PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833631

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833631

Coffee Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

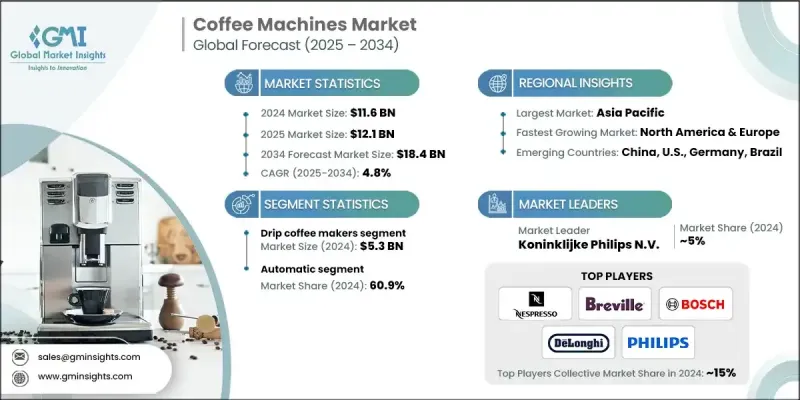

The Global Coffee Machines Market was valued at USD 11.6 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 18.4 billion by 2034.

This growth is closely tied to evolving lifestyle preferences, the increasing popularity of coffee culture, and the daily ritual that coffee consumption has become for many consumers. Urban living and modern aesthetics have pushed the housing segment to dominate the market, accounting for approximately 70% of total sales. Consumers today not only demand high functionality but also place value on design, making coffee machines a core part of home decor. In parallel, the expansion of smart kitchen appliances is revolutionizing how users interact with coffee makers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.6 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 4.8% |

Tech-savvy models integrated with Wi-Fi, mobile apps, and voice assistants are gaining significant traction. These machines are equipped with features such as milk frothing, automatic grinding, and personalized brewing settings, catering to the rising demand for convenience and customization. Bean-to-cup, espresso, and cold brew systems are witnessing increased adoption as consumers seek cafe-quality results at home. Single-serve models that use pods or capsules are also performing well due to their quick operation and minimal cleanup, making them attractive for busy lifestyles and modern kitchens.

In 2024, the drip coffee makers segment generated USD 5.3 billion and is expected to register a CAGR of 4.9% from 2025 through 2034. Their growing popularity stems from their affordability and user-friendly operation. Drip machines allow multiple servings in one brew cycle, making them ideal for family settings, shared office spaces, or individuals who value simplicity over high-end brewing. They are seen as a reliable option for consumers looking for convenience without the complexity of espresso or specialty coffee systems.

The automatic coffee machines segment held a 60.9% share in 2024 and is anticipated to grow at a CAGR of 5%. These machines, including fully automatic espresso systems, pod-based units, and automated drip brewers, are favored for their speed, consistency, and ease of use. This segment attracts consumers who prioritize hassle-free operation and reliable coffee quality. As demand for home-based coffee experiences grows, automatic solutions are becoming increasingly important in meeting evolving preferences.

U.S. Coffee Machines Market generated USD 2.7 billion in 2024 and is projected to grow at a CAGR of 5% through 2034. Growth in the U.S. is driven by a shift toward premium and specialty beverages, supported by rising interest in high-performance machines that can deliver cafe-style drinks at home. Convenience-focused products, including single-serve systems, continue to gain popularity due to their efficiency, speed, and consistent taste making them ideal for American consumers with fast-paced routines and a strong coffee culture.

Prominent players in the Global Coffee Machines Market include Melitta Group, Rancilio Group, Keurig Dr Pepper, Bosch, La Marzocco, AEG, Saeco, De'Longhi, Gaggia, Illycaffe, JURA Elektroapparate, Nespresso, Hamilton Beach Brands, Breville Group, and Koninklijke Philips N.V. Leading companies in the coffee machines market are focused on innovation and customer-centric product development to reinforce their market standing. Many are investing in smart features such as IoT connectivity, touch-screen interfaces, and automated brewing systems. Partnerships with coffee brands and retailers help expand their consumer reach. Emphasis on energy-efficient technology and sustainable materials also resonates with environmentally conscious buyers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type trends

- 2.2.3 Technology trends

- 2.2.4 Price range trends

- 2.2.5 End use trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global coffee consumption

- 3.2.1.2 Growth of at-home coffee culture

- 3.2.1.3 Technological advancements

- 3.2.1.4 Convenience & single-serve solutions

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition and market saturation

- 3.2.2.2 Price sensitivity and consumer budget constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap analysis

- 3.9 Risk assessment and mitigation

- 3.10 Trade analysis

- 3.10.1 Top 10 export countries

- 3.10.2 Top 10 import countries

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behavior analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behavior

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Espresso machines

- 5.3 Drip coffee makers

- 5.4 Single-serve coffee machines

- 5.5 Others (bean to cup, etc.)

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

- 6.4 Others (smart, etc.)

Chapter 7 Market Estimates & Forecast, By Price range, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others (individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AEG

- 11.2 Bosch

- 11.3 Breville Group

- 11.4 De'Longhi

- 11.5 Gaggia

- 11.6 Hamilton Beach Brands

- 11.7 Illycaffe

- 11.8 JURA Elektroapparate

- 11.9 Keurig Dr Pepper

- 11.10 Koninklijke Philips N.V.

- 11.11 La Marzocco

- 11.12 Melitta Group

- 11.13 Nespresso

- 11.14 Rancilio Group

- 11.15 Saeco