PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833635

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833635

Automotive Electric Vacuum Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

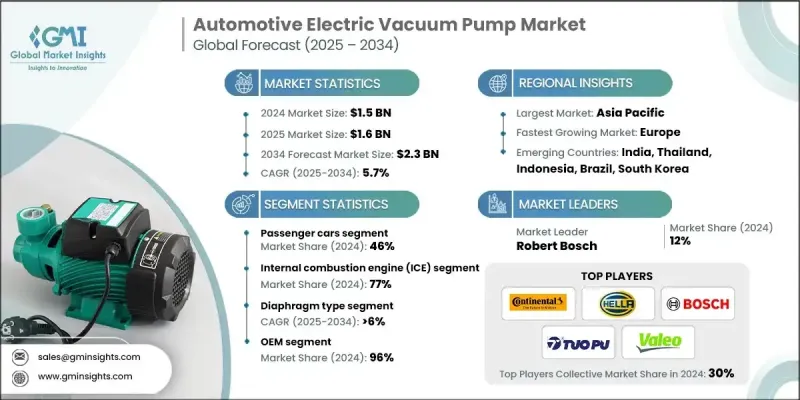

The Global Automotive Electric Vacuum Pump Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 2.3 billion by 2034.

This market plays a critical role in enabling automotive manufacturers to enhance vehicle efficiency, comply with evolving emission norms, and support powertrain electrification. OEMs are increasingly relying on EVPs to provide a consistent and independent vacuum source for essential vehicle systems, particularly in hybrid and electric vehicles where engine-based vacuum sources are absent. The shift toward eco-friendly mobility and consumer preference for vehicles that are both energy-efficient and safe is accelerating the integration of EVPs into modern vehicles. Stringent government regulations focused on lowering carbon footprints have further fueled demand. As manufacturers strive to meet sustainability targets and operational efficiency, EVPs are being engineered to support advanced features such as regenerative braking, start-stop systems, and ECU-driven vehicle dynamics. With the automotive industry rebounding post-pandemic, the need for reliable, emission-reducing technologies is driving both innovation and adoption of electric vacuum pumps across all major automotive markets worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.7% |

The passenger car segment held a 46% share and is projected to grow at a CAGR of 7% from 2025 to 2034. Passenger cars continue to serve as the primary application area for EVPs due to their wide deployment in various vehicle categories, including SUVs, hatchbacks, and compact cars. These pumps ensure consistent braking performance, improve overall vehicle safety, and support vacuum needs in the absence of traditional engine vacuum sources, especially in electric and hybrid variants. Automakers prefer EVPs for their easy integration and cost-effectiveness, making them a practical solution for enhancing vehicle efficiency without extensive redesigns.

The internal combustion engine (ICE) segment held a 77% share in 2024 and is set to grow at a CAGR of 4.5% through 2034. Even as electrification gains momentum, ICE-powered vehicles continue to dominate global fleets, particularly in emerging economies. With stricter emissions and fuel efficiency mandates coming into effect globally, ICE vehicle manufacturers are increasingly implementing EVPs to reduce engine dependency and improve operational efficiency. These systems play a key role in enhancing brake booster functionality and auxiliary system performance during idle phases, start-stop cycles, and traffic congestion.

Asia Pacific Automotive Electric Vacuum Pump Market held 54% share in 2024, driven by the accelerating electrification of vehicles and increasingly stringent emissions regulations in major economies such as China, Japan, and South Korea. With EV and hybrid adoption growing rapidly across this region, automakers are under pressure to integrate energy-efficient components that comply with current and upcoming regulatory benchmarks. As a result, EVPs have become a critical part of modern vehicle architecture. The region's robust automotive production capacity, favorable policy frameworks, and increasing investments in electric mobility innovation have positioned Asia Pacific as a stronghold for automotive technology advancement.

Key players shaping the Global Automotive Electric Vacuum Pump Market include Valeo, Youngshin Precision, Continental, Aisin, Tuopu, Robert Bosch, ZF Friedrichshafen, Rheinmetall Automotive, Magna International, and Hella. Leading companies in the automotive electric vacuum pump market are focusing on developing lightweight, compact, and energy-efficient EVP systems compatible with all powertrain types such as ICE, hybrid, and electric. Innovation in motor efficiency, pump housing materials, and electronic control units is central to product differentiation. Many manufacturers are expanding production capabilities in high-growth regions to meet increasing demand and reduce supply chain dependencies.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicles

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 Type

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Stringent emission and fuel economy regulations

- 3.2.1.3 Rising adoption of hybrid and electric vehicles

- 3.2.1.4 Technological advancements in electric motors and sensors

- 3.2.1.5 Consumer demand for enhanced safety and efficiency

- 3.2.1.6 Government incentives for electrification and green mobility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Reliability under extreme conditions

- 3.2.2.2 Integration complexity with vehicle systems

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with hybrid and electric powertrains

- 3.2.3.2 Advancements in electric motor and pump technology

- 3.2.3.3 Integration with advanced braking and safety systems

- 3.2.3.4 Growing focus on regulatory compliance and emission reduction

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global safety standards & testing requirements

- 3.4.2 Regional regulatory frameworks & approval processes

- 3.4.3 Environmental regulations & emission compliance

- 3.4.4 Quality management systems & ISO standards

- 3.4.5 Automotive industry standards (IATF 16949, ISO/TS)

- 3.4.6 Functional safety requirements (ISO 26262)

- 3.4.7 Electromagnetic compatibility (EMC) standards

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Next-generation electric motor technologies

- 3.7.1.2 Smart pump integration & IoT connectivity

- 3.7.1.3 Predictive maintenance & condition monitoring

- 3.7.1.4 Energy efficiency optimization & power management

- 3.7.2 Emerging technologies

- 3.7.2.1 Noise reduction & acoustic engineering

- 3.7.2.2 Miniaturization & weight reduction technologies

- 3.7.2.3 Integration with advanced driver assistance systems

- 3.7.2.4 Artificial intelligence & machine learning applications

- 3.7.2.5 Wireless communication & remote diagnostics

- 3.7.2.6 Sustainable materials & circular economy design

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk assessment & market intelligence

- 3.13.1 Supply chain risk analysis & mitigation strategies

- 3.13.2 Technology obsolescence & innovation risks

- 3.13.3 Regulatory compliance risks & management

- 3.13.4 Market demand volatility & scenario planning

- 3.13.5 Competitive threats & strategic response planning

- 3.13.6 Economic & currency risk assessment

- 3.13.7 Geopolitical risks & trade policy impact

- 3.13.8 Environmental & sustainability Risks

- 3.14 Future market outlook & strategic opportunities

- 3.14.1 Electric vehicle market growth impact & opportunities

- 3.14.2 Autonomous vehicle integration requirements

- 3.14.3 Emerging market expansion & localization strategies

- 3.14.4 Technology convergence & cross-industry applications

- 3.14.5 Sustainability trends & green technology adoption

- 3.14.6 Investment opportunities & market entry strategies

- 3.14.7 Partnership & collaboration opportunities

- 3.14.8 Long-term market evolution & disruption scenarios

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicle

- 5.3.2 Medium commercial vehicle

- 5.3.3 Heavy commercial vehicle

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EVs)

- 6.3.1 Battery electric vehicles (BEVs)

- 6.3.2 Plug-in hybrid electric vehicles (PHEVs)

- 6.3.3 Hybrid electric vehicles (HEVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Braking systems

- 7.3 Emission control systems

- 7.4 HVAC & climate control systems

- 7.5 Engine management systems

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Swing piston

- 8.3 Diaphragm

- 8.4 Leaf

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aptiv

- 11.1.2 BorgWarner

- 11.1.3 Continental

- 11.1.4 DENSO

- 11.1.5 Magna International

- 11.1.6 Mahle

- 11.1.7 Rheinmetall Automotive

- 11.1.8 Robert Bosch

- 11.1.9 Schaeffler

- 11.1.10 Valeo

- 11.1.11 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Aisin

- 11.2.2 Faurecia (Forvia)

- 11.2.3 Hella

- 11.2.4 Hitachi Astemo

- 11.2.5 Hyundai Mobis

- 11.2.6 Marelli

- 11.2.7 Nexteer Automotive

- 11.2.8 Pierburg

- 11.2.9 Plastic Omnium

- 11.2.10 Tenneco

- 11.2.11 Tuopu

- 11.2.12 Youngshin Precision

- 11.3 Emerging Players

- 11.3.1 Aeromotive

- 11.3.2 Classic Performance

- 11.3.3 NAVAC

- 11.3.4 Pfeiffer Vacuum Technology

- 11.3.5 Thomas Magnete