PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833636

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833636

Prenatal and Newborn Genetic Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

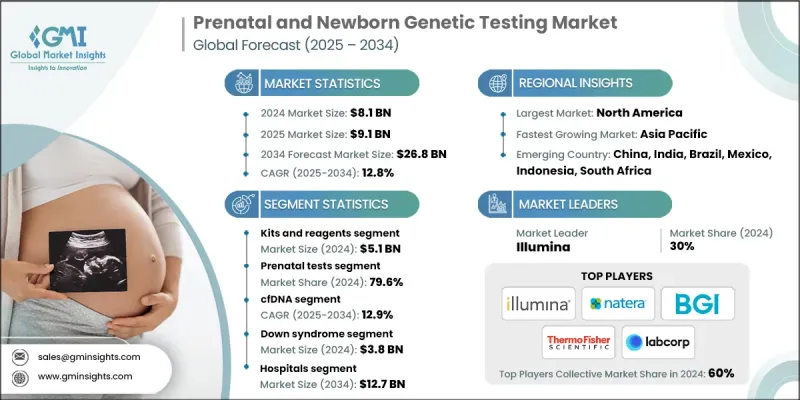

The Global Prenatal and Newborn Genetic Testing Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 9.1 billion by 2034.

The increasing prevalence of genetic conditions such as Down syndrome, cystic fibrosis, and spinal muscular atrophy is driving demand for early detection through prenatal and newborn genetic testing. Expectant parents are increasingly seeking reassurance and early intervention options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 12.8% |

Rising Adoption of Kits and Reagents Segment

The kits and reagents segment held a significant share in 2024, as these consumables are essential for both clinical diagnostics and research workflows. Laboratories and diagnostic centers depend on high-quality, reliable reagents to ensure accurate and reproducible results. As testing volumes grow, driven by increasing demand for early genetic screening, the recurring nature of consumable use continues to boost segment performance.

Increasing Demand for the Prenatal Tests Segment

The prenatal tests segment held a sizeable share in 2024, owing to rising maternal age, increased risk awareness, and strong clinical adoption of non-invasive and invasive testing options. These tests help detect chromosomal abnormalities, genetic mutations, and fetal anomalies early in pregnancy, enabling more informed clinical decision-making. The shift toward first-trimester screening and the inclusion of expanded genetic panels have fueled sustained growth in this segment.

cfDNA to Gain Traction

The cell-free DNA (cfDNA) testing segment held a sustainable share in 2024, driven by a non-invasive, highly accurate method to screen for common chromosomal conditions like trisomy 21, 18, and 13. This method analyzes fetal DNA fragments circulating in maternal blood, reducing the need for invasive procedures like amniocentesis.

North America to Emerge as a Propelling Region

North America prenatal and newborn genetic testing market is poised to grow at a sizeable share in 2024, driven by strong healthcare infrastructure, advanced lab capabilities, and widespread access to genetic services. In the U.S. and Canada, early screening is widely adopted, supported by favorable insurance coverage, regulatory backing, and increasing public awareness. Continued investment in genomic medicine, expansion of NIPT guidelines, and integration of AI-based diagnostic tools are further fueling market growth across this region.

Major players in the prenatal and newborn genetic testing market are Genes2me, Trivitron Healthcare, Retrogen, Aetna, Fulgent Genetics, Eurofins, Illumina, CENTOGENE, Genelab (Clevergene), Thermo Fisher Scientific, Myriad Genetics, Natera, Revvity, LaCAR, BGI Group, BillionToOne, LabCorp, Agilent, and Yourgene Health.

To strengthen their position in the prenatal and newborn genetic testing market, companies are pursuing a mix of innovation-driven and expansion-focused strategies. Many are investing in R&D to develop high-throughput platforms and broaden their test portfolios to cover rare genetic conditions and inherited disorders. Strategic collaborations with hospitals, academic institutions, and technology partners are enabling faster market penetration and access to diverse patient populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product and services trends

- 2.2.3 Test type trends

- 2.2.4 Technology trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising maternal age and increasing demand for prenatal screening

- 3.2.1.2 Increasing demand for NIPT testing

- 3.2.1.3 Rising incidence of genetic disorders

- 3.2.1.4 Growing parental awareness and demand for early diagnosis

- 3.2.1.5 Expanding advancement in technologies for accuracy and accessibility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced tests

- 3.2.2.2 Data privacy and security

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for personalized medicine in prenatal care

- 3.2.3.2 Increasing penetration in emerging markets

- 3.2.3.3 Expanding public-private initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Investment and funding landscape in the genetic testing industry

- 3.6 Technological landscape

- 3.6.1 Emerging technologies

- 3.6.2 Current technologies

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product and Services, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kits and reagents

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Prenatal tests

- 6.2.1 Screening

- 6.2.1.1 Non-invasive prenatal testing (NIPT)

- 6.2.1.2 Carrier screening

- 6.2.1.3 Serum screening

- 6.2.1.4 Nuchal translucency ultrasound

- 6.2.2 Diagnostic

- 6.2.2.1 Chorionic villus sampling (CVS)

- 6.2.2.2 Amniocentesis

- 6.2.1 Screening

- 6.3 Newborn tests

- 6.3.1 Heel prick test

- 6.3.2 Hearing screening

- 6.3.3 Critical congenital heart defect (CCHD)

- 6.3.4 Other newborn test types

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Next-generation sequencing (NGS)

- 7.3 Cell-free DNA (cfDNA)

- 7.4 Array-comparative genomic hybridization (aCGH)

- 7.5 Fluorescence in-situ hybridization (FISH)

- 7.6 Spectrometry

- 7.7 Whole exome sequencing (WES)

- 7.8 Other technologies

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Down syndrome

- 8.3 Phenylketonuria (PKU)

- 8.4 Cystic fibrosis (CF)

- 8.5 Sickle cell anemia

- 8.6 Congenital hypothyroidism

- 8.7 Pendred syndrome

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Maternity and specialty clinics

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aetna

- 11.2 Agilent

- 11.3 BGI Group

- 11.4 BilliontoOne

- 11.5 CENTOGENE

- 11.6 Eurofins

- 11.7 Fulgent Genetics

- 11.8 Genelab (Clevergene)

- 11.9 Genes2me

- 11.10 Illumina

- 11.11 Labcorp

- 11.12 LaCAR

- 11.13 Myriad Genetics

- 11.14 Natera

- 11.15 Retrogen

- 11.16 Revvity

- 11.17 Thermo Fisher Scientific

- 11.18 Trivitron Healthcare

- 11.19 Yourgene Health