PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833628

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833628

Hearing Amplifiers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

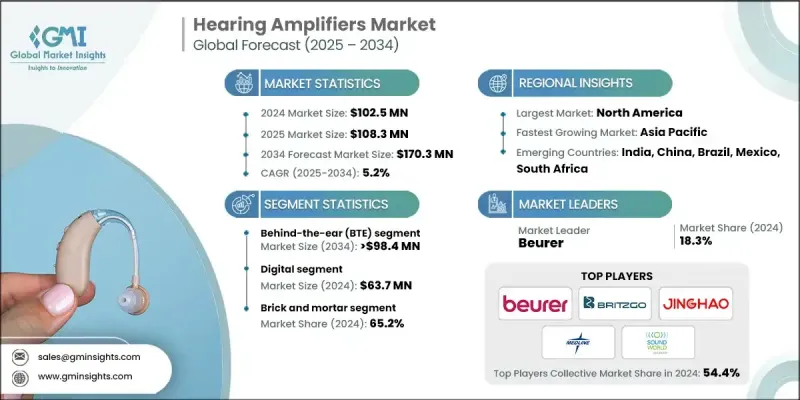

The Global Hearing Amplifiers Market was valued at USD 102.5 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 170.3 million by 2034.

This growth is fueled by several key factors, including the rising number of individuals experiencing hearing loss, a rapidly aging global population, continued innovation in sound amplification technologies, and increasing awareness and consumer acceptance. Hearing amplifiers, often referred to as personal sound amplification products (PSAPs), are designed to boost the volume of ambient sounds for people with mild to moderate hearing difficulties. Unlike traditional hearing aids, PSAPs are not classified as medical devices, making them easily accessible over the counter without the need for an audiologist. The affordability and convenience of these devices make them an appealing choice for many, especially older adults who are hesitant to invest in more expensive hearing aids. Leading companies are maintaining their competitive edge through strategic geographic positioning, a strong focus on product innovation, and significant investment in research and development to refine their hearing amplifier offerings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $102.5 Million |

| Forecast Value | $170.3 Million |

| CAGR | 5.2% |

In 2024, the behind-the-ear (BTE) segment held 59% share. This segment has gained popularity because of its user-friendly features, strong amplification capabilities, and compatibility with various degrees of hearing impairment. BTE models are favored by older consumers, especially those with limited hand dexterity, due to their ease of adjustment, comfort, and ergonomic benefits compared to in-ear devices. These qualities make BTE hearing amplifiers a preferred solution across a wide demographic, further solidifying their dominance in the market.

The analog segment is forecasted to grow at a CAGR of 5.5% through 2034. Consumers who prioritize cost-effectiveness continue to gravitate toward analog models. Their appeal lies not only in affordability but also in their simple, user-friendly controls that offer customizable sound settings. These features attract buyers in both developed and developing regions who want functional and budget-conscious options for personal sound amplification.

North America Hearing Amplifiers Market held 38.5% share in 2024. A significant driver of regional growth is the evolving regulatory landscape, particularly the authorization of over-the-counter (OTC) hearing devices. Such policy shifts have created new growth opportunities by removing traditional barriers to entry, expanding retail channels, and empowering consumers to explore accessible hearing solutions without medical consultations. These changes have significantly increased visibility and interest in hearing amplifiers across the region.

Key players actively shaping the Hearing Amplifiers Industry include MEDCA HEARING, JINGHAO, Sound World Solutions, Diglo, NUHEARA, Beurer, Alango, Medline, Britzgo, Kinetik Medical, Innerscope Hearing Technologies, Conversor, and Foshan Vohom Technology. To strengthen their foothold in the hearing amplifiers market, companies are emphasizing product innovation, focusing on ergonomic and high-performance designs tailored to older consumers. Many firms are investing heavily in R&D to enhance functionality, sound quality, and user control. By leveraging advances in wireless technology and miniaturization, companies aim to deliver discreet, powerful devices that are easy to use. Expanding distribution through OTC and online retail channels helps boost accessibility. In addition, partnerships with healthcare providers and promotional efforts aimed at raising awareness are enabling firms to tap into wider demographics and solidify brand presence in both mature and emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of age-related hearing loss

- 3.2.1.2 Rising geriatric population base

- 3.2.1.3 Technological improvements in amplification and noise reduction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from prescription hearing aids and cochlear implants

- 3.2.2.2 Limited reimbursement/insurance coverage

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of online sales and tele-audiology platforms

- 3.2.3.2 Product miniaturization and improved ergonomics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Consumer pathway

- 3.7 Pricing analysis, 2024

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Behind-the-ear (BTE)

- 5.3 In-the-ear (ITE)

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Digital

- 6.3 Analog

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alango

- 9.2 Beurer

- 9.3 Britzgo

- 9.4 Conversor

- 9.5 Diglo

- 9.6 Foshan Vohom Technology

- 9.7 Innerscope Hearing Technologies

- 9.8 JINGHAO

- 9.9 Kinetik Medical

- 9.10 MEDCA HEARING

- 9.11 Medline

- 9.12 NUHEARA

- 9.13 Sound World Solutions