PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833622

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833622

Semiconductor Tubing and Fittings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

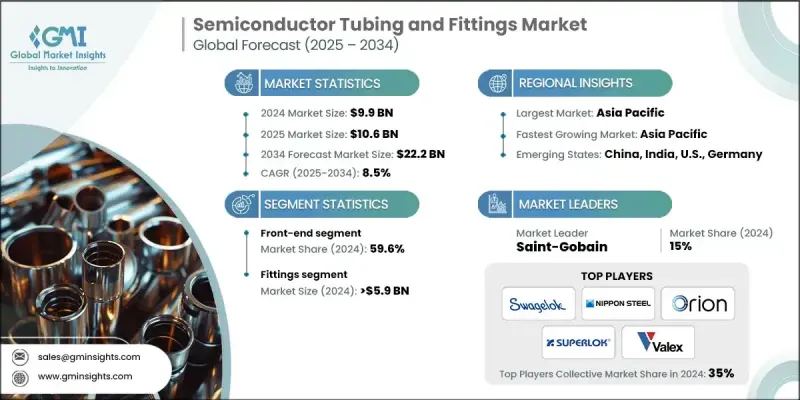

The global semiconductor tubing and fittings market was estimated at USD 9.9 billion in 2024 and is expected to grow from USD 10.6 billion in 2025 to USD 22.2 billion by 2034, at a CAGR of 8.5%, according to the latest report published by Global Market Insights Inc.

Semiconductor processes use aggressive chemicals and specialty gases that must be transported safely and cleanly. This increases demand for chemically resistant and high-purity tubing and fittings, such as those made from PFA, PTFE, and PVDF.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $22.2 Billion |

| CAGR | 8.5% |

Rising Adoption of Front-End Semiconductor

The front-end segment held a significant share in 2024, driven by wafer fabrication processes, where purity and precision are non-negotiable. This stage involves complex chemical delivery systems that require ultra-clean tubing and corrosion-resistant fittings to maintain process integrity. With fabs operating under extreme contamination control standards, demand for front-end fluid handling components continues to surge, particularly as chipmakers transition to smaller nodes and more complex architectures.

Fittings to Gain Traction

The fittings segment generated substantial revenues in 2024, as even the slightest leakage or material degradation can compromise the entire semiconductor production process. Fittings are expected to withstand aggressive chemicals, maintain leak-proof connections under varying pressures, and remain stable over time. The market is witnessing a growing preference for precision-engineered, weldable, and quick-connect fittings made from high-purity metals and engineered plastics.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific semiconductor tubing and fittings market held a sizeable share in 2024. Countries like Taiwan, South Korea, China, and Japan are home to several leading foundries and integrated device manufacturers (IDMs), demanding high-purity fluid handling systems. Government-backed investments in chip fabrication and aggressive capacity expansions by local and global players are fueling the need for ultra-clean tubing and fittings. The market growth is driven by rising wafer production, the construction of new fabs, and strategic partnerships between OEMs and component suppliers.

Major players in the semiconductor tubing and fittings market are Rensa Tubes, Swagelok, Advance Fittings Corp, FITOK Group Co Ltd, Ihara Science Corporation, Valex Corp, Orion, FUJIKIN, Masterflex Group, Superlok, Dibert Valve & Fitting Co Inc, Saint-Gobain, APT, Nippon Steel Corp, Heraeus Covantics.

To strengthen their foothold in the semiconductor tubing and fittings market, companies are adopting a mix of innovation, partnerships, and regional expansion strategies. Leading players are heavily investing in R&D to develop next-generation materials that offer enhanced chemical resistance, temperature stability, and zero particle generation. Many are also building or expanding cleanroom manufacturing facilities near key customer locations to shorten lead times and improve service responsiveness. Strategic collaborations with semiconductor OEMs and fab equipment manufacturers allow tubing and fittings suppliers to integrate more seamlessly into system-level designs. Additionally, businesses are pursuing mergers and acquisitions to diversify product portfolios and enter new regional markets, particularly in Asia and North America, where semiconductor investment is surging. These proactive strategies help firms differentiate themselves in a highly technical and quality-sensitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Process

- 2.2.4 Equipment type

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of the semiconductor industry

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increase in R&D activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of specialized materials

- 3.2.2.2 Complexity of manufacturing and quality control

- 3.2.3 Opportunities

- 3.2.3.1 Development of advanced materials

- 3.2.3.2 Customization and modular solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Tubing

- 5.2.1 Metal tubing

- 5.2.2 Fluoropolymer tubing

- 5.2.3 Quartz tubing

- 5.2.4 Composite tubing

- 5.2.5 Specialty polymer tubing

- 5.3 Fittings

- 5.3.1 Compression fittings

- 5.3.2 Flare fittings

- 5.3.3 Face seal fittings

- 5.3.4 Weld fittings

- 5.3.5 Ultra-high purity (UHP) fittings

- 5.3.6 Quick-connect fittings

- 5.3.7 Threaded fittings

- 5.3.8 Others

Chapter 6 Market Estimates and Forecast, By Process, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Front-end

- 6.3 Back-end

Chapter 7 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Semiconductor design

- 7.3 Mask/Reticle manufacturing

- 7.4 Wafer manufacturing/processing

- 7.5 Surface conditioning

- 7.6 Assembly & packaging

- 7.7 Test/Inspection

- 7.8 Fabrication facility

- 7.9 Thermal processing

- 7.10 Deposition

- 7.11 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advance Fittings Corp

- 10.2 APT

- 10.3 Dibert Valve & Fitting Co Inc

- 10.4 FITOK Group Co Ltd

- 10.5 FUJIKIN

- 10.6 Heraeus Covantics

- 10.7 Ihara Science Corporation

- 10.8 Masterflex Group

- 10.9 Nippon Steel Corp

- 10.10 Orion

- 10.11 Rensa Tubes

- 10.12 Saint-Gobain

- 10.13 Superlok

- 10.14 Swagelok

- 10.15 Valex Corp