PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833632

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833632

Healthcare Consulting Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

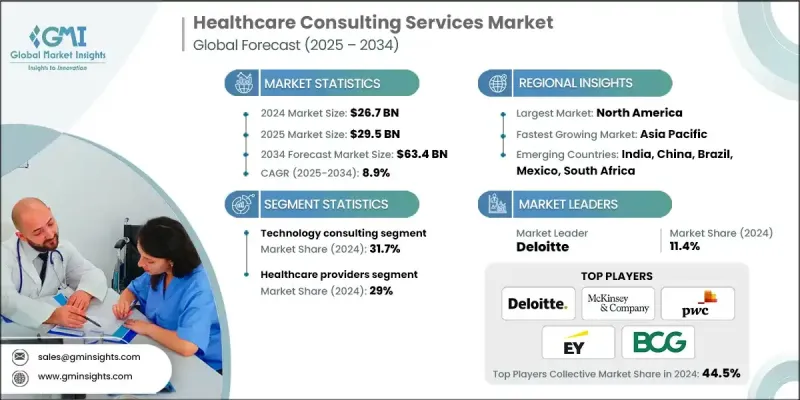

The global healthcare consulting services market was estimated at USD 26.7 billion in 2024 and is expected to grow from USD 29.5 billion in 2025 to USD 63.4 billion in 2034, at a CAGR of 8.9%, according to the latest report published by Global Market Insights Inc.

The push toward digitization, such as implementing electronic health records (EHR), telemedicine platforms, and AI-powered diagnostics, is creating a strong need for expert guidance. Healthcare consultants support providers and payers in choosing, deploying, and optimizing digital tools that align with clinical and business objectives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.7 Billion |

| Forecast Value | $63.4 Billion |

| CAGR | 8.9% |

Technology Consulting to Gain Traction

The technology consulting segment held a notable share in 2024, as providers and payers accelerate digital initiatives to modernize their operations. From implementing electronic health records (EHRs) and telehealth platforms to deploying AI-driven analytics and cybersecurity solutions, technology consultants are essential partners in helping healthcare organizations adapt to a more data-centric, connected ecosystem. As digital health adoption grows, the demand for strategic, scalable, and compliant technology roadmaps remains a major growth driver for consulting firms.

Rising Adoption of Healthcare Providers

The healthcare providers segment generated significant revenues in 2024, driven by the need to optimize operations, improve patient outcomes, and reduce administrative overhead. Consultants work closely with provider organizations to redesign care delivery models, align with value-based care frameworks, and manage clinical and financial performance. Whether it's workforce planning, digital integration, or supply chain optimization, providers are increasingly turning to expert advisors to help them adapt to a fast-changing healthcare landscape.

North America to Emerge as a Propelling Region

North America healthcare consulting services market held a sustainable share in 2024, driven by advanced healthcare infrastructure, high levels of technology adoption, and a strong focus on regulatory compliance. The United States leads in demand, fueled by ongoing shifts toward value-based reimbursement models, population health initiatives, and digital transformation across large hospital networks and insurance providers. Consulting firms are expanding their presence by investing in specialized talent, local delivery capabilities, and cross-functional service offerings to meet the diverse needs of clients in both urban and rural markets.

Major players in the healthcare consulting services market are IQVIA, Guidehouse, L.E.K. Consulting, Vizient, Capgemini, Ernst & Young, Boston Consulting Group, Cognizant, Bain & Company, Deloitte, Oliver Wyman, Accenture, Chartis, PricewaterhouseCoopers (PwC), ClearView Healthcare Partners, Kearney, NTT DATA, HURON, McKinsey & Company, and KPMG.

To strengthen their position, leading firms in the healthcare consulting services market are adopting strategies that focus on specialization, scalability, and client-centric innovation. Many are building vertical-specific teams with deep domain expertise in areas like payer strategy, population health, or regulatory compliance. Firms are also expanding their digital capabilities through acquisitions or partnerships with health tech startups, allowing them to offer end-to-end transformation services. Additionally, a strong emphasis is being placed on data security and interoperability, with companies developing frameworks that align with HIPAA and other privacy mandates. By combining strategic advisory with hands-on implementation and long-term change management, consulting providers are positioning themselves as indispensable partners in healthcare transformation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in the healthcare sector

- 3.2.1.2 Increased merger and acquisitions activity

- 3.2.1.3 Rising global spending on research and development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Hidden costs and operational dynamics

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for digital health transformation

- 3.2.3.2 Demand for AI and data analytics integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Technology consulting

- 5.3 Strategy consulting

- 5.4 Operations consulting

- 5.5 Financial consulting

- 5.6 Other service types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Healthcare providers

- 6.3 Healthcare payers

- 6.4 Life science and pharma companies

- 6.5 Healthcare technology and digital health companies

- 6.6 Government and regulatory agencies

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Accenture

- 8.2 Bain & Company

- 8.3 Boston Consulting Group

- 8.4 Capgemini

- 8.5 Chartis

- 8.6 ClearView Healthcare Partners

- 8.7 Cognizant

- 8.8 Deloitte

- 8.9 Ernst & Young

- 8.10 Guidehouse

- 8.11 HURON

- 8.12 IQVIA

- 8.13 Kearney

- 8.14 KPMG

- 8.15 L.E.K Consulting

- 8.16 McKinsey & Company

- 8.17 NTT DATA

- 8.18 Oliver Wyman

- 8.19 PricewaterhouseCoopers (PwC)

- 8.20 Vizient