4.1 Quantum-Safe Monitoring Protocols

- 3.10.4.2 6G Network Preparation Requirements

- 3.10.4.3 Satellite Network Monitoring Capabilities

- 3.10.4.4 Programmable Network Probe Architectures

- 3.10.1 Active Probing Technologies

- 3.11 Vendor Selection & Implementation Framework

- 3.12 Use cases

- 3.12.1 Telecommunications & Service Providers

- 3.12.1.1 5G Network Slice Monitoring Requirements

- 3.12.1.2 Customer Experience Management Integration

- 3.12.1.3 Revenue Assurance & Fraud Detection

- 3.12.1.4 SLA Compliance Automation (Unique)

- 3.12.2 Financial Services

- 3.12.2.1 High-Frequency Trading Network Monitoring

- 3.12.2.2 PCI DSS Compliance Automation

- 3.12.2.3 Real-time Fraud Detection Integration

- 3.12.2.4 Regulatory Reporting Automation (Unique)

- 3.12.3 Healthcare

- 3.12.3.1 Medical Device Network Security

- 3.12.3.2 HIPAA Compliance Monitoring

- 3.12.3.3 Telemedicine Quality Assurance

- 3.12.3.4 Patient Data Protection Validation (Unique)

- 3.12.4 Government & Defense

- 3.12.4.1 FISMA Continuous Monitoring Requirements

- 3.12.4.2 Classified Network Monitoring Protocols

- 3.12.4.3 Critical Infrastructure Protection

- 3.12.4.4 Insider Threat Detection Capabilities (Unique)

- 3.12.5 Enterprise & Corporate

- 3.12.5.1 Remote Work Infrastructure Monitoring

- 3.12.5.2 BYOD Security Compliance

- 3.12.5.3 Cloud Migration Monitoring

- 3.12.5.4 Digital Transformation ROI Measurement

- 3.12.1 Telecommunications & Service Providers

- 3.13 Best-case scenario

- 3.14 Investment & Funding Trends Analysis

- 3.15 Supply Chain Dynamics & Dependencies

- 3.16 Market Maturity Assessment by Region

- 3.17 Vendor Lock-in Risk Assessment Framework

- 3.18 Skills Gap Impact Analysis & Training Requirements

- 3.19 Sustainability and environmental aspects

- 3.19.1 Sustainable practices

- 3.19.2 Waste reduction strategies

- 3.19.3 Energy efficiency in production

- 3.19.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Vendor Roadmap Alignment Assessment

- 4.7 Customer Switching Cost Analysis

- 4.8 Key news and initiatives

- 4.8.1 Mergers & acquisitions

- 4.8.2 Partnerships & collaborations

- 4.8.3 New Product Launches

- 4.8.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Packet Brokers

- 5.2.2 Network Switches

- 5.2.3 Specialized Processing Units (FPGA / ASIC-based)

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional Services

- 5.4.2 Managed Services

Chapter 6 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Large enterprise

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Deployment mode Service, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud Based

- 7.3 On-premises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 IT & Telecom

- 8.3 BFSI

- 8.4 Government

- 8.5 Healthcare

- 8.6 Retail

- 8.7 Manufacturing

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 NETSCOUT Systems

- 10.1.2 Keysight Technologies

- 10.1.3 VIAVI Solutions

- 10.1.4 Cisco Systems

- 10.1.5 Broadcom

- 10.1.6 Juniper Networks

- 10.1.7 IBM

- 10.1.8 SolarWinds

- 10.1.9 Riverbed Technology

- 10.1.10 HPE

- 10.2 Regional Champions

- 10.2.1 Progress Software

- 10.2.2 ManageEngine (Zoho Corp)

- 10.2.3 Gigamon

- 10.2.4 Paessler

- 10.2.5 SevOne

- 10.2.6 LiveAction

- 10.2.7 Plixer

- 10.2.8 Corvil

- 10.2.9 Dynatrace

- 10.3 Emerging Players & Disruptors

- 10.3.1 Qualys

- 10.3.2 ExtraHop Networks

- 10.3.3 Netskope

- 10.3.4 Kentik

- 10.3.5 Nyansa

- 10.3.6 Catchpoint Systems