PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833624

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833624

North America and Europe Snow Blowers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

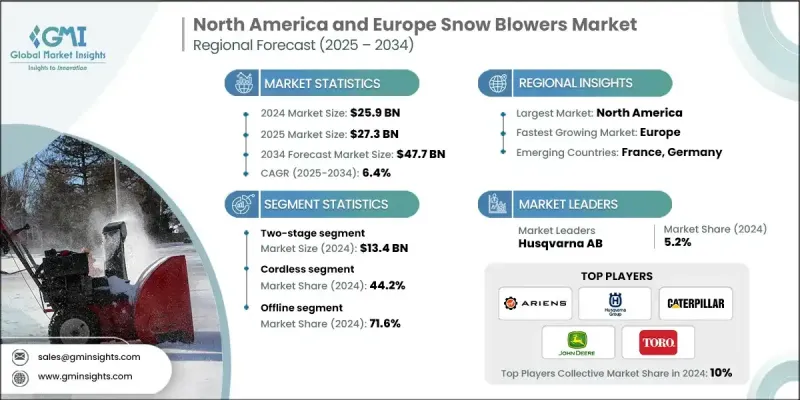

North America & Europe Snow Blowers Market was valued at USD 25.9 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 47.7 billion by 2034.

This expansion is driven by a rise in demand across residential, commercial, and municipal sectors. Increasingly unpredictable and heavy snowfall, along with severe winter weather, has heightened the need for effective snow removal solutions. Homeowners, businesses, and local governments alike rely on snow blowers to maintain safety, clear streets and walkways, and minimize disruptions caused by snow accumulation. Additionally, a surge in homeownership and disposable income in developed regions has fueled the purchase of snow blowers, particularly portable and battery-operated models that offer ease of use and transport. Environmental concerns are also reshaping the market, especially in Europe, where regulations and growing eco-consciousness have bolstered demand for electric and battery-powered options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.9 Billion |

| Forecast Value | $47.7 Billion |

| CAGR | 6.4% |

The cordless snow blowers segment accounted for a 44.2% share in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2034. Their rising popularity stems from evolving consumer preferences, stricter environmental policies, and technological progress, especially as they emit no exhaust gases, making them more appealing in regions with tough emissions standards.

The offline sales channels held a 71.6% share in 2024. The preference for brick-and-mortar stores is largely due to the nature of snow blowers, which are often costly, bulky, and technically complex. Buyers prefer to physically inspect these machines to evaluate factors like weight, durability, ease of use, and power before committing to a purchase, ensuring the product will perform well under harsh winter conditions.

United States Snow Blowers Market held a 74.9% share, generating USD 7.9 billion in 2024. This dominance is supported by the country's economic strength, climate patterns, and infrastructure demands. Regions experiencing heavy snowfall maintain steady demand for snow-clearing equipment. Additionally, American homes often feature larger properties and driveways, necessitating more robust snow removal tools compared to European homes.

Key players in North America & Europe Snow Blowers Market include Ariens, Boschung, Caterpillar, Honda, Husqvarna, John Deere, Kubota, MTD Holdings, Overaasen, RPM Tech, Stiga, The Toro Company, Zhejiang Dobest Power Tools, Aebi, and Briggs and Stratton. In terms of strategies, companies in North America and Europe snow blower markets focus heavily on innovation and sustainability to secure their market position. Many are investing in developing advanced battery-powered and cordless models to meet growing environmental regulations and consumer demand for eco-friendly options. They also prioritize enhancing product performance and ease of use through technological improvements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Power source

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising snowfall & climate uncertainty

- 3.2.1.2 Growing residential demand

- 3.2.1.3 Shift toward eco-friendly solutions

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High equipment cost

- 3.2.2.2 Maintenance & operational complexity

- 3.2.3 Opportunities

- 3.2.3.1 Battery-powered & Green Models

- 3.2.3.2 Commercial & municipal contracts

- 3.2.3.3 Smart & connected features

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology and innovation landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Price trends

- 3.5.1 By region

- 3.5.2 By Product

- 3.6 Regulatory landscape (HS code -84302000)

- 3.6.1 standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer buying behavior analysis

- 3.12.1 Demographic trends

- 3.12.2 Factor affecting buying decisions

- 3.12.3 Consumer product adoption

- 3.12.4 Preferred distribution channel

- 3.12.5 Preferred price range

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Single stage

- 5.3 Two-stage

- 5.4 Three stages

Chapter 6 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Cordless

- 6.4 Gas

Chapter 7 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Municipal/public sector

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 U.K.

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Baltic

- 9.3.6 Russia

- 9.3.7 Ukraine

- 9.3.8 Iceland

Chapter 10 Company Profiles

- 10.1 Aebi

- 10.2 Ariens

- 10.3 Boschung

- 10.4 Briggs and Stratton

- 10.5 Caterpillar

- 10.6 Honda

- 10.7 Husqvarna

- 10.8 John Deere

- 10.9 Kubota

- 10.10 MTD Holdings

- 10.11 Overaasen

- 10.12 RPM Tech

- 10.13 Stiga

- 10.14 The Toro Company

- 10.15 Zhejiang Dobest Power Tools