PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833621

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833621

U.S. Trauma Fixation Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

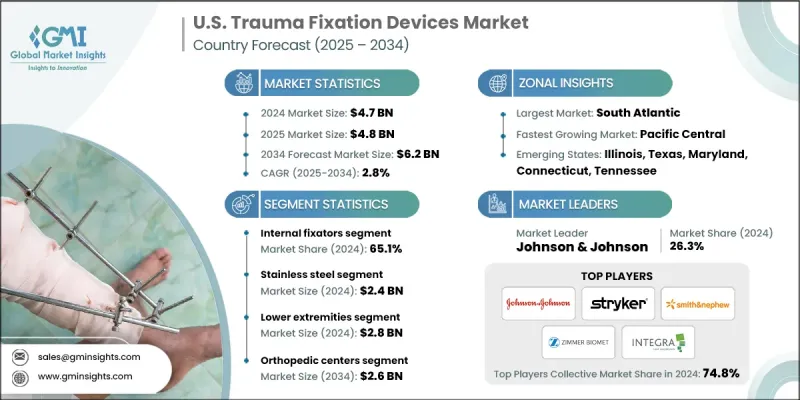

U.S. trauma fixation devices market was estimated at USD 4.7 billion in 2024 and is expected to grow from USD 4.8 billion in 2025 to USD 6.2 billion by 2034, at a CAGR of 2.8%, according to the latest report published by Global Market Insights Inc.

Elderly individuals are especially vulnerable due to lower bone density and balance-related issues, while younger, active demographics face injuries tied to athletic and recreational activities. This growing volume of trauma cases is pushing hospitals and trauma centers to adopt advanced fixation technologies such as locking plates, screws, and intramedullary nails that offer stability, quicker recovery, and reduced complication rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 2.8% |

Rising Demand for Internal Fixators

The internal fixators segment held a significant share in 2024, driven by their critical role in stabilizing complex fractures and enabling early mobilization. Surgeons prefer internal fixation due to its minimally invasive nature and improved patient outcomes compared to traditional external fixation methods. The growing adoption of advanced locking plates, intramedullary nails, and bioresorbable implants is further propelling segment growth.

Increasing Adoption of Stainless Steel

The stainless-steel segment generated a substantial share in 2024, attributed to its cost-effectiveness, durability, and biocompatibility. Its widespread use in plates, screws, and wires is favored particularly in emergency trauma care, where immediate availability and reliability are crucial. Market leaders are investing in advanced stainless-steel alloys that improve corrosion resistance and mechanical properties to enhance patient safety and implant longevity.

Increasing Prevalence of Lower Extremities Segment

The lower extremities segment held a notable share in 2024, driven by a high incidence of fractures in the femur, tibia, ankle, and foot due to traffic accidents and sports injuries. This segment demands robust and versatile fixation devices that can accommodate varied load-bearing requirements and complex anatomical structures. Leading companies are developing specialized intramedullary nails and locking plates designed specifically for lower limb fractures, while also expanding their presence through collaborations with trauma centers and orthopedic specialists to deliver tailored solutions that improve recovery times and reduce complications.

Orthopedic Centers to Gain Traction

The orthopedic centers generated substantial revenues in 2024, reflecting the increasing volume of trauma surgeries performed in specialized facilities. These centers prioritize advanced fixation technologies that offer precision, reliability, and reduced surgical times to enhance patient outcomes. To strengthen their market foothold, companies are focusing on building strong relationships with orthopedic surgeons through training programs, clinical support, and digital platforms that facilitate product adoption and feedback.

Major players in the U.S. trauma fixation devices market are Medicon, Zimmer Biomet, KLS Martin Group, B. Braun, Arthrex, Implanet, Johnson & Johnson, Smith+Nephew, Acumed, ORTHOFIX, Bioretec, CONMED, Citieffe, INTEGRA, and Stryker.

To bolster their presence in the competitive U.S. trauma fixation devices market, companies are investing heavily in R&D to develop innovative, patient-specific fixation solutions that address unmet clinical needs. Emphasis on collaborations with healthcare providers and academic institutions facilitates clinical validation and surgeon education, driving wider adoption. Moreover, firms are expanding their product portfolios through acquisitions and partnerships to offer comprehensive fixation solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Zonal/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 Site trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of degenerative bone diseases

- 3.2.1.2 Rising incidence of traumatic injuries

- 3.2.1.3 Technological advancements in trauma fixation devices

- 3.2.1.4 Surging demand for surgical interventions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of trauma fixation devices

- 3.2.2.2 Post-surgery complication

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient surgical centers

- 3.2.3.2 Development of lightweight and biocompatible materials

- 3.2.3.3 Advancements in robotic-assisted surgery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 External fixation mechanism

- 3.8 Number of fatalities in road accidents, by Zone

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

- 3.12 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Internal fixators

- 5.2.1 Plates

- 5.2.2 Nails

- 5.2.3 Screws

- 5.2.4 Other internal fixators

- 5.3 External fixators

- 5.3.1 Unilateral and bilateral

- 5.3.2 Hybrid

- 5.3.3 Circular

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Titanium

- 6.4 Other materials

Chapter 7 Market Estimates and Forecast, By Site, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Lower extremities

- 7.2.1 Foot & ankle

- 7.2.2 Knee

- 7.2.3 Lower leg

- 7.2.4 Hip and pelvic

- 7.2.5 Thigh

- 7.3 Upper extremities

- 7.3.1 Arm

- 7.3.2 Hand & wrist

- 7.3.3 Shoulder

- 7.3.4 Elbow

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Orthopedic centers

- 8.3 Hospitals

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 East North Central

- 9.2.1 Illinois

- 9.2.2 Indiana

- 9.2.3 Michigan

- 9.2.4 Ohio

- 9.2.5 Wisconsin

- 9.3 West South Central

- 9.3.1 Arkansas

- 9.3.2 Louisiana

- 9.3.3 Oklahoma

- 9.3.4 Texas

- 9.4 South Atlantic

- 9.4.1 Delaware

- 9.4.2 Florida

- 9.4.3 Georgia

- 9.4.4 Maryland

- 9.4.5 North Carolina

- 9.4.6 South Carolina

- 9.4.7 Virginia

- 9.4.8 West Virginia

- 9.4.9 Washington, D.C.

- 9.5 Northeast

- 9.5.1 Connecticut

- 9.5.2 Maine

- 9.5.3 Massachusetts

- 9.5.4 New Hampshire

- 9.5.5 Rhode Island

- 9.5.6 Vermont

- 9.5.7 New Jersey

- 9.5.8 New York

- 9.5.9 Pennsylvania

- 9.6 East South Central

- 9.6.1 Alabama

- 9.6.2 Kentucky

- 9.6.3 Mississippi

- 9.6.4 Tennessee

- 9.7 West North Centra

- 9.7.1 Iowa

- 9.7.2 Kansas

- 9.7.3 Minnesota

- 9.7.4 Missouri

- 9.7.5 Nebraska

- 9.7.6 North Dakota

- 9.7.7 South Dakota

- 9.8 Pacific Central

- 9.8.1 Alaska

- 9.8.2 California

- 9.8.3 Hawaii

- 9.8.4 Oregon

- 9.8.5 Washington

- 9.9 Mountain States

- 9.9.1 Arizona

- 9.9.2 Colorado

- 9.9.3 Utah

- 9.9.4 Nevada

- 9.9.5 New Mexico

- 9.9.6 Idaho

- 9.9.7 Montana

- 9.9.8 Wyoming

Chapter 10 Company Profiles

- 10.1 Acumed

- 10.2 Arthrex

- 10.3 B. Braun

- 10.4 Bioretec

- 10.5 Citieffe

- 10.6 CONMED

- 10.7 Implanet

- 10.8 INTEGRA

- 10.9 Johnson & Johnson

- 10.10 KLS Martin Group

- 10.11 Medicon

- 10.12 ORTHOFIX

- 10.13 Smith+Nephew

- 10.14 Stryker

- 10.15 Zimmer Biomet