PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833634

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833634

Heparin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

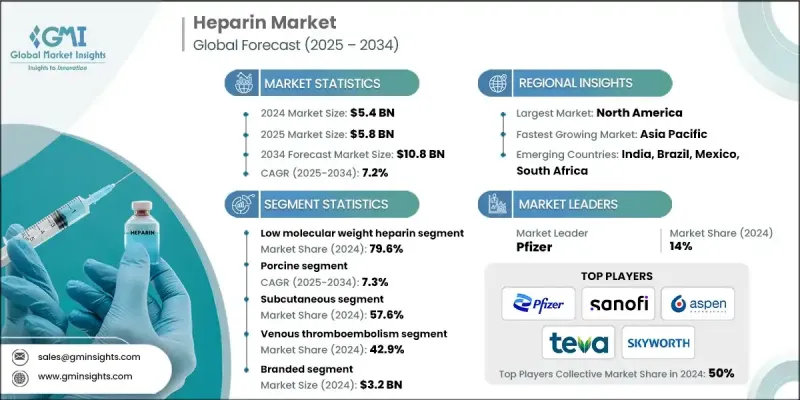

The Global Heparin Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 10.8 billion by 2034.

The increasing demand is largely attributed to a surge in cardiovascular and thrombotic conditions, coupled with a growing number of surgical interventions worldwide. Heparin is also seeing broader adoption in fields like dialysis, cancer treatment, and various medical device applications. These therapeutic expansions are further amplified by improvements in healthcare infrastructure, particularly in emerging economies across Latin America and the Asia-Pacific region. The continued focus on innovation and the development of more effective anticoagulant therapies with fewer adverse effects is pushing market dynamics forward. Research initiatives are fueling product advancements, making heparin-based treatment options more accessible across hospitals, clinics, and home care facilities. As cardiovascular disease continues to place a substantial burden on healthcare systems globally, the ongoing evolution of anticoagulation technology is expected to accelerate market adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $10.8 Billion |

| CAGR | 7.2% |

The low molecular weight heparin (LMWH) segment held 79.6% share in 2024, driven by several clinical advantages, including its favorable pharmacokinetics, lower risk of bleeding, ease of administration, and suitability for outpatient settings. LMWH offers predictable therapeutic outcomes and requires less frequent monitoring, making it a preferred choice among healthcare providers and patients alike.

The porcine-derived heparin segment held a CAGR of 7.3% in 2024 due to its consistent supply, clinical reliability, and reduced incidence of complications like heparin-induced thrombocytopenia (HIT). This variety of heparin is integral in the manufacturing of the most widely used LMWH types and remains the cornerstone of large-scale production.

United States Heparin Market generated USD 2.8 billion in 2024. The country's high incidence of cardiovascular diseases and chronic health conditions has led to strong demand for anticoagulant therapies. Regulatory support from the FDA, along with favorable reimbursement frameworks, continues to facilitate the widespread acceptance of both branded and generic heparin formulations. The growing use of prefilled syringes and autoinjectors in hospitals and home care environments is also contributing to the safe and convenient use of these medications.

Key companies leading the global heparin industry include Leo Pharma, Pfizer, Suanfarma, Shenzhen Hepalink Pharmaceuticals, Bioiberica, Amphastar, Sanofi, Dr. Reddy's Laboratories, Changzhou Qianhong Biopharma, Teva Pharmaceutical Industries, Fresenius Kabi, Aspen Pharmacare, Nanjing King-Friend Biochemical Pharmaceutical, Laboratorios Farmaceuticos ROVI, and Yantai Dongcheng Biochemicals. Leading players in the heparin market are leveraging a combination of strategic collaborations, vertical integration, and capacity expansion to strengthen their market position. Several companies are investing in R&D to develop next-generation anticoagulants with better efficacy and fewer side effects. Others are entering into partnerships and licensing agreements to broaden distribution channels and secure raw material supplies. Geographic expansion into high-growth emerging markets has also become a critical focus area.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Source

- 2.2.4 Route of administration

- 2.2.5 Application

- 2.2.6 Type

- 2.2.7 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global cardiovascular disease prevalence

- 3.2.1.2 Aging population and surgical procedures

- 3.2.1.3 Expansion of hospital infrastructure and homecare

- 3.2.1.4 Government and institutional health initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded LMWH and biosimilars

- 3.2.2.2 Supply chain disruptions and raw material dependency

- 3.2.3 Market opportunities

- 3.2.3.1 Development of synthetic and recombinant heparin

- 3.2.3.2 Emerging markets with rising healthcare investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technology

- 3.6.2 Emerging technologies

- 3.7 Patent landscape

- 3.8 Pricing analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Low molecular weight heparin

- 5.3 Unfractionated heparin

- 5.4 Ultra-low molecular weight heparin/synthetic heparin

Chapter 6 Market Estimates and Forecast, By Source, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Porcine

- 6.3 Bovine

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Intravenous

- 7.3 Subcutaneous

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Venous thromboembolism

- 8.3 Atrial fibrillation/flutter

- 8.4 Coronary artery disease

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Branded

- 9.3 Generics

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Clinics

- 10.4 Ambulatory surgical centers (ASCs)

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Amphastar

- 12.2 Aspen Pharmacare

- 12.3 Bioiberica

- 12.4 Changzhou Qianhong Biopharma

- 12.5 Dr. Reddy’s Laboratories

- 12.6 Fresenius Kabi

- 12.7 Laboratorios Farmaceuticos ROVI

- 12.8 Leo Pharma

- 12.9 Nanjing King-Friend Biochemical Pharmaceutical

- 12.10 Pfizer

- 12.11 Sanofi

- 12.12 Shenzhen Hepalink Pharmaceuticals

- 12.13 Suanfarma

- 12.14 Teva Pharmaceutical Industries